- It takes approximately 10 minutes to mine one new Bitcoin block.

- Mining is a complex process with various components that have to be evaluated.

- These components include hardware efficiency, the way and the costs of mining, hash rate and mining difficulty.

The price of Bitcoin is expected to rise in the future and so the demand. As purchasing Bitcoin is the easiest way to acquire it, the option of mining one is also worth the attention.

Although Bitcoin is the leading and most expensive digital asset across the cryptocurrency market, it is not the fastest one to be minted. For those who plan to start mining BTC, the knowledge of how long does it take to mine 1 Bitcoin, as well as the evaluation of the profitability, is necessary.

On average it takes around 10 minutes to mine a new Bitcoin block, this is even four times slower compared to Litecoin or even Dogecoin mining. On the other hand, there are many more criteria to evaluate alongside the speed of cryptocurrency mining for those who consider starting minting digital coins. Since mining Bitcoin might be a profitable business, in this article we will review the main parameters everyone should keep in mind before diving into the Bitcoin mining business.

What is mining?

Basically Bitcoin mining is a process of validating transactions. The nodes (computers) compete with each other to create new blocks of confirmed transactions, add them to the blockchain, and get a reward for their efforts.

Sponsored

Each time when the cryptocurrency transaction is made, the nodes of the network have to ensure its authenticity and update the blockchain with all the necessary information of the transaction.

A certain node competes with the others by solving complicated mathematical puzzles. And when it wins, it earns a reward – a native cryptocurrency of the blockchain. Competing with other nodes and confirmation of transactions requires a lot of computing power, which makes the whole process expensive. In order to compensate for the expense, the network itself offers the reward for confirming transactions.

Sponsored

The process of Bitcoin mining is a finite one since the total supply of Bitcoins is 21 million. As estimated, the last Bitcoin should be mined in the year 2140. The number of Bitcoins dedicated as a reward however will keep decreasing every four years, due to the Bitcoin halving. The process that occurred this May the third time in history is taking place every 210.000 blocks and cuts the block reward in half, with the current rate of 6.25 Bitcoins per block.

What determines how long does it take to mine 1 Bitcoin?

Due to Bitcoin’s supply algorithm, the average amount of time needed to mine 1 Bitcoin is around 10 minutes. And although the timeframe of creating a new single block is constant, there are other critical components that play an important role in calculating the profitability of mining the world’s leading digital currency:

- Mining hardware

- Way of mining

- Hash rate

- Mining difficulty

The proper mining hardware

Bitcoin mining technologies have evolved a lot since its start in 2009. Although miners were able to create new blocks on their personal computers back then, today the mining landscape is radically different and the mining process is more challenging and expensive.

As Bitcoin uses SHA-256 mining algorithm, not all computers are capable of handling this process. This is why Bitcoin mining requires efficient and powerful hardware to generate millions of computations in a limited timeframe.

Today the most widely used hardware includes Application-specific integrated circuits (ASICs), Field Programmable Gate Arrays (FPGAs), and Graphics Processing Units (GPUs). Such powerful hardware is able to generate more hashes per second and thus get higher chances to win the block reward.

However, the more powerful is the mining hardware, the more electric power it needs to consume. This fact should be kept in mind before acquiring a particular machine like Bitmain’s Ant Miner or Bithull’s BH Miner. Since the electricity costs are among the main expenses of mining Bitcoin, it is critical to evaluate the efficiency of mining machines. This means that it is important to know how many gigahashes per watt the machine is capable of performing.

In the meantime, the electricity costs might vary sharply depending on the mining hardware and on the location of it. As different countries apply different price rates, the mining process might become extremely unprofitable in countries, where energy costs are high.

This is one of the reasons why the vast majority of crypto mining farms are based in China, especially in the province of Sichuan, which can offer cheap hydropower due to the rain season and thus the lower electricity expenses.

