- The stablecoin market cap has undergone a prolonged decline.

- The potential impact of spot ETF applications looms as a catalyst for market change.

- FDUSD has defied the market trend with an astonishing supply surge since its Binance launch.

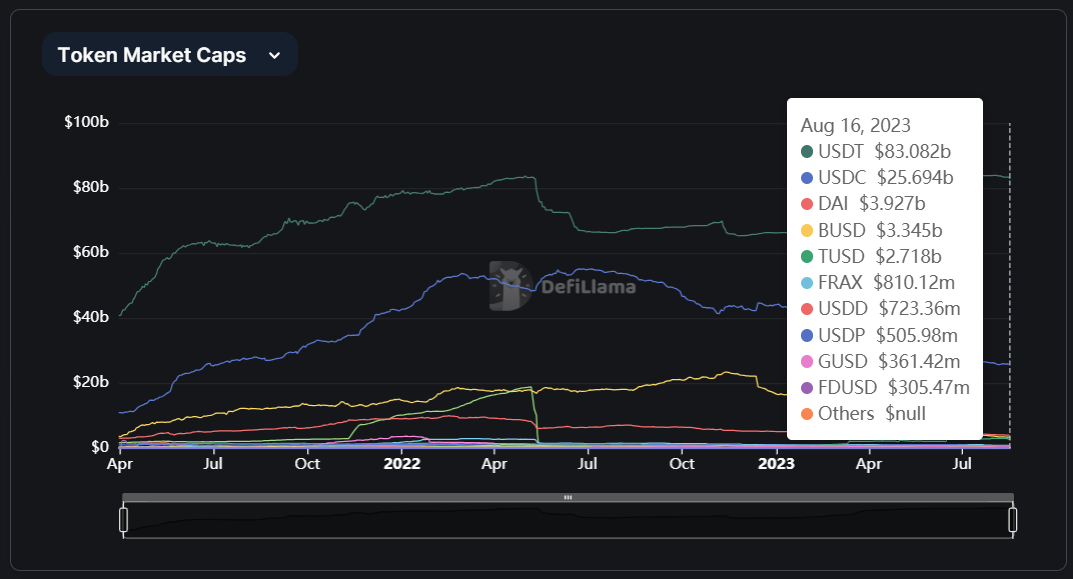

The combined value of stablecoins in the market has been steadily decreasing for 17 months. Presently, it stands at $124 billion, marking its lowest point since August 2021, according to information provided by CCData.

BTC and ETH’s Low Volatility Linked to Stablecoin Drop?

This decline in stablecoin market cap has also had a broader impact on the trading volume of these stablecoins every month. Noteworthy is that in July, this trading volume dropped significantly to its second-lowest value for the year, reaching only $453 billion.

CCData has attributed this considerable decline to the subdued behavior of the market in relation to Bitcoin and Ethereum. These major cryptocurrencies have been undergoing an uncommon phase of reduced fluctuations, reaching volatility levels that haven’t been observed in multiple years.

Tether Dominates Trading with Almost 70% of Total Volume

Tether (USDT) leads the pack, contributing over $2.8 Trillion to this trading volume. In the meantime, despite facing challenges, both Binance USD (BUSD) and Circle’s USD Coin (USDC) have managed to record a combined trading volume of $898 billion.

Even though the overall market has experienced a decline, the circulating supply of First Digital USD (FDUSD), listed on Binance, has surged by an impressive 1410%, now reaching a value of $305 million. This surge occurred less than a month after the stablecoin’s launch on the crypto exchange.

Back in July, a representative from Binance stated that the company was actively promoting this asset due to its belief in the benefits that its customers could gain from having more choices of stablecoins in the market. Consequently, the exchange introduced multiple features to encourage its utilization on its platform.

Out of the total $305 million supply, approximately $280 million were generated on the Ethereum (ETH) network. In comparison, the remaining $25 million were created on the Binance-supported BSC Chain network, as per the data provided by DeFillama.

On the Flipside

- The substantial surge in the circulating supply of Binance-listed FDUSD could reflect the market interest and demand for new big exchange-backed stablecoin offerings.

- The significant surge of 1410% in the circulating supply of FDUSD within a short timeframe underscores the substantial influence of Binance, the largest cryptocurrency exchange.

- A key consideration is whether FDUSD’s value and adoption are sustained beyond the initial push facilitated by Binance’s resources.

Why This Matters

As major cryptocurrencies like Bitcoin and Ethereum experience unprecedented stability, a shift in stablecoin dynamics could hint at potential shifts in investor behavior and market sentiment.

Sponsored

To learn more about the dominance of USDT in exchange reserves and the recent lows in Bitcoin’s performance, read here:

USDT Dominates Exchange Reserves While Bitcoin Hits Multi-Year Lows

For insights into the intriguing legal battle involving an anonymous banker rejoining the SEC and the speculation about their identity in relation to Ripple, read here:

Anonymous Banker Rejoins SEC vs. Ripple Labs Legal Battle: Who Could It Be?