Bitcoin Halving 2020: Another Milestone in History of Cryptocurrency

One of the most important crypto industry events has finally happened. Just hours ago the leading cryptocurrency Bitcoin went through its third halving process, marking another turning point in its history.

The event, when a reward for mining Bitcoin block is cut in half, happened on May 11 after the 630.000 block was minted. This means that from the third Bitcoin halving all miners will get 6.25 Bitcoin reward instead of the previous 12.5 Bitcoins for each block, minted every 10 minutes.

The process when separate computers or specialized computing rigs compete to solve complex math problems to validate Bitcoin transactions and get a reward happens every four years and has a strong impact on Bitcoin’s price.

Sponsored

Meanwhile, the total number of Bitcoins is 21 million, the reward for miners will keep halving since there will be no single Bitcoin block left to mine. This is expected to happen in the year 2140. Historically the reduced supply of Bitcoins ended in an increase of demand and thus strongly affected the price of the top-ranked digital asset.

How Bitcoin halving affects the price

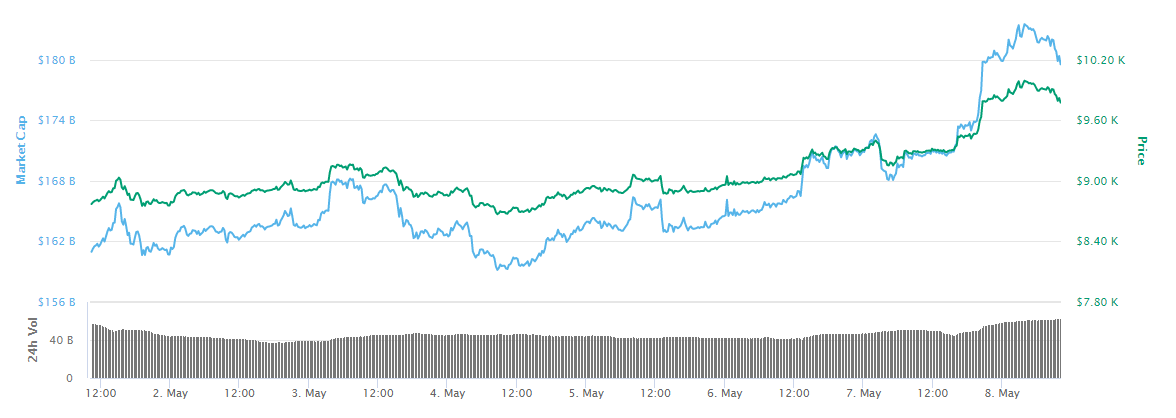

Since the halving is a highly anticipated process, it already brought Bitcoin price volatility back to the markets. With investors and traders expecting to take a profit before the decrease in supply, the Bitcoin has rallied weeks before May 11.

The coin has hit the $10.000 at the beginning of the month, fully recovering from the dramatic fall to below $4.000 mark during the massive sell-offs on Black Thursday market crash, caused by coronavirus outbreak and oil wars between Russia and Saudi Arabia. Bitcoin has been one of the best-performing assets since then.

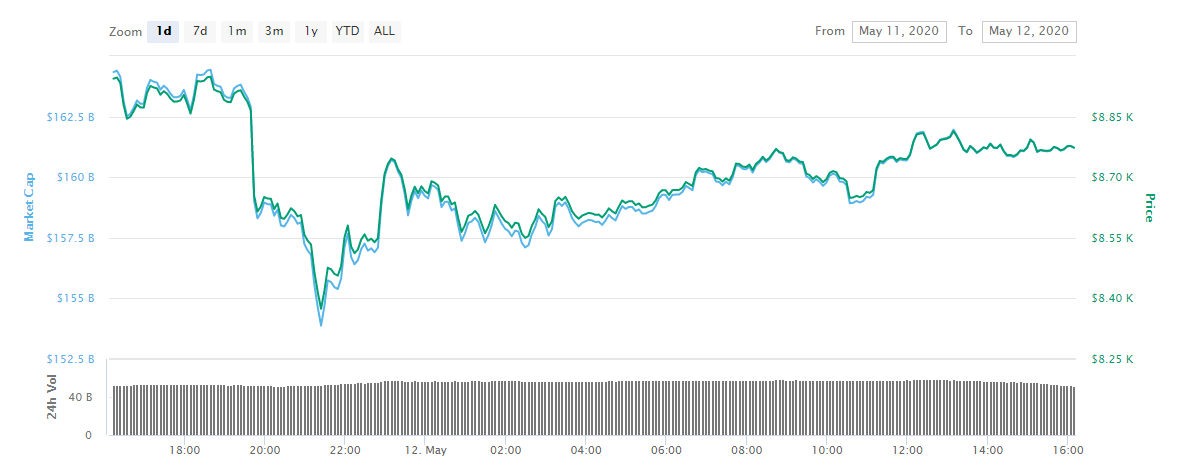

However, with only a few days left before halving, the Bitcoin experienced a sudden loss of nearly 15%. The massive sell-offs of long-position holders caused a price drop from $9.500 to $8.100 in just minutes.

Although the price slightly recovered and stabilized around $8.700, volatility gripped the markets again hours before the halving moment. The Bitcoin fluctuated withing the huge price intervals, shooting over $9.100 and then falling back down to $8.300 a few hours later on May 11. At the time of press, the price has regained to the level of around $8.700.

