- Dogwifhat falls behind in market liquidity compared to rivals SHIB and PEPE.

- Several on-chain factors point to plummeting interest in Solana’s BONK.

- Continuous double-digit plunge comes after triple-digit gains in March.

Bonk (BONK) and Dogwifhat (WIF) are facing new monthly lows after claiming new all-time highs (ATH) during the memecoin-induced Spring rally. While WIF fetched an all-time peak of $4.83 on March 31, 2024, the canine coin returned to $3.29 in a week, ‘filling the wick’ to $4 again on April 9.

As crypto traders on X mark $5.79 as the next price target, Dogwifhat’s rise above $5 is challenged by a 33% decrease in daily trading volume. Even though the combined liquidity books show an almost perfect balance between pending sales and bids, with both slightly above 10 million, this is far less than the competing memecurrency Pepe (PEPE), which has $40 million in combined orders, according to blockchain research platform CoinPaprika.

BONK Slumps Below $1B Market Cap

Meanwhile, Bonk seems doomed to an early TOP 100 exit by global market cap, as the memecoin has a relatively low daily trading volume of $7,725,900 in the latest 24-hour timeframe.

Sponsored

Currently seated at #97, Solana’s Bonk nosedived to $0.00001393, backtracking 69% from its highest price point of $0.00004547, recorded on March 4, 2024. Sporting a market cap of $927,169,193 as of press time, BONK slipped below the $1 billion mark for the first time since February 28, 2024.

Did SOL Whales Forget About BONK?

In addition, BONK and WIF took a 17% hit over the past 24 hours, as Bitcoin retouched the support levels of $60K due to rising tension in the Middle East and the yearly United States tax-day crypto selloff. Bonk’s technical pattern also depicts bearish tendencies.

Sponsored

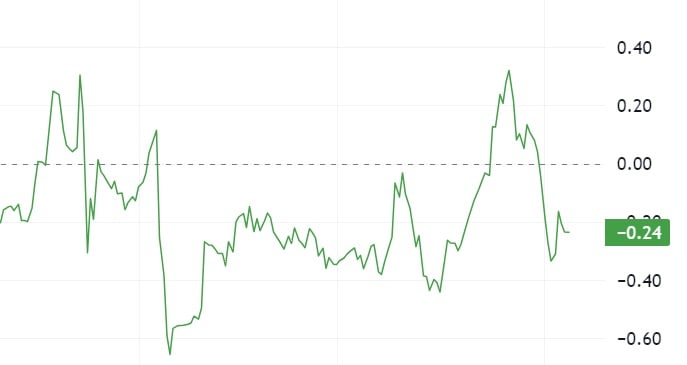

To illustrate, Chaikin Money Flow (CMF) has dropped heavily below zero, currently pointing the scales to -.024. This indicator measures the money flow trajectory of BONK, judging by whales and retail investors accumulating or distributing during this phase. A positive CMF index can also mean institutional interest, while negative hints at whales retreating.

While Bonk has a higher adoption rate among major crypto exchanges than its younger sibling, Binance takes up the lion’s share of BONK trading with nearly 40% of daily trading volume. On the platform, BONK’s Relative Strength Index (RSI) stands at just above 20, indicating a strongly oversold condition.

On the Flipside

- Emerging in late 2022, Bonk plunged to a single million market cap before taking off to a $1.5 billion market cap during the first rally in December 2023.

- Derivatives crypto markets defy the Spot trend with a 22% rise in BONK’s trading volume, with $190M on Bonk’s Perpetuals and the 1000BONK contract combined.

Why This Matters

Memecurrencies hosted on Solana’s Layer-1 chain have often been the talk of the crypto town due to their mass appeal and quick adoption by major crypto platforms.

Check out DailyCoin’s trending crypto stories:

Ethereum L2s Targeted by Ruggers: How to Spot Rugpulls

SHIB & DOGE Evolve in Market Depth Amidst Market Correction