Besides that, to mine Bitcoin profitably it is also helpful to calculate the hardware acquisition expenses and the fact that the equipment is going to wear off over time. Mining machines usually run at full capacity, so they also break down time and again, which may cause a decrease in profitability.

The way of mining

As the price of a new Bitcoin mining hardware may reach several thousand dollars, the fact of buying it might be the main obstacle for wannabe Bitcoin miners. In this case, joining the mining pool might be an option.

Contrary to the solo mining, which defines the process is done by yourself and ensures you don’t have to share a reward with anyone else, the mining in a pool allows joining the resources together with other miners in order to achieve the higher hash rate. The higher hash rate allows to mine more blocks and thus to increase the odds of winning a block.

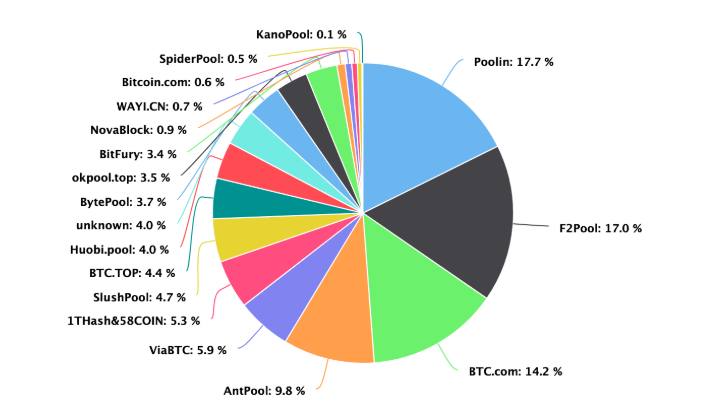

Mining in Bitcoin pools like Poolin, F2Pool or Slush Pool allows sharing resources, computing power and electricity bills. And since it increases the odds to win the block, it also requires sharing the reward with the other participants. Furthermore, they create a possibility for smaller miners to compete with the big mining companies, as their joint hardware is capable of generating a high enough hash rate.

When choosing between mining pools, it is necessary though to check up the factors like reputation, monthly fees and hash rate.

The reputable pools tend to be larger and more transparent in distributing rewards for their miners. Meanwhile, the bigger total hash rate of the mining pool is directly related to its ability to find new Bitcoin blocks faster. This means that the mining pools with a higher hash rate have a bigger amount of computing power to mine digital coins. Last but not least is the factor of the monthly fees paid for using the mining pool. Usually, the pools charge up to between 1-2% of the miner’s total reward. There also are mining pools that offer lower or zero fees, however, they may charge on subscriptions or apply higher withdrawal limits.

Although mining in a pool is one of the best options that gives an ability to compete with mining market whales, there certainly are other ways to mine Bitcoins. One of them is the already mentioned solo mining. The process however is highly difficult to make profit unless the miner has powerful enough hardware to generate a competitive hash rate.

The third available option – cloud mining – allows renting computing power from a hosting company that owns and runs Bitcoin mining hardware. However, the business model has become popular among the scammers lately, when so-called cloud mining companies gather the funds and then do not payout. Thus it is very important to do your own research before choosing the cloud mining option.

Hash rate

Hash Rate is the critical metric that measures how much power the Bitcoin network needs to process its function, or in other words – to find and validate the blocks of transactions. The metric shows the ability of the blockchain network to solve mathematical puzzles and is calculated by the number of operations (hashes) per second.

The hashrate is an important indicator of the health of the network as it shows how many times the network can attempt to complete mathematical puzzles per second. With more nodes competing to solve the block, the total computing power of the network increases and thus rises the hash rate. Accordingly, the higher hashrate means that the network has a higher opportunity to confirm the next block.

The size of hashrate should be considered before choosing the mining pool, as different Bitcoin mining pools charge differently based on their hash power. Hashrate on the other hand is closely related and intertwined with the mining difficulty.

