- October has seen a Bitcoin surge that stirs anticipation, leaving the sustainability of its momentum in question.

- The debut of the spot ETF has ignited speculation within the crypto landscape.

- Bitcoin has exhibited cyclical patterns, generating anticipation of a bullish surge.

Bitcoin has broken its long spell of inactivity, finally gaining momentum after several months of sluggish performance. During the month of October, it embarked on a remarkable surge, with the widely-anticipated “Uptober” delivering an impressive 28.5% increase. Nonetheless, as we transition into a new month, there are signs that Bitcoin’s fervor may be subsiding.

As we look into this market, we aim to find interesting events that might show the market is about to get shaky. To do this, we offer you the Bi-Weekly DailyCoin Bitcoin Report, put together by our expert, Kyle Calvert.

News and Events: Understanding Impacts

Another Bitcoin Spot ETF Application Gets Added to DTCC List

The ticker for Invesco and Galaxy’s spot Bitcoin exchange-traded fund (ETF), BTCO, debuted on the Depository Trust and Clearing Corporation’s (DTCC) website. This development represents a significant stride in the application process for these two asset management firms.

‘Buy Bitcoin’ Search Query on Google Surge 826% In the UK

Global Google searches for “buy Bitcoin” have witnessed a remarkable surge. Notably, within the United Kingdom, the search term experienced an astonishing 826% increase during the week spanning from October 20 to October 27, as revealed by research conducted by Cryptogambling.tv.

Blackrock Spot Bitcoin ETF Relisted on DTCC

The conundrum surrounding spot ETFs in the United States baffles investors as BlackRock’s IBTC seemingly disappears and reappears on the DTCC website. Historically, such actions by the DTCC have typically foreshadowed the imminent introduction of a new financial product.

Community Sentiment

Bitcoin’s price trends often follow a cyclical pattern. Analysts have observed similarities between the current price movement and historical trends, hinting at a potential bullish cycle reminiscent of 2013 to 2017.

Recently, the price fell below $34,500, which experts considered an “ideal” level for a local low. However, Bitcoin’s value has since dropped by more than $1,000, raising concerns among investors, particularly in the derivatives markets.

Material Indicators, a monitoring resource, also advised caution in the current Bitcoin trading environment. They provided a snapshot of the BTC/USDT order book on the popular global exchange, Binance. Their analysis warned that support levels could vanish rapidly, creating a situation of rapid decline.

As of now, the support levels gaining liquidity are situated at both $34,000 and $33,500. These observations shed light on the current state of the Bitcoin market and the need for vigilance among investors.

Current Outlook

In the current week, the price of Bitcoin neared the $36,000 threshold, only to swiftly change course and settle at $34,250. Following a nearly 30% climb in the past month, it’s only natural for the price to take a breather as some traders pocket their gains and market participants assess whether the factors driving the rally are still in play.

Although there was a 4.67% drop in intraday price on Thursday, several analysts maintain a positive outlook on Bitcoin. Some even anticipate another squeeze if the BTC price breaks through the $36,300 mark.

Fear and Greed

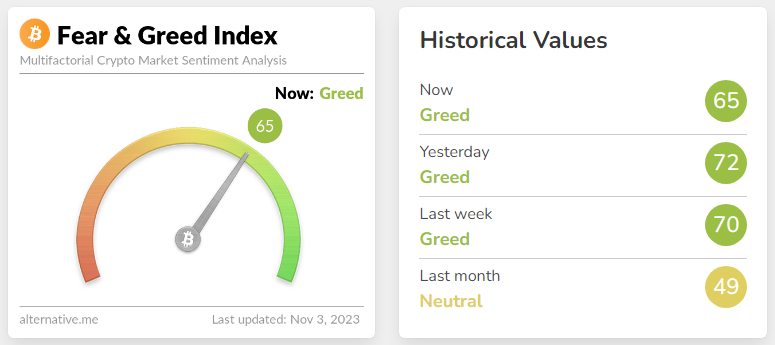

The way people feel significantly impacts the cryptocurrency market. To navigate these emotions, the Fear and Greed Index plays a crucial role. This index is built upon two fundamental concepts:

- Extreme fear suggests a potential buying opportunity.

- Excessive greed signals an overheated market.

The index ranges from zero to 100, with zero representing extreme fear and 100 indicating extreme greed.

Today’s Fear and Greed Index stands at 65, indicating an increase of 12 points compared to the reading from two weeks ago. It is crucial to note that the Fear and Greed chart undergoes daily fluctuations; therefore, it is essential to stay updated by regularly monitoring it.

On the Flipside

- While Bitcoin’s recent surge is noteworthy, it’s important to remember that the cryptocurrency market can be highly volatile, and past performance is not always indicative of future results.

- The increased Google searches for “buy Bitcoin” may also be driven by speculative interest, which can sometimes lead to price manipulation and sudden market shifts.

- The historical cyclical patterns of