Historically, the halving process led to the price growth in a long-term perspective, however, on a short term extreme volatility and the price drop is expected.

As it is known, the past two halvings led to short-term price drops. However, the price of Bitcoin rocketed to over $1.100 in a year after the first halving. Furthermore, it rallied even stronger after the second halving in 2016. During this time, Bitcoin was worth about $650. The halving inspired a massive bull run of about 18 months and the price of Bitcoin skyrocketed over 3.000% to nearly $20.000 per coin at the peak of the uptrend in late 2017.

Experts predict long-term growth

Despite the fact, that the economic situation around the third Bitcoin halving is different from those in 2012 and 2016, financial experts agree that long-term growth perspectives are bright for Bitcoin.

As Scott Freeman, co-founder of crypto-focused institutional trading firm JST Capital told Forbes:

Bitcoin has risen over 100% over the last few months and we believe most of that rise was driven by continued retail demand. We expect continued volatility but expect to see good long term risk reward in Bitcoin and also expect it to behave in an uncorrelated manner to traditional financial assets.

Meanwhile, Garric Hileman, the head of research at Blockchain.com claims, that different market situation might play a key role in affecting the Bitcoin’s price in a short-term perspective. According to him, the derivatives – like Bitcoin futures and options – allow institutional investors to speculate on the price going down:

It is a very different world in 2020 than it was during the last two halvings, the derivatives market is much larger and more important. One way I would say the market has changed is that historically the trading market was more lopsided toward upward transactions because there were not as many ways to speculate on the price going down, for example, the ability to borrow and sell short. That’s something that now exists through futures and options. So all these products have created a more level playing field for people who want to bet on the price going down.

The different circumstances surrounding the third halving, include as well the global recession, caused by the COVID-19 pandemic. During the mid-March markets crash, Bitcoin has its first-ever test in the economical crisis. The top-rated coin since then showed a positive correlation with traditional market indexes.

The fact not typical for Bitcoin, which was always perceived as digital gold because of decentralized nature and weak relationships with traditional assets, like stocks. However, financial experts believe, that positive correlation to assets like gold, makes Bitcoin more immune to negative market shock.

The impact on miners

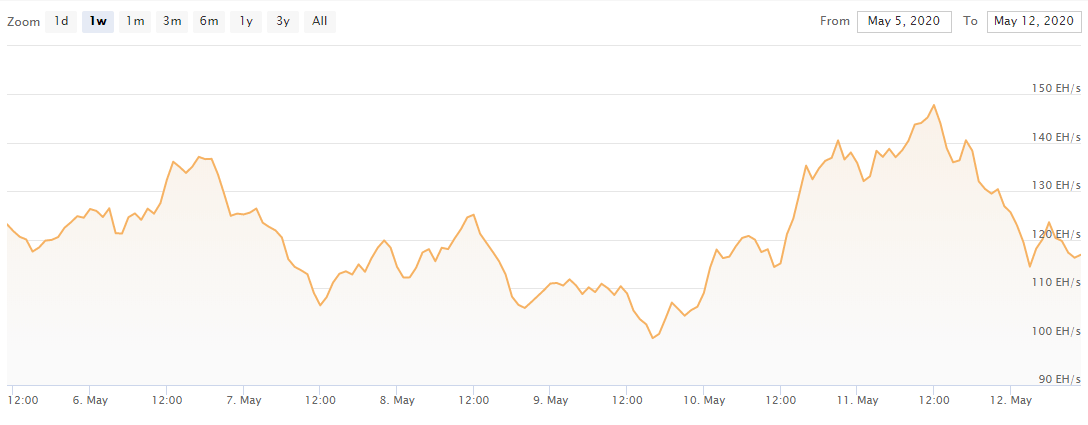

In the meantime, the total computing power, generated to mine Bitcoin blocks keeps holding strong positions despite the decrease in miners’ reward.

According to the data of cryptocurrency mining website CoinWarz, hours after the halving, the hashrate of Bitcoin decreased around 10%, from 130 exahashes per second (EH/s) to nearly 118 EH/s at the press time.

The current number, however, mostly marks the return to the average daily hashrate of around 120EH/s, recorded during the past week. As DailyCoin reported previously, the hype before Bitcoin halving generated the spurt in computing power usage resulting in the new 140 EH/s hashrate all-time-high.

Meanwhile, the popular theory of the “mining death spiral” is circulating around the industry, causing concerns about the future of lots of smaller miners. Since the decrease in the Bitcoin block reward correlates with the drop in miner’s revenue, the theory claims that lots of miners will start selling their Bitcoins. The increased supply on the cryptocurrency exchanges will then accordingly lead to a decrease in price and thus – to the other miners leaving the industry.

However, the current global situation might play an important role here as well, preventing from pessimistic theory coming into force. And one of the important factors here is cheaper electricity and the decreased demand for energy usage.

China is one of the crypto miners with nearly 65% of Bitcoin’s global computing power. It’s southwestern Sichuan province alone accumulates over 50% of the network’s total power. Since the rainy season started in the region, the country’s biggest crypto mining providers turn to use hydropower, which is 20% cheaper than the traditional energy.

Furthermore, the global coronavirus pandemic locked countries in quarantine and thus reduced industrial energy usage. The power plants, like the nuclear ones Ukraine, generate the excess energy, which might as well be used for cryptocurrency mining.