- Monero’s daily transactions spike.

- The move coincided with a sharp increase in Bitcoin fees.

- The average Bitcoin fee is hundreds of times higher than Monero’s.

Blockchain financial privacy has faced mounting regulatory pushback as nations embrace the Financial Action Task Force’s (FATF) Travel Rule. In a bid to combat money laundering and terrorist financing, the Travel Rule calls for crypto service providers to collect and disclose the sender and recipient details of cryptocurrency transfers.

Despite the threat of transaction surveillance and monitoring, the adoption of privacy-focused cryptocurrencies appears to be recovering. Data shows transaction volume on Monero, the leading privacy token, has trended higher since the start of 2023, regardless of the intended effect of the Travel Rule.

Monero Transaction Volume Rises

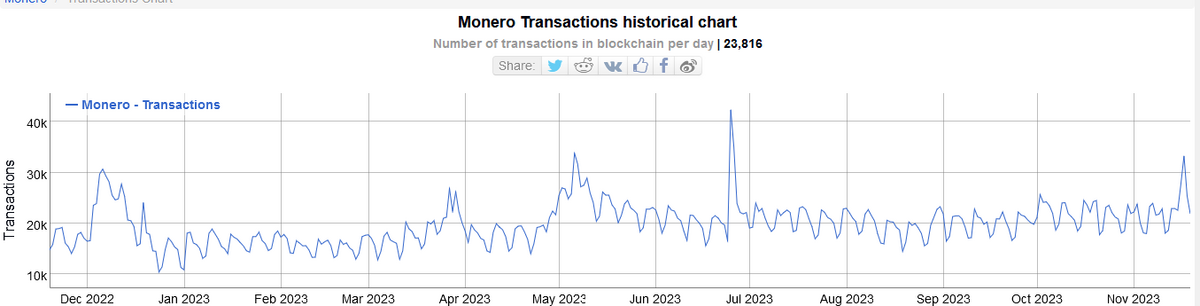

According to data from Bitinfocharts, Monero’s daily transaction volume has surged dramatically since the start of 2023. Transactions bottomed out at a yearly low of 10.9k on January 1st, but have since skyrocketed to hit 33.4k on November 17th. This massive increase of approximately 200% represents a 21-week high for Monero activity.

Sponsored

Monero daily transactions had been increasing steadily throughout 2023, reaching a peak of 42.5k by late June. However, this was followed by a sharp decline to record a local bottom of 14.5k daily transactions on August 19. Despite this decline, the leading privacy token has continued to gain traction, with transaction volume trending higher after hitting the local bottom in August.

The fall in Monero transaction volume in June coincided with BlackRock filing its Bitcoin ETF application in mid-June. The ETF filing likely shifted investor sentiment in favor of Bitcoin over other cryptocurrencies. However, with the Securities Exchange Commission continuing to delay its approval of a Bitcoin ETF, Monero activity has seen a gradual, sustained uptick since the August local bottom.

Bitcoin Fees Rise

The uptick in recent Monero activity comes alongside rising fees on the BTC network, as noted by privacy advocate OrangedMike who stated that Bitcoin users have been facing “crazy transaction fees” of late.

Sponsored

The jump in transaction fees is attributed to a massive influx of BRC-20 transactions congesting the Bitcoin blockchain. With limited transaction capacity, this flood of activity has caused Bitcoin fees to skyrocket as users bid against each other for priority.

On November 16, the average Bitcoin fee spiked to $18.67 per transaction, marking a 27-week high. This is over 460 times more expensive than the average Monero fee, which amounted to $0.045 on the same day.

On the Flipside

- Authorities have skewed policy in favor of privacy encroachment, treating all privacy coin users as criminals.

- Just 0.24% of crypto activity in 2022 was related to illicit transactions, suggesting that FATF rules are overzealous.

- The future of privacy coins is uncertain without regulatory approval.

Why This Matters

Monero activity appears to have an inverse relationship with Bitcoin fees, making the recent rise in Monero activity not solely attributable to a resurging interest in privacy, but also external factors like Bitcoin network constraints. Either way, rising Monero activity highlights that a subset of cryptocurrency users remain undeterred by FATF directives.

Learn more about Monero’s fight against growing regulatory scrutiny here:

Monero (XMR): What’s New With the Dark Web Darling

Discover how Javier Milei’s election victory is driving calls for Bitcoin legal tender in Argentina here:

Calls For Bitcoin Legal Tender Grow After Milei’s Victory