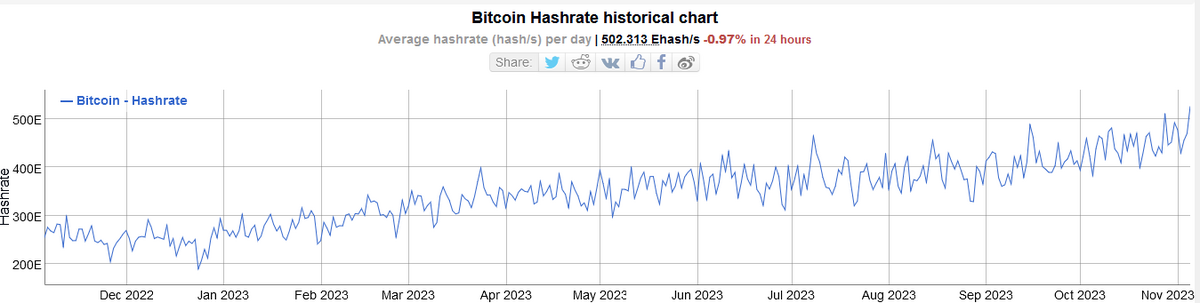

- Bitcoin hash rate hits another new ATH.

- 2023 has seen an uptrend in hash rate.

- The Bitcoin price hit a yearly high last week.

Bitcoin mining is the heartbeat that keeps the network humming, with miners’ computing power verifying transactions and distributing new coins into circulation. The hash rate represents the combined processing power of the network, offering insight into the network’s overall health and level of security.

In recent weeks, the price of Bitcoin has rallied to a yearly high of $36,000, driving expectations of further price appreciation to come. Likewise, Bitcoin’s hash rate has also been increasing rapidly, recently reaching a new all-time high to fuel crypto market optimism further.

Bitcoin Hash Rate Soars

On November 5, the Bitcoin hash rate reached a new all-time high of 527 EH/s, according to BitInfoCharts. This figure equates to miners collectively making 527 quintillion (527,000,000,000,000,000,000) “guesses” per second to identify the target hash and “win” the block, plus the accompanying 6.25 BTC block reward and fees.

Sponsored

The Bitcoin hash rate has been on a steady uptrend since December 2022, when the hash rate bottomed at 190 EH/s. As 2023 progressed, the hash rate climbed higher, hitting a string of new all-time highs along the way, culminating in the network’s processing power hitting another new all-time high on Sunday.

The rising hash rate suggests miners are confident in the price of Bitcoin rising, restarting inactive mining rigs and actively deploying new equipment to capitalize on expected price rises. Their increased investment in securing the network points to renewed faith after a challenging period for Bitcoin and the broader crypto ecosystem.

Recent price buoyancy results from several bullish factors, particularly regarding US spot ETF applications, as rumors of imminent approval swirl.

ETF Approval

Bullish Bitcoin price movements appear to be fueled by the optimism surrounding the prospects of a spot Bitcoin ETF in the US. A spot ETF would enable mainstream investors to gain exposure to Bitcoin without needing to hold or custody the asset directly.

Sponsored

Many in the crypto community believe it is only a matter of time before the US Securities Exchange Commission (SEC) approves a spot Bitcoin ETF. While the SEC has remained tight-lipped on the matter, Swan CEO Cory Klippsten recently predicted that the approvals will be made in Q1 2024.

Meanwhile, in a further boost to bullishness, it has emerged that Hong Kong’s Securities Futures Commission is now considering a spot Bitcoin ETF. Commenting on this, Twitter analyst “Seth” told his 36,000 followers that Chinese authorities are “afraid to be left behind.”

On the Flipside

- The correlation between BTC price and hash rate is debatable, making hash rate as an indicator of future price direction questionable.

- The upcoming Bitcoin halving in April 2024 is another bullish driver of price.

- Despite positive inflows in recent weeks, the crypto market remains below previous peak prices.

Why This Matters

Hash rate hitting a new ATH indicates that miners’ confidence has returned. While this, in isolation, is not a guarantee of future price increases, it remains one of many bullish drivers that suggest the bull market is gearing up.

Learn more about Bitcoin’s recent price surge here:

Bitcoin Bulls on Alert as Price Targets Stability at $35,000

Find out what happens post-Voltaire after the Cardano Foundation steps back:

Cardano Braces for Life Without the Foundation, What Happens After Voltaire?