- BTC’s brief surge to a new year-to-date high has triggered market-wide fervor.

- Bitcoin has encountered a formidable obstacle in its journey to $40,000.

- Material Indicators have spotlighted a crucial factor hindering Bitcoin’s journey.

Merely seven days have passed since our latest DailyCoin Bitcoin Regular update. However, given the substantial price movements during this period, the desire for a fresh update is entirely understandable.

Here at DailyCoin, we take pride in keeping our audience well-informed. Thus, to satiate your curiosity, let’s delve into some noteworthy events from the past week. To do this, we offer you the Bi-Weekly DailyCoin Bitcoin Report, put together by our expert, Kyle Calvert.

News and Events: Understanding Impacts

Bitcoin Hits Year-To-Date High

Bitcoin has danced around the $38,000 threshold, hitting its highest level in 18 months. Following a robust October and a promising kickoff to November, BTC has surged to a year-to-date peak of $37,926.

SEC Engages in Discussions with Grayscale

Grayscale has contacted the SEC’s Division of Trading and Markets and the Division of Corporation Finance. This move follows a ruling mandating the SEC to reexamine Grayscale’s pursuit of a spot bitcoin ETF conversion. The update was reported by an insider, familiar with the matter.

Valkyrie CIO Predicts November End Bitcoin ETF

Valkyrie’s Chief Investment Officer anticipates the green light for a U.S. Spot Bitcoin ETF soon, suggesting a potential approval by the close of November and setting the stage for a possible launch in 2024.

Community Sentiment

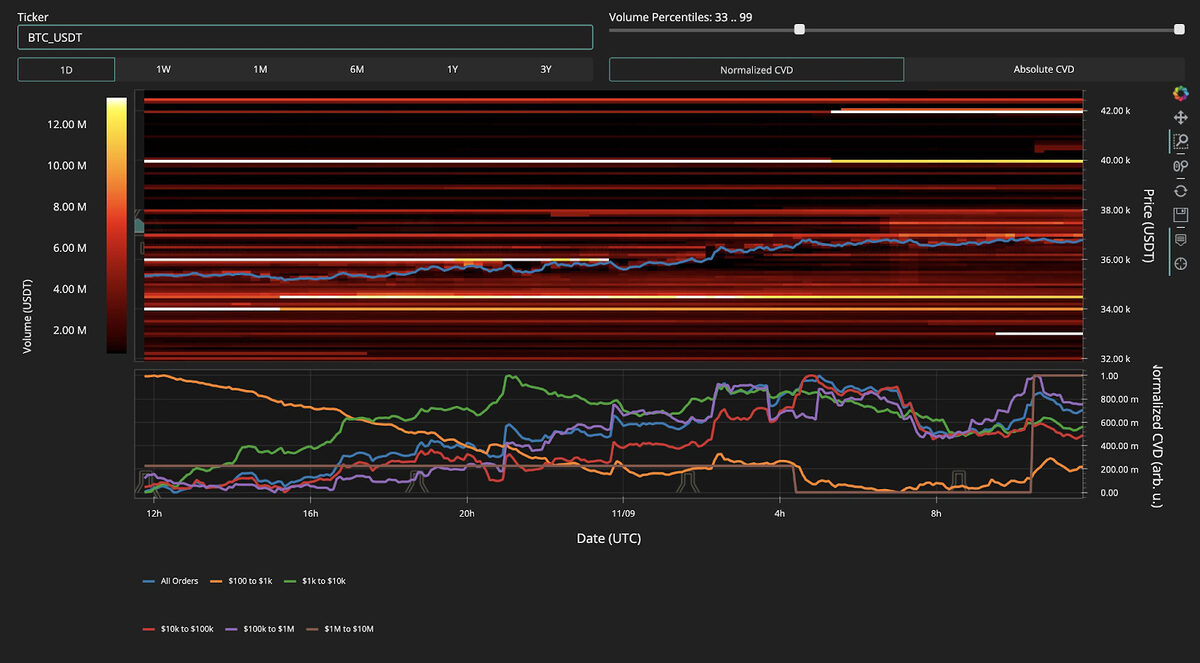

Bitcoin is boldly pushing to overcome hurdles on its journey to the $40,000 milestone. According to Material Indicators, a tool for monitoring on-chain activities, the challenge is tied to trading volume. As detailed in its recent X post, the analysis indicates the absence of robust volume support at the current levels.

