The whole crypto industry is counting days until the most important event in 4 years – Bitcoin halving. However, the crypto mining operators in China are in stillness as never.

Since various mining farms across China have been shut down during coronavirus outbreak, the pandemic caused other damage. The panic led to massive sell-offs across cryptocurrency markets, resulting a drop in BTC prices and lower mining farm margins.

Despite the fact, that the price recovered since mid-March crash, it shows no breakthrough, and Chinese cryptocurrency mining providers are struggling to find enough customers to fill the capacity.

Sponsored

Furthermore, the unusual stillness is happening right before the upcoming Bitcoin halving, estimated on May 13. The process brings additional pressure to revenues of the miners, as halving reduces the amount of newly minted coins by 50%.

The profit perspectives for crypto mining providers in China remain opaque, at least until halving. As says Huang Fangyu, the co-founder of ValarHash that runs 1THash mining pool:

If Bitcoin’s price doesn’t go up post-halving, then who’s going to buy new equipment to fulfill this capacity?

Cheaper electricity

China is one of the biggest crypto miners with nearly 65% of Bitcoin’s global computing power. It’s southwestern Sichuan province alone accumulates over 50% of the network’s total power.

Mining plants located in a water-rich Sichuan province are already offering 20% lower electricity prices to attract new customers. The move is not uncommon, as spring and summer are usually the best time for the local mining business due to the raining season. Since rain generates more electric power, crypto mining becomes cheaper and thus profitable.

Sponsored

The experts estimated, that even the slightest drop in electricity price has a huge impact on mining farm profit. For example, if the average electricity cost of 0.25 yuan ( $0.035) per kWh in Sichuan dropped to just 0.01 yuan, the difference for 100 mWh plant would mean a daily saving of over $3.360, which is more than $100.000 per month.

Computing power dilemma

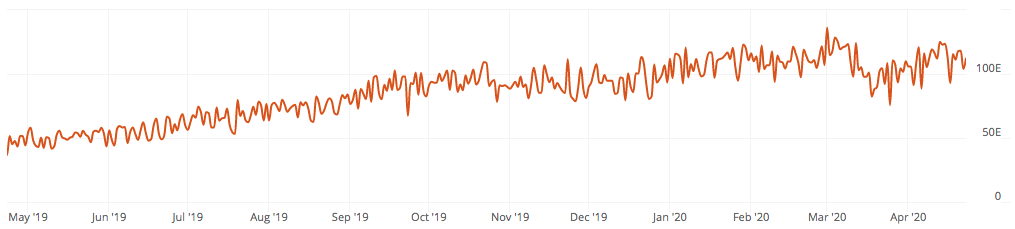

The total average computing power of Bitcoin mining currently surpassed 113 million Terahashes per second (TH/s). The number is twice bigger compared with the same time last year when Bitcoin’s mining hashrate was not even 50 million TH/s.

The increase is mainly caused by the employment of new unused and thus more powerful mining equipment like the WhatsMiner M20S, which has an average efficiency of 50 watts per TH/s. Even though Bitcoin’s price was lower at a time, it showed an upward trend. The fact was enough to boost the adoption of more powerful mining machines.

Since Bitcoin’s price is settled around $7.000 and if it does not change after halving, the older crypto mining equipment will have to be shut down. Experts predict that the move might lead to a decrease of the network’s hashing power. If this happens, mining farmers will fall into an even more difficult situation as it makes even harder to find new customers.

And while the purchase of new and more powerful equipment cooled down due to coronavirus, the farmers expect older mining machines to be back on track. As said Liu Fei, the mining facilities manager at Chinese Bitcoin startup Bixin for local media channel ODaily:

It would be normal to see Bitcoin network’s hashrate drop to 60 to 70 million TH/s after halving. But when the mining competition drops in June, with mining farms offering more electricity promotions and sourcing second-hand equipment to fulfill their capacities, we may see the hashrate go back to 100-120 million TH/s again.

The market is already seeing attempts to sell numbers of second-hand mining facilities at extremely cheap prices. For example, AntMiner S9s, that cost over $3000 in 2017, can now be purchased from $20 to $80 per unit on Alibaba.

Even though mining experts predict that older equipment might be a pay off, Bitcoin’s price has to increase up to $10.000 to generate a profit completely.