- NFT sales have more than doubled in recent weeks.

- The yearly low in volume was reached last month.

- Blue-chip NFT collections are still significantly below their peaks.

The NFT market has been on a roller coaster ride since gaining mainstream attention in early 2021. According to CryptoSlam, weekly sales of NFTs reached a fever pitch of $2.2 billion by August 2021. However, since that peak, weekly sales have cooled significantly, dropping as much as 99%. This has led many critics to call NFTs a passing fad.

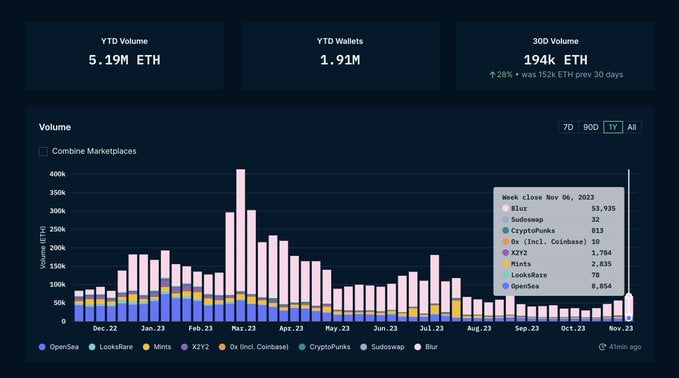

Despite the plunge in sales, recent data from Nansen suggests that the NFT market is showing signs of recovery, with weekly NFT sales on the Ethereum blockchain having more than doubled since October 9.

Return of NFTs?

According to Nansen, NFT sales volume has shown consistent week-over-week growth over the past five weeks, doubling from around 30,000 ETH during the week ending October 9 to over 68,000 ETH for the week ending November 6.

Sponsored

The week ending October 9 marked the low point in weekly sales over the past year, suggesting that the market bottom is in. While the current volume is still far short of March’s peak of over 400,000 ETH, this steady upward trajectory in trading activity since October 9 hints at a possible changing tide after years in the doldrums.

However, given the extent of the NFT market decline from its heydays, NFT investors are reminded that there’s a long way to go before recapturing past glories, as illustrated by the severity of price drops on blue-chip offerings.

Decline in Blue-Chips

The leading blue-chip NFT collections on the Ethereum blockchain by market cap are CryptoPunks and Bored Ape Yacht Club at 498,500 ETH (US$937.2 million) and 285,050 ETH (US$535.9 million), respectively. However, both have suffered severe price declines since the market top.

Sponsored

The CryptoPunks price floor peaked at 114 ETH in October 2021, reaching a local bottom of 41 ETH by July 2023, equating to a peak-to-trough decline of 64%. Nonetheless, late October has seen a revival in price, leading to a current price floor of 49.9 ETH (US$93.8k).

Bored Ape Yacht Club saw a similar decline, peaking at 128 ETH in April 2022 before bottoming at 22 ETH in August 2023, equating to an 83% drawdown. Since bottoming in August, the price floor for Bored Ape Yacht Club NFTs has been edging higher, coming in at 28.5 ETH (US$53.6k) at the present time.

On the Flipside

- Regulations around NFTs remain unclear, which could hamper mainstream adoption long-term.

- While ETH volumes may have doubled recently, prices remain far below previous highs, making full recovery uncertain.

- Mark Cuban believes the NFT market decline is cyclical in nature and will rise again.

Why This Matters

An NFT comeback has implications across crypto, foreshadowing a broader return of speculative assets. While the bull market is not confirmed, the recent NFT market bounce further proves that things are turning. This suggests a growing appetite for blockchain-based innovations.

Learn more about the Simpsons NFT Halloween special here:

NFTs Get the Simpsons Treatment in Halloween Special

Find out more on the sustained uptrend in Bitcoin hash rate here:

Bitcoin Miners Go Into Overdrive, Hash Rate Sets New ATH