The Solana network has faced its fair share of criticisms and struggles over the years. While some consider the Solana blockchain one of the most impressive layer-one blockchains in the crypto space, others argue that it is nothing more than a large-scale pump-and-dump coordinated by venture capitalists.

Blockchain purists from competing networks like Ethereum (ETH) and Cardano (ADA) claim that Solana is highly centralized, with singular entities exercising too much power and control over protocol.

Sponsored

In addition, Solana has experienced numerous network outages, suggesting that the SOL blockchain platform isn’t as secure as it should be.

Is there any weight behind these claims?

Table of Contents

Why Do Blockchain Purists Consider Solana to Be Centralized?

Unlike legacy chains like Bitcoin (BTC) and Ethereum, Solana arrived in a crypto world where venture capitalists and angel investors were eager to splash their cash and make outsized returns.

In its early stages, Solana attracted large amounts of funding from prominent investment firms. This meant that much of the initial supply of SOL tokens was held by private investors who could secure enormous amounts of tokens at dirt-cheap prices.

Sponsored

However, this is also true for most Layer One blockchains launched following the 2017 cryptocurrency boom. Rival networks like Avalanche, Aptos, and NEAR have also enjoyed huge fundraising rounds and allocated large holdings of tokens to private investors.

Aside from centralized initial token distribution, Solana’s early decentralization woes were largely because the Solana Foundation operated the majority of the blockchain’s validator nodes. This meant that the Solana Foundation had outsized control over the network.

In addition, the Solana network demanded far larger hardware requirements than most of its competitors. For example, running a validator node on Ethereum, Cardano, or Avalanche requires between 16 GB and 32GB of RAM.

Meanwhile, a Solana validator requires a minimum of 128GB of RAM to function correctly. This high barrier to entry can make it difficult for prospective validators to establish their nodes.

But decentralization is a labyrinthine concept that shouldn’t be treated in absolutes. How can we analyze what makes a blockchain ecosystem decentralized?

How Can We Measure Network Decentralization?

One of the simplest and most effective methods of measuring a Proof-of-Stake network’s decentralization is to read its Nakamoto Coefficient. This catch-all score outlines the minimum number of validators that could work together to control over 33.3% of a network’s stake and begin acting maliciously.

Simply put, a low Nakamoto Coefficient score means taking over a network is easy. A higher score means the blockchain is better distributed across many validators and is more secure against attack.

However, that’s just the tip of the iceberg. We also need to consider a vast array of factors that can influence how truly decentralized a blockchain network is, including:

- Node Client Diversity – A node client is a specific kind of software tool that validators use to connect and communicate with the network. A greater range of node clients makes a network more stable, considering that bugs, code errors, or hacks that affect a node client could impact all validators using that software.

- Hosting Distribution – In case you didn’t already know, most PoS validators are hosted on centralized cloud servers like Amazon Web Services or Google Cloud. Again, more diversity means a more robust network. For example, over 35% of Ethereum nodes are hosted on Amazon. If AWS were to collapse, even briefly, it would dramatically alter the landscape of the Ethereum network.

- Geographic Distribution – Ideally, a decentralized network needs to be spread out across the world. As you’d expect, having nodes distributed around the globe means that the blockchain is less likely to be affected by both natural disasters and localized regulation. To give you an idea, a dramatic earthquake or crypto ban could put an entire country’s node operators out of business, causing a significant change to network distribution.

With all this in mind, how decentralized is the Solana network, and how does it compare with its closest rivals?

How Decentralized is the Solana Network?

At face value, Solana seems to have made great progress toward decentralization. More validators are frequently cropping up worldwide, and the lengthy crypto winter and FTX collapse have given SOL token distribution a much-needed reset.

SOL emissions distributed through Solana’s unique Proof-of-History consensus mechanism have also helped to spread the token supply, meaning that SOL holders have less to fear from private investors with heavy bags.

Simply put, a decent Nakamoto Coefficient score places Solana as one of the more decentralized layer-one networks in the blockchain industry. With 21, Solana beats out rivals like Ethereum, NEAR, Aptos, and SUI but falls short of decentralization leaders like Cardano.

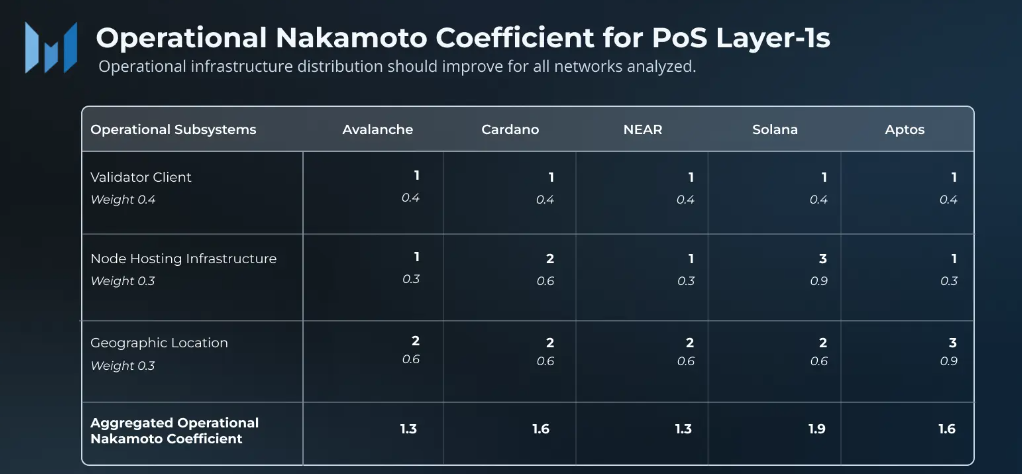

However, as we now know, blockchain decentralization goes deeper than that. Messari, one of the industry’s leading blockchain research teams, recently explored decentralization across layer-ones, considering factors like node client diversity, geographic distribution, and hosting.

The results are certainly surprising. All analyzed networks had a decidedly low aggregate coefficient score, suggesting that all blockchains are far less decentralized than they appear.

What’s more surprising is that the analysis suggested that Solana is more decentralized than its peers, including what many crypto enthusiasts consider to be decentralization benchmarks like Cardano.

Beyond that, we can also expect the Solana network to become even more decentralized with the rollout of its upcoming Firedancer node client.

Solana Network Issues

Solana is known for its trademark scalability, boasting low transaction fees and high throughput. This has made Anatoly Yakovenko’s network wildly popular among blockchain users, with decentralized finance, NFTs, and a staggering range of dApps deploying on the chain in a few short years.

However, the digital asset network hasn’t always been smooth sailing.

Solana Network Outages

For all its high-performance claims, the Solana network has been plagued by frequent network outages that have frozen the chain for hours at a time. Solana has suffered major outages at least seven times since 2021.

In most cases, this is due to network congestion overwhelming the blockchain. Solana’s low transaction fees mean that bot users can spam thousands of transactions per second trying to mint hyped NFT drops or meme coin launches instead of paying extortionate transaction fees in gas wars, like on Ethereum.

Solana Network Congestion

DeFi and on-chain activity have exploded on Solana in 2024, with millions of wallets interacting with smart contracts on the network daily.

As a result, the Solana mainnet has recently suffered severe network congestion issues. Many users have reported sluggish operating speeds and failed transactions. Fortunately, the engineers and developers at Solana Labs were able to implement a network update that eased congestion and brought Solana back up to speed.

Where can I Track Solana Network Activity?

With so much discussion around network activity, outages, and congestion, knowing where to get the facts is more important than ever. There are plenty of great resources available where you can track the status of the network, including:

On the Flipside

- Rival blockchains like Cardano and Ethereum have a much better history of network uptime, suggesting that they are more secure blockchain platforms.

Why This Matters

Don’t trust, verify. Instead of blindly believing claims and statements in the crypto space, like the idea that Solana is still heavily centralized, learn how to research this information and make an informed opinion based on data.

FAQs

No, Solana is its own blockchain network.

You can buy SOL on leading crypto exchanges like Binance and Coinbase.

The Solana network has no owner. Instead, it is a decentralized network operated by a distributed community of validators and cryptocurrency holders.