- Argentina will enforce FATF rules on crypto exchanges.

- Crypto exchanges operating in the country face new compliance requirements.

- The change will also affect Argentine crypto users.

Javier Milei’s November 2023 election victory was enthusiastically met by many digital asset advocates, who anticipated a new era for Argentina under a Bitcoin standard. The outspoken economist had previously praised Bitcoin as a safeguard against inflation and fiat devaluation.

Despite some progress, such as approving the use of Bitcoin to settle contracts, Milei’s administration has, so far, failed to live up to crypto community expectations. In a further setback, Milei’s government recently introduced mandatory registration requirements for crypto firms operating in Argentina, citing enforcement of controversial Financial Action Task Force (FATF) rules on virtual assets.

Hopes for Argentine Bitcoin Boom Fade

In a bid to comply with FATF virtual asset rules, Argentina’s National Securities Commission (CNV,) which oversees the country’s capital markets, announced the roll-out of a Registry of Virtual Asset Services Providers (PSAVs). Under this change, crypto firms must register with the agency or face being banned from the country.

Sponsored

Driving this regulatory crackdown is Argentina’s effort to comply with FATF’s Recommendation 15 on virtual assets, which mandates crypto firms obtain licensing and comply with money laundering and terrorist financing obligations. These obligations affect users who will be subject to due diligence, transaction monitoring, and vetting against financial sanctions lists.

CNV president Roberto E. Silva stated the agency has been working hard to ensure PSAV is compliant with Argentine legislation and to present the registry before a FATF delegation leaves Argentina. Silva added that the registration process is underway, and “those who are not registered will not be able to operate in the country.”

Silva’s position signals Argentina aims to get a grip on its rapidly growing crypto market, which has seen billions in inflows as Latin Americans embrace digital assets amid economic instability.

Argentina Crypto Adoption

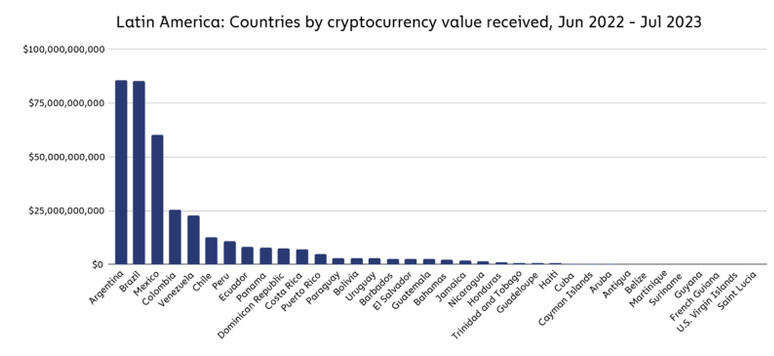

Although Latin America has a smaller overall crypto economy than other regions, grassroots adoption in the region is booming due to the prevalence of weak domestic currency and high inflation.

Sponsored

Argentina ranked 15th in Chainalysis’ Global Crypto Adoption Index. It led the Latin American countries for crypto inflows, receiving around $89 billion between June 2022 and July 2023, marginally more than neighboring Brazil at $87 billion over the same period.

Chainalysis noted that Latin Americans have the highest preference for centralized exchanges; this suggests a potentially massive compliance gap that Milei’s administration aims to address with the PSAV roll-out.

On the Flipside

- All significant jurisdictions impose FATF crypto rules.

- Enforcing FATF rules could stifle innovation and deter crypto businesses from operating in Argentina.

Why This Matters

Ultimately, Milei’s pivot to FATF crypto compliance may be a sobering reality check on his self-styled anarcho-capitalist revolution. While disillusioning the Bitcoin faithful, who tout the importance of operating without the permission of a third party, aligning with global standards paves the way for greater institutional investment and international credibility.

The Milei administration opts to exclude crypto tax proposals under new reforms. Read more here:

Argentina Slashes Crypto Tax Proposals from Omnibus Bill

Discover why Bitcoin Cash is back in the limelight, having soared to a 123-week high: