- Shiba Inu’s $31B trading volume challenges Dogecoin’s dominance.

- Open Interest hike pinpoints the rising demand for crypto’s top dogs.

- Derivatives market sees $7.22M DOGE shorts liquidated as bears retreat.

Shiba Inu (SHIB) is back among the top-performing digital assets this week. This comes after memecoins reached a whopping volume of $80 billion across crypto markets last week, marking the memecoin department as the hottest sector in crypto right now.

SHIB accounts for $31 billion of last week’s $80 billion weekly trading volume, while Dogecoin (DOGE) falls short of Shiba Inu’s trading volume by $8 billion. In addition, SHIB’s $31 billion trading volume surpassed Solana (SOL) in this metric, according to blockchain research firm Kaiko Data.

This trading volume hike has increased Shiba Inu’s dominance in the memecoin sector to 39%, throwing down the gauntlet to Dogecoin for the top dog’s crown. Indeed, SHIB got extremely close to DOGE in the crypto charts on March 5, 2024, when it breached $26 billion in global crypto market capitalization.

Sponsored

Standing at $19.92 billion now, Shiba Inu’s chances of scorching past DOGE will depend on the upcoming SHIB auto-burning mechanism and a flurry of new applications on Shibarium, the self-sufficient Layer-2 blockchain. To compare, Dogecoin encompasses a $26.82 billion market cap and works on Proof Of Work (PoW) consensus with less scalability.

Who’s the Top Dog in Crypto Derivatives?

One of the catalysts for the tremendous growth of dog-encrusted memecurrencies is the rising demand in Derivatives markets. According to blockchain analytics enterprise CoinGlass, SHIB’s OI-weighted funding rate reached its monthly peak on March 5, 2024, as the canine coin inked 289% gains to trade at a two-year peak of $0.000044.

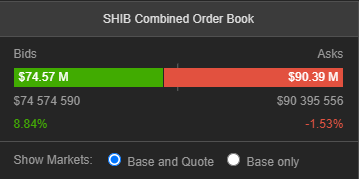

After facing a sharp market correction on the same day to quickly drop to $0.00002835, SHIB sustained above the support cluster of $0.00003 for the rest of the week. Shiba Inu inked 7% gains over the past seven days and trades at $0.00003385, according to CoinGecko. However, the current price range puts SHIB at risk of extra selling pressure, as depicted in the combined liquidity book.

While the pending sells outweigh the bids by nearly $16 million, it’s also important to note the sentiment surrounding Crypto Derivatives markets. While the on-chain analytics unveil a 32% upswing in Derivatives volume to $727 million, the short positions across all platforms now outscore the long positions, evident in the 0.9342 ratio.

Sponsored

Dogecoin’s ratio is at 0.9877, indicating that short positions are the majority. However, short traders have a rough time on Derivatives markets, as evident in the $7.22 million liquidated short positions over the past 24 hours.

While SHIB has significantly upped its dominance, it’s clear that DOGE is still the most demanded memecurrency in the Derivatives market with a whopping $5.64 billion in 24-hour trading volume and an Open Interest (OI) rate of $1.59B.

On the Flipside

- In a recent survey by ConsenSys, American crypto enthusiasts have placed Shiba Inu (SHIB) as their third favorite cryptocurrency overall.

- By popularity, SHIB was only lagging behind the King crypto Bitcoin (BTC) and Ethereum (ETH), the largest Proof of Stake (PoS) network.

Why This Matters

Trading volume often depicts the demand for a cryptocurrency and its liquidity status.

Read DailyCoin’s trending crypto news: