- Mark Cuban is optimistic that the NFT market will eventually recover.

- Cuban likened the downturn to the dot com crash of 2000.

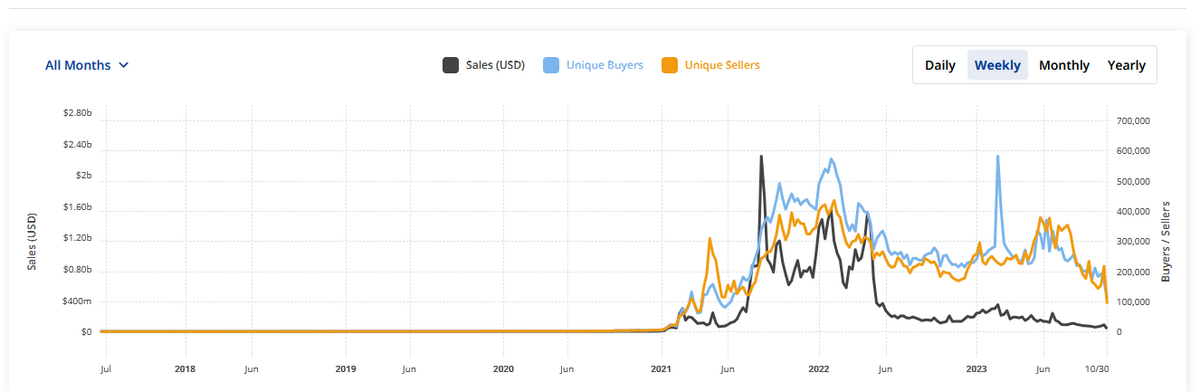

- Weekly NFT sales have seen severe drawdowns.

NFTs exploded into mainstream consciousness in March 2021 after Beeple’s “Everydays – The First 5000 Days” sold for an eye-watering $69 million at Christie’s. The headline-grabbing sale sparked a mania, triggering skyrocketing prices as crypto enthusiasts and speculators piled in to flip digital collectibles for profits.

However, sales volumes soon cooled, with weekly NFT sales plummeting 99% from August 2021’s peak, leading many critics to deride NFTs as a passing fad. Despite the severity of the sales decline, billionaire Mark Cuban remains optimistic about NFTs, recently stating that all markets are cyclical.

NFTs to Rise Again, Says Cuban

In a video post shared by NFT Now’s Twitter account, Cuban responded to a question on the market decline by acknowledging the dire situation facing the sector at present. However, he chose to focus on the positive side of things by mentioning that a similar scenario played out during the dot com cycle that imploded in 2000. This eventually subsided, leading to a price recovery from the lows.

Sponsored

“There was a time after the internet stock market crash when Amazon was selling for $5 a share. Microsoft was selling for a hundredth of what they sell for right now,” explained Cuban.

Cuban also advised that the best strategy is to buy NFTs you like rather than getting caught up in speculative trading. Adopting this approach circumvents anxiety around daily price fluctuations.

“Some day we’re going to turn around, and you know what you’re going to say to yourself? You’re going to say to yourself, “I should have bought those damn NFTs when they were next to nothing,” exclaimed Cuban.

Sponsored

Despite Cuban’s optimism, there is no denying that both speculators and collectors have suffered painful losses during the downturn.

Punishing Drawdown

Data from CryptoSlam highlighted a downturn in weekly sales and the number of buyers and sellers from August 2021. The downtrend in weekly sales saw the printing of lower highs, culminating in a severe drawdown from May 2022 onwards.

Weekly NFT sales peaked at $2.2 billion on August 29, 2021, when the average NFT sale was valued at $1,221. The local bottom was reached recently, during the week ending October 8, with weekly sales amounting to $55.8 million at an average sale price of $36.56.

On the Flipside

- The recording-breaking sale of Beeple’s “Everydays – The First 5000 Days” triggered NFT mania through mainstream media exposure.

- The downturn in the NFT market has only crystalized longstanding critiques that center on the lack of utility offered by NFT art.

Why This Matters

Cuban’s continued faith in NFTs is noteworthy, given the severity of the market downturn. With plunging sales and average prices, many have already written off NFTs as a passing fad. However, Cuban’s positive take on the matter has given weary investors much-needed hope.

Learn more about the UK’s recommendations for NFT copyright infringement policy here:

UK Committee Targets NFTs: Urging Copyright Rules

Find out why CoinMarketCap is under fire over data inaccuracies on its platform here:

CoinMarketCap Integrity Questioned Amid Ergo Fee Controversy