Sponsored

“Support is anchored by new plunge protection at $33k. Meanwhile, resistance at $40k has moved up to the $42k range,” it noted.

Meanwhile, notable trader Skew brought attention to ongoing whale selling pressure, particularly targeting the $40,000 mark — now emerging as a significant psychological threshold in its own regard.

Current Outlook

Bitcoin showcased its prowess by reaching an intra-day high of $37,972 on Thursday. However, this ascent was short-lived, as it retraced back below the $37,000 mark shortly after. The year’s surge to this new high unfolded amidst fervor surrounding a potential spot BTC ETF.

This excitement triggered a cascade of short liquidations, propelling prices upward across the crypto market. At the time of writing, Bitcoin has reclaimed a position above the $37,000 threshold, hovering around $37,100.

Fear and Greed

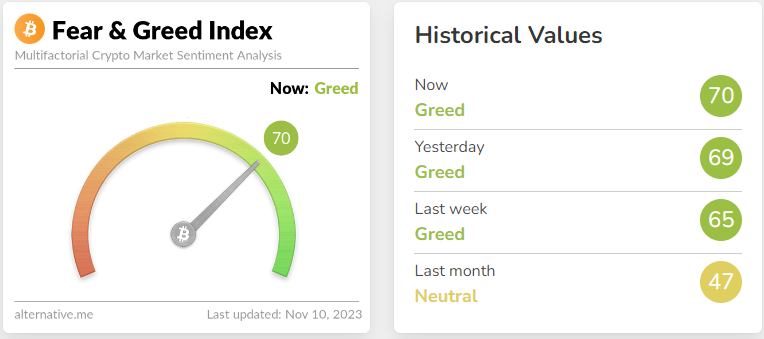

The way people feel significantly impacts the cryptocurrency market. The Fear and Greed Index plays a crucial role in navigating these emotions. This index is built upon two fundamental concepts:

- Extreme fear suggests a potential buying opportunity.

- Excessive greed signals an overheated market.

The index ranges from zero to 100, with zero representing extreme fear and 100 indicating extreme greed.

Today’s Fear and Greed Index stands at 70, indicating an increase of 5 points compared to the reading from last week. It is crucial to note that the Fear and Greed chart undergoes daily fluctuations; therefore, it is essential to stay updated by regularly monitoring it.

On the Flipside

- Historical patterns reveal Bitcoin’s ability to defy conventional volume expectations. There have been many instances where price movements have diverged from volume trends.

- The psychological impact of hitting $40,000 could trigger a surge of momentum, potentially propelling Bitcoin beyond the perceived resistance and into a new bullish phase.

- The Fear and Greed Index are snapshots in time, subject to constant fluctuations, view it as a tool for dynamic market analysis rather than fixed sentiment indicators.

Why This Matters

The current push and pull around Bitcoin’s journey to $40,000 is a litmus test for market resilience. The nuanced interplay between trading volumes, whale activities, and psychological thresholds shapes Bitcoin’s trajectory. It casts ripples that reverberate across the entire cryptocurrency realm, underscoring the interconnected nature of this dynamic market.

To explore the nuances of Bitcoin’s ascent towards the $38,000 resistance amid declining volume, delve into the intricacies here:

Bitcoin Heads Towards $38K Resistance Despite Falling Volume

Curious about the potential implications of a spot Bitcoin ETF approval? Uncover the insights and possibilities by reading more here:

What a Bitcoin Spot ETF Approval Could Signify for Users