- Coingecko report shows Solana dominating investor interest in 2024.

- Ethereum and BNB trail behind, while Base and Arbitrum emerge as leading layer-2.

- However, a closer look at the numbers paints a different picture.

Solana, known for its high-performance network, has been on a roll in 2024, with a surge in value and network transaction volume. Moreover, recent reports suggest interest in the network is skyrocketing, capturing nearly half of the global crypto investor interest in 2024.

This surge places Solana at the forefront of blockchain ecosystems, surpassing long-standing leaders like Ethereum and BNB Smart Chain. However, is Solana really about to outpace these networks? A closer look at the figures paints a different picture, largely driven by retail enthusiasm.

What Solana’s Lead in Investor Interest Actually Means

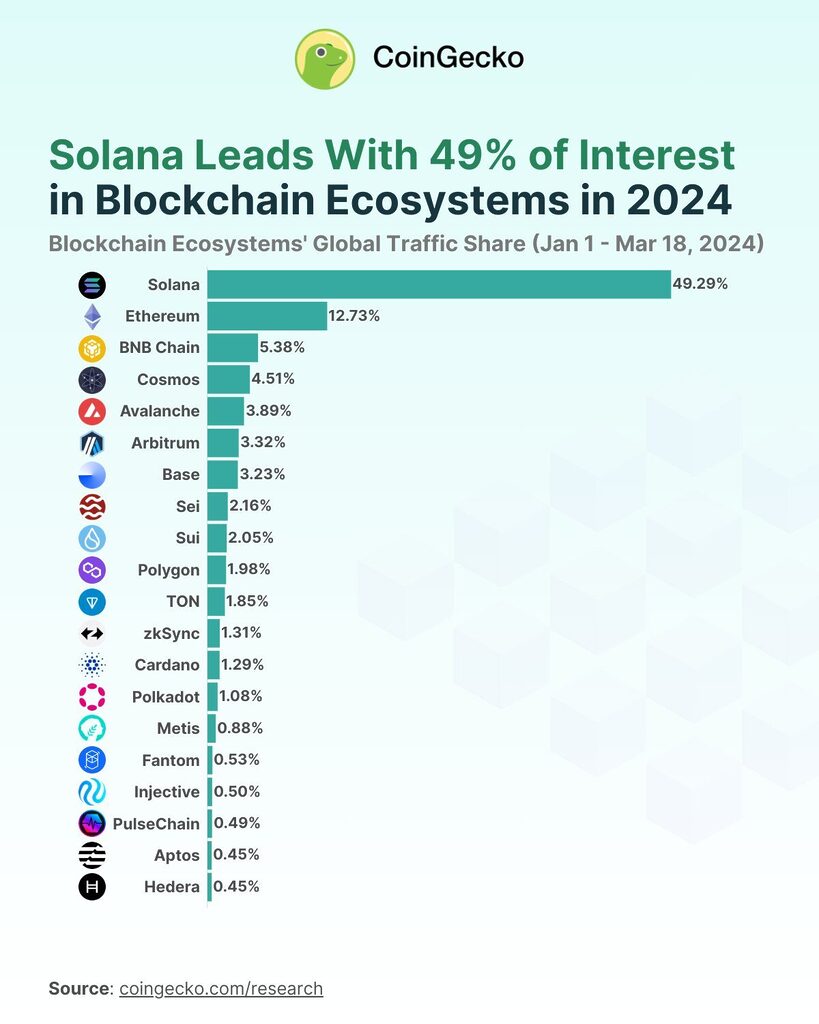

On March 25, CoinGecko released a study suggesting a significant leap in interest for Solana’s blockchain ecosystem. The study, focusing on non-botted global web traffic from January 1 to March 18, reveals that nearly 50% of crypto investor interest pivoted toward Solana.

According to the study, Solana commands 49.3% of global crypto investor interest. Once the undisputed leader, Ethereum now holds 12.7% of investor interest, placing it in second position. At the same time, BNB holds 5.38% of investor interest.

Sponsored

These numbers led to reports of Solana flipping Ethereum. However, this sentiment is largely exaggerated due to the nature of the metrics used in Coingecko’s study. The focus on web traffic predominantly captures retail investor interest. Retail investors are likelier to research and explore blockchain ecosystems through web platforms.

Institutional investors, on the other hand, rely on a variety of data and analysis tools that may not directly contribute to web traffic metrics. But even when they did, web traffic does not account for the outsized influence of both institutions and crypto whales on the crypto market.

Sponsored

Therefore, the surge in interest in Solana can be interpreted as a significant increase in retail enthusiasm for the platform.

Why Retail Investor Interest in Solana Surged

The remarkable surge in retail investor interest in Solana throughout 2024 was largely driven by the surge of Solana memecoins. Memecoins like BONK, Book of Meme (BOME), and Dogwifhat (WIF) have seen explosive growth.

For instance, BONK surged 4051.23% since its launch last year, while dogwifhat surged 1653.44% in that period. BOME, on the other hand, only launched in March 2024 and is already up 1402.63%.

The rise of memecoins on Solana has undoubtedly contributed to the blockchain’s visibility and appeal among retail investors, marking an interesting development in cryptocurrency.

On the Flipside

- The memecoin surge in Solana is not without its critics. Even Solana co-founder Anatoly Yakovenko urged traders not to dump significant amounts of capital in memecoin presales.

- Solana memecoins have recently gotten negative attention due to a large number of memecoins with overtly racist themes.

Why This Matters

The surge in retail interest in Solana captures the trend of memecoin trading, in which Solaan is growing.

Read more about the surge of Solana memecoins:

Solana’s Stellar Rise in 2024: What’s Behind the Success?

Read more about the privacy concerns with Worldcoin: