IOTA’s crypto vision looks like this: a sprawling ‘Internet of Everything’ where every device, every machine, and every transaction is stored on IOTA’s Tangle. The IOTA Network promises improved scalability, smart contracts, and feeless transactions within an Internet of Things (IoT) ecosystem.

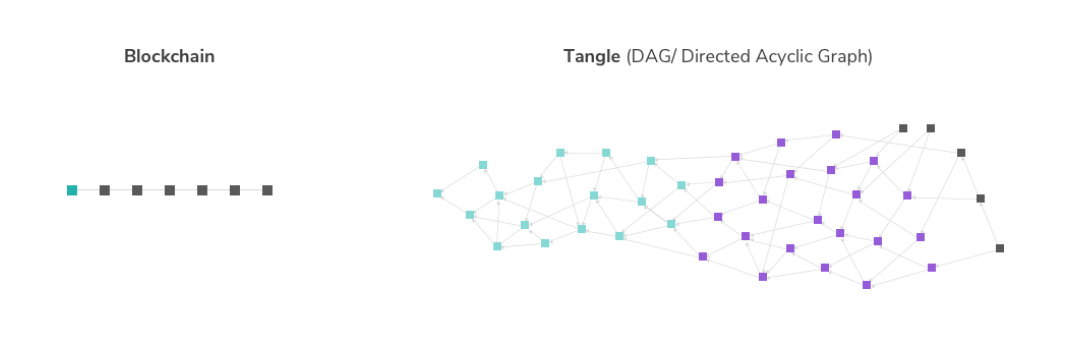

Unlike classic cryptocurrencies, such as Bitcoin (BTC) and Ethereum (ETH), IOTA doesn’t rely on blockchain technology. Instead, the IOTA Foundation built its ‘Internet of Everything’ using a Directed Acyclic Graph (DAG), another kind of digital network.

Is IOTA breaking new ground in DLT (Distributed Ledger Technology) with the Tangle algorithm? Why was IOTA so widely criticized after announcing a partnership with Microsoft, one of the world’s largest software companies?

Sponsored

Let’s untangle the mysteries surrounding IOTA (MIOTA), the Internet of Things cryptocurrency.

Table of Contents

What Is IOTA (MIOTA)?

IOTA is a unique DLT network designed to execute and register secure, immutable transactions within an Internet of Things ecosystem.

IOTA’s Internet of Everything is a thriving network of physical devices, from everyday items like refrigerators and thermostats to supply chain industrial machinery. Like a 3D jigsaw, every device and element within the network fits together, seamlessly communicating and transferring important data.

Sponsored

The IOTA Foundation, a non-profit organization responsible for the growth and development of the open-source network, has already partnered with household names, including Bosch and Volkswagen, to explore the potential use cases of IOTA crypto assets in common industries.

The vision is clear: IOTA aims to bridge the gap between the human economy and the machine economy, creating a world where devices not only communicate with each other but also transact and share value, like digital currency, securely and autonomously.

How Does IOTA Work?

At its core, the IOTA network uses its own consensus algorithm known as the Tangle. Unlike traditional blockchain technologies, Tangle mixes things up and takes a different approach. Like Hedera Hashgraph (HBAR), Tangle is a type of Decentralized Acyclic Graph (DAG), where transactions are interlinked in a non-linear, web-like structure.

In the Tangle, each transaction is linked to two previous transactions. This link is a record-keeping mechanism and a validation process that adds new data to the network. Every time a new transaction is added to Tangle, it verifies two previous transactions in real time, which helps to keep the network secure.

This innovative approach eliminates the need for crypto mining, a typical feature in Proof-of-Work cryptocurrencies. In the IOTA network, there are no blocks, no chains, and, most importantly, no transaction fees. This makes IOTA extremely scalable and enables fast, feeless transactions, even on basic devices with minimal computing power, like a toaster.

The Tangle also supports simultaneous transactions, which increases the network’s speed and capacity as it expands. This makes IOTA particularly suitable for the IoT ecosystem, where a staggering number of devices need to communicate and transfer data efficiently.

The MIOTA Token

MIOTA, the native cryptocurrency of the IOTA network, plays a crucial key role in facilitating transactions within the Tangle. While most cryptocurrencies rely on inflationary emissions, MIOTA’s total supply was created at the network’s launch following an initial coin offering (ICO) in December 2015.

During the ICO, 1 MIOTA (one million IOTA tokens) was offered for $0.001 worth of Bitcoin. The ICO successfully raised around $500,000 for the development of the project. While this may seem small by today’s valuations, it was considered a large raise by 2015’s standards.

Perhaps the most interesting part of the ICO was that IOTA team did not reserve any MIOTA for early backers or developers. Remarkably, only 60% of the total supply was claimed by ICO participants, with the remaining 40% returning to the project.

Today, MIOTA is traded on crypto exchanges and is used as a currency of exchange within the network. As IOTA continues to develop new use cases within the IoT ecosystem, the role of MIOTA as the ‘connective tissue’ between human and machine economies is expected to grow.

IOTA’s Strengths

IOTA provides a host of strengths that set it apart in the crowded field of DLT networks. Its innovative design and unique features bring plenty to the table, making it a promising solution for the challenges faced by Internet of Things ecosystems.

First things first, the IOTA network promises scalability. IOTA’s Tangle architecture allows for parallel processing of transactions, which theoretically means the network becomes faster as more devices join. If that wasn’t enough, IOTA also boasts zero transaction fees, thanks to its unique validation process.

While not technically a blockchain, the IOTA crypto network retains certain key features of blockchain technology. All data stored and recorded on the network is unalterable and cannot be deleted, ensuring data integrity and security.

According to its whitepaper, the IOTA network is also quantum-resistant, eliminating one of the greatest threats that the crypto industry might face in the near future. While this sounds impressive, it’s important to note that this is unproven and unconfirmed.

Finally, IOTA is designed with interoperability in mind. The network enables seamless interactions between different systems and devices, making it a strong candidate to become the protocol for machine-to-machine IoT transactions.

IOTA Crypto History

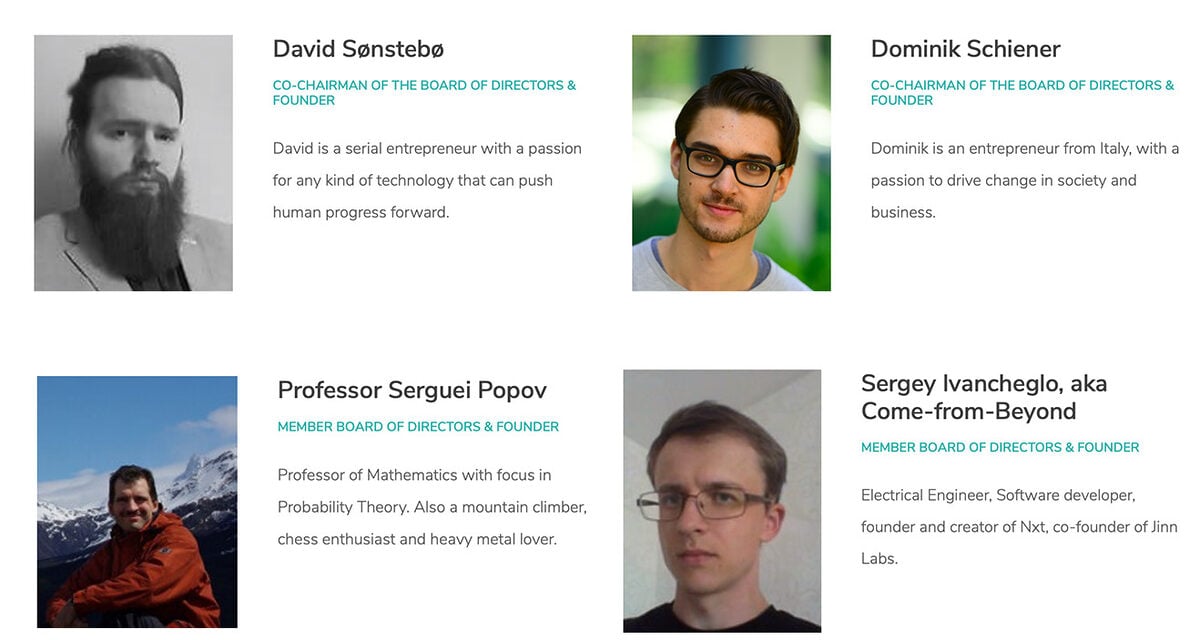

The story of IOTA began with a vision to overcome the limitations of traditional blockchain technology and bring true decentralization to the Internet of Things. The project was announced in October 2015 by co-founders Sergey Ivancheglo, Serguei Popov, David Sønstebø, and Dominik Schiener.

