- Solana rolls out Mainnet v1.17.31 to combat congestion.

- Successful implementation relies on one key factor.

- Solana has seen significant traffic increases.

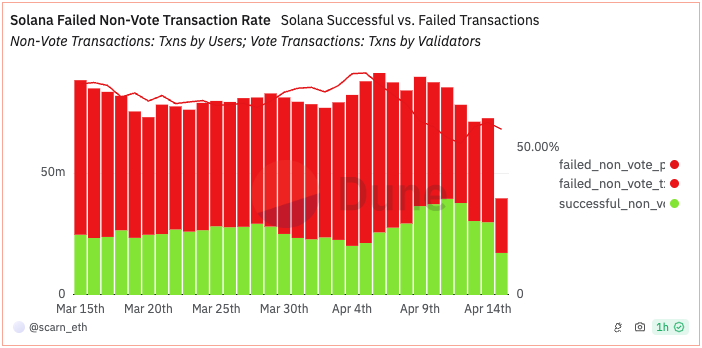

Solana, known for its high-speed transactions and low costs, has recently been plagued by congestion issues. The congestion, primarily due to an increase in transaction volumes and network demand, has led to delays and high failure rates of transactions.

In response, the Solana development team has released an update fixing a specific bug, hoping to alleviate congestion. While SOL investors reacted positively, boosting the token by 9%, it is unclear whether the update is a long-term solution for the network.

What the Solana Congestion Update Changed

On April 15, Solana rolled out a critical update to fix congestion issues that had led to major transaction failures. Currently, 56.48% of non-voting Solana transactions fail, down from a high of 75% last week.

The update focused on correcting an “implementation bug” related to the QUIC protocol, a network communication protocol initially developed by Google. It is designed to support a high number of simultaneous connections where packets of data are transferred quickly and efficiently.

Sponsored

Moreover, the update provides a more refined handling of staked versus non-staked packets. Now, the network should prioritize transactions from more invested network participants.

Adjustments have also been made to treat nodes with very low stakes as non-staked in the streamer quality of service (QoS). Furthermore, the update tightens the minimum streams per 100 milliseconds for staked nodes, enhancing the overall flow of transactions across the network.

Sponsored

Solana investors reacted positively to the update, as SOL increased 9% to $155 following the update. However, the success of the update relies on several key factors.

Will the Update Fix the Issue?

The update’s success relies heavily on widespread adoption by network validators. Anza, a group of developers within the Solana community, has urged validators to upgrade to the new patch as soon as the network experiences less than a 5% delinquent stake.

This strategy ensures a smooth transition without overwhelming the network during critical operations. However, it is not clear whether the update will allow the network to keep up with the ever-increasing traffic on Solana.

In recent months, Solana has seen a notable surge in network traffic, primarily driven by its growing popularity in the decentralized finance (DeFi) and non-fungible token (NFT) sectors.

The blockchain’s capability to process transactions rapidly and at lower costs has attracted a myriad of developers and investors. However, it has also attracted trading bots, significantly contributing to network congestion.

On the Flipside

- Critics argue that in its quest to achieve high speeds and low fees, Solana may compromise on decentralization and security.

- Despite efforts to enhance scalability, the repeated network outages raise questions about the robustness of Solana’s infrastructure.

Why This Matters

The effectiveness of Solana’s strategies to mitigate congestion and improve network performance is critical for SOL. As the network relies on its reputation for performance, it has to maintain it to keep developers on the platform.

Read more about Solana’s efforts to promote decentralization:

How is The Solana Foundation Decentralizing the SOL Blockchain?

Read more about Solana’s MarginFi protocol drama:

MarginFi’s CEO Resigns Amid Turmoil Rocking Solana DeFi