- Dogecoin dipped 3.2% during Tuesday’s market-wide drawdown.

- On-chain metrics give mixed signals as DOGE hits monthly lows.

- After a three-week trade below $0.20, DOGE sees rising volumes.

After a month-long intense crypto market correction, the crypto bears have taken a huge bite out of Dogecoin (DOGE), resulting in a 33% monthly deficit. As the general crypto markets incurred a 2% loss in market cap this Tuesday, DOGE dipped below the $0.14 support level for the first time since March 20, 2024.

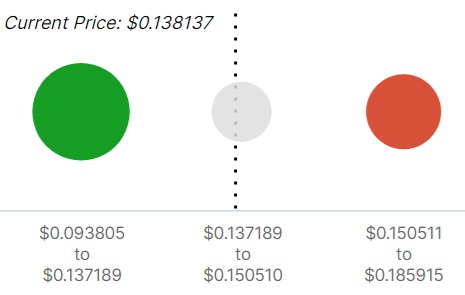

Back then, the support cluster portrayed in the middle assisted DOGE in reaching a new yearly peak at $0.22 a week later. Holding a 6.44 billion DOGE in 232.28K addresses, this support bubble is considerably smaller than the one painted in green, representing the $0.09 – $0.137 price range, according to on-chain data by IntoTheBlock.

Sponsored

DOGE’s price performance aligns with the top crypto asset, Bitcoin (BTC). The high 0.92 price correlation saw both assets tumbling below key support levels on Tuesday. Shiba Inu (SHIB) is also perfectly correlated with Dogecoin, as both assets slipped by 12.9% over the past seven days.

Bears & Bulls Go Head-to-Head for DOGE

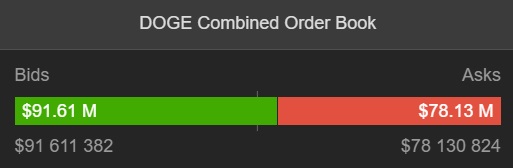

Despite the ongoing bearish trend, DOGE trading volume has doubled in both Spot and Derivatives crypto markets. To illustrate, the top dog crypto saw a 15.26% spike in trading volume, totaling $1,789,809,872 over the past 24 hours. By the combined liquidity book, buyers have an edge over sellers by $91 million to $78 million, real-time data from crypto research platform CoinPaprika shows.

While the combined Spot market liquidity stats favor the bulls, key on-chain metrics like ‘In The Money’ suggest that bears and bulls are yet to fight it out. For example, 18% of currently active addresses are making a profit, while 21% of active DOGE custodians are in the red.

Two Key On-Chain Signs in Favor of Bears

Judging by the seven-day charts on Spot, bears have won 126 to 123, while the rather even dual is mirrored in the Derivatives markets. The overall long versus short ratio now stands at 0.9387, implying that there are more short positions on DOGE than longs. However, traders at major exchanges like Binance and OKX seem ultra-bullish on DOGE, sporting 4.13 and 4.45 long versus short ratios, respectively.

As of press time, DOGE, the largest Proof of Work (PoW) blockchain aside from BTC, is exchanging hands at $0.1369, according to CoinGecko. Incurring a 3.2% drop over the past 24 hours, Dogecoin would need to sustain above $0.145 on the daily close to reach the $0.20 price target, creating a mirrored ascending triangle. Otherwise, a close below $0.14 can send DOGE to retest the green support cluster below $0.12.

On the Flipside

- DOGE hasn’t reclaimed its $0.20 price goal since April 12, 2024.

- The previous two surges above $0.20 in March didn’t last more than three days.

Why This Matters

Dogecoin’s status as a long-term TOP 10 contender by market cap is supported by a large and vibrant community and popular crypto personalities.

Check out DailyCoin’s trending crypto news:

Did Ethereum’s Vitalik Buterin Just Create a New Form of Math?

Altcoin Season: Tips and Tactics for Market Research