Before achieving its final form as IOTA, the original idea for the network was linked to a project called Jinn. In 2014, Jinn held a crowd sale for its tokens, raising approximately $250,000. However, due to regulatory concerns around whether Jinn tokens might be considered a Security, the project rebranded to IOTA in 2015, and a new token sale was held.

IOTA Concerns

Despite its innovative approach and potential, IOTA has faced its share of challenges and concerns. These primarily revolve around technical issues and the ambitious scope of the project.

In its early days, IOTA faced criticism for some technical vulnerabilities. To give you an idea, MIT’s Digital Currency Initiative found serious vulnerabilities with IOTA’s hash function, Curl. The function produced the same output when given two different inputs, a property known as collision, which denotes a broken hash function. This could have allowed a bad actor to steal or destroy user funds. However, the IOTA team has since addressed this issue.

But that wasn’t the end of IOTA’s issues. Since 2020, The IOTA network has relied on a central server known as a Coordinator to ensure transaction security. While this has helped IOTA find its feet, it has been criticized for introducing a single point of failure, raising questions about IOTA’s decentralization.

While IOTA’s Tangle is designed to improve scalability, some experts, including Ethereum co-founder Vitalik Buterin, have cast doubts on DAG’s effectiveness. Buterin argues that the scalability of a system using DAG technology still depends on the capacity and speed of individual computers within its network. Understatement of the year: Vitalik knows a thing or two about network capacity, so I’m inclined to take his word on this.

Misleading Announcements

Perhaps the biggest concern surrounding IOTA is a history of overhyped partnerships. For example, in late 2017, IOTA faced a wave of criticism following a misunderstanding about its relationship with tech giant Microsoft. An IOTA crypto press release proudly announced the launch of a publicly accessible IOT data marketplace, name-dropping Microsoft’s role as a participant.

The news led to a significant increase in the price of MIOTA, as investors were excited by the prospect of a partnership between IOTA and Microsoft. MIOTA price surged over 400% before the IOTA team clarified that there was no formal partnership.

Instead, IOTA built its data marketplace using Microsoft Azure. When crypto news brought this observation to light, it led to a backlash against the IOTA team, with critics accusing the project of misleading investors.

IOTA Cryptocurrency Pros and Cons

As with any technology, IOTA has its own advantages and disadvantages. Understanding these pros and cons provides a balanced perspective on the potential and challenges of this innovative DLT network.

Pros

- Scalable – IOTA’s Tangle architecture allows fast, zero-fee transactions with rapid finality.

- Energy Efficient – IOTA is designed to be lightweight and efficient, making it suitable for use on a wide range of devices, including those with minimal processing power and energy resources.

- Quantum-Resistance – The IOTA team claims its network is quantum-resistant, protecting it from future security threats in the crypto market.

- First Mover Advantage – The network is a leader in its niche. IOTA market share is significant, especially compared to other Internet of Things-focused crypto projects.

Cons

- Technical Flaws – IOTA has faced criticism for technical vulnerabilities. Although these issues have been addressed, they have raised concerns about the robustness of the technology.

- Centralization Concerns – Since 2020, IOTA’s network has relied on a central server known as a Coordinator to ensure transaction security. This introduces a singular point of failure and goes against IOTA’s decentralization claims.

- Misleading Partnerships – Despite announcing partnerships with globally-recognized brands like Bosch and Jaguar Land Rover, it appears that none of these partnerships have fully developed into anything substantial.

On the Flipside

- IOTA is an ambitious project that started from humble beginnings. The project has been in development since 2015, so the fact that IOTA is still here proves the network’s longevity and vision. At the same time, this also means that IOTA should arguably be more relevant in the market than it currently is.

Why This Matters

The Internet of Things is a relatively new field within the tech industry. Some theorists believe that the IoT will be a key player in Web 4, the next generation of the internet. Given IOTA’s position as a leader within the Internet of Things niche, it may have a significant role in the future of the cryptocurrency industry.

If IOTA’s price reached $100 USD, that would mean its market cap would be roughly over $200 B. That would give IOTA a similar valuation to Ethereum, the industry’s second largest cryptocurrency.

You can buy IOTA on crypto exchanges like Binance, Kucoin, and Bitfinex.

IOTA’s all-time high price was recorded on the 19th of December, 2017. The highest registered IOTA price on this day was registered at $5.69 USD.

IOTA coin has plenty of unique benefits that make it an interesting crypto asset; however, it is not without its faults. It is recommended that you always conduct thorough research before investing in any cryptocurrency and never invest more than you can afford to use.