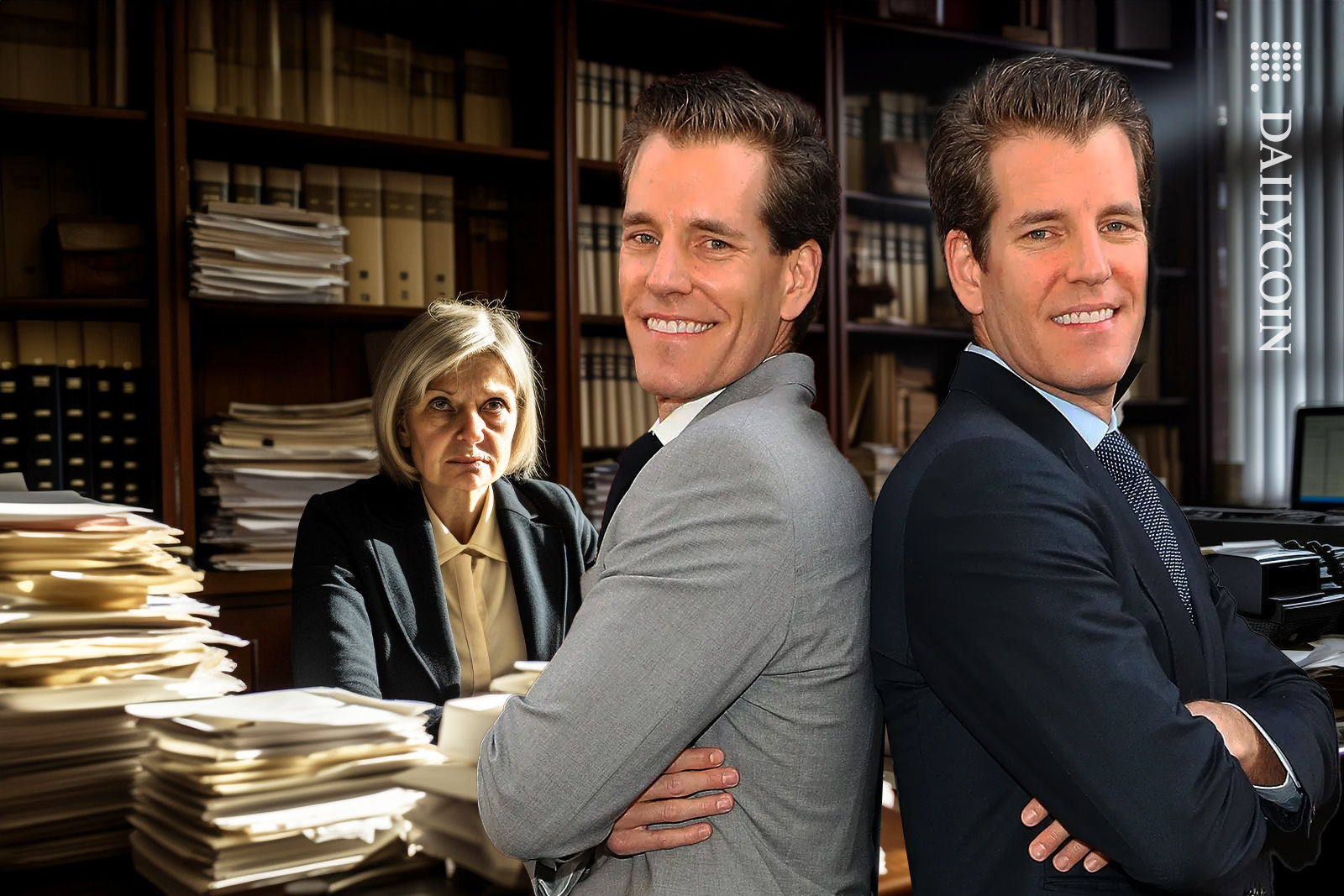

- Genesis has sued its business partner turned adversary Gemini.

- The company seeks to recover hundreds of millions of dollars from Gemini.

- The two companies are embroiled in a legal battle as U.S. authorities continue to pursue them.

Bankrupt Digital Currency Group (DCG) subsidiary Genesis Global Capital has initiated legal proceedings against crypto exchange Gemini to recover hundreds of millions of dollars in preferential transfers.

Formerly business partners, the two crypto-focused firms have been embroiled in corporate and legal feuds since the collapse of Sam Bankman-Fried’s FTX exchange. Genesis’s lawsuit comes on the heels of another action filed against the company by Gemini on October 27.

Genesis Takes Legal Action Against Gemini

In a court filing dated November 21, Genesis alleged that its former business partner Gemini made a substantial withdrawal of $689,302,000 in gross privileged payments during a critical 90-day period leading to Genesis’ bankruptcy filing in January.

Sponsored

Genesis argued that although the transactions were preferential, the transfers were “avoidable” and unfair since they were made at the expense of other creditors. The company further accused Gemini of continuing to “benefit to this day through their retention of the property” it seeks to recover.

Accordingly, the company wants the court to invoke the remedies provided in the U.S. Bankruptcy Code to rectify the unfairness and make the defendants whole, as has been done for other similarly situated creditors.

Besides asking to recover the preferential transfers, Gemini raised another argument, claiming that during the Terraform Labs collapse and the implosion of Three Arrows Capital, Gemini made “unprecedented withdrawals” that led to a “run on the bank” and the subsequent bankruptcy filing.

Sponsored

But as the two companies continue to spur in the courtrooms, U.S. regulators are breathing fire on their necks.

Government Tied to the Legal Circus

U.S. authorities are actively pursuing both Genesis and Gemini on various charges. Just before Genesis initiated Chapter 11 proceedings in January, the Securities and Exchange Commission (SEC) accused both Genesis and Gemini of selling unregistered securities.

On October 19, the New York State Attorney General filed a sweeping lawsuit against Genesis, DCG, and Gemini, charging all three companies with defrauding 230,000 investors out of over $1 billion.

Read more about the recent Genesis, Gemini in-principle deal with creditors:

Genesis and DCG Reach In-Principle Deal with Creditors

Stay updated on why Genesis sued its parent company, DCG:

Genesis Sues Parent Company DCG over $610 Million Debt