Mining Difficulty

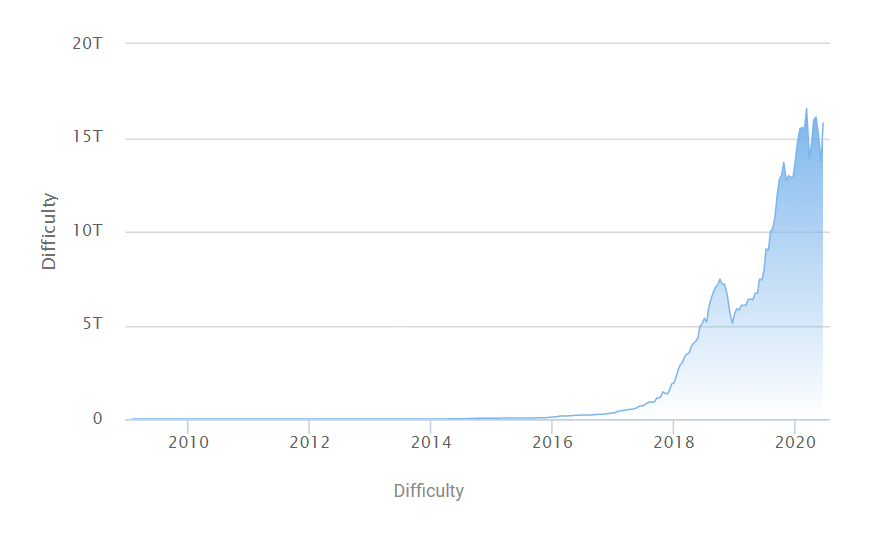

Another metric – a mining difficulty – indicates how difficult it is to find the right hash for each Bitcoin block. The parameter reveals how much work the node has to put in to get a reward. Depending on the fact that the mining difficulty is constantly changing, it might be a challenge to estimate its potential mining time precisely.

The unstable difficulty is mainly related to the controlled supply of Bitcoin. The Bitcoin network is created to adjust the difficulty every 2016 block in order to ensure that the process happens every 10 minutes.

The level of Bitcoin mining difficulty varies depending on the ease of mining within the network. Since the network has to keep stable and to add a new BTC block to the circulating supply every 10 minutes, it also has to ensure that these time intervals keep stable and do not change the Bitcoin protocol.

Thus when it becomes easy to mine new blocks, the network increases the mining difficulty to make the process tougher. Accordingly, the network decreases the difficulty, when there are not enough miners and the mining process becomes harder. This usually happens when the difficulty sharply increases and mining becomes tough or when the price of Bitcoin falls down and lots of miners quit the process.

Since the network has to maintain consistent block production, it has to keep the mining difficulty and also hash rate under control. However, the difficulty of Bitcoin mining has constantly increased since its start, mainly due to the powerful mining hardware like ASIC, which produces terahashes every single second.

Because of the constantly changing factors like competition among the miners and the computing power their hardware generates, it is difficult to calculate the precise amount of time needed to mine one Bitcoin. Preliminary, one of the most powerful AntMiner S19 Pro models with 110 TH/s computing power might bring a profit of up to $10 a day, however, the amount of time needed to generate one Bitcoin is not clear.

Is it profitable to mine Bitcoin?

Roughly it takes about 10 minutes to mine a new Bitcoin block. However, the amount of time the miner needs to mine his Bitcoin depends on the amount of the mining power he has. But as Bitcoin mining technologies evolved since 2009, the process of Bitcoin mining has become more challenging as well.

Bitcoin mining might still be a lucrative and profitable business for big miners, but it could be risky for the smaller ones as the process requires investments and proper hardware to generate profit.

And although the criteria of how long does it take to mine 1 Bitcoin is important, there are far more various components that have to be thoroughly calculated and considered in order to make a profit from mining the world’s benchmark digital asset. The efficiency of mining hardware, the cost of it, the cost, and also the way of mining are equally important to the parameters like mining difficulty and hash rate, that determine the technical capabilities of the Bitcoin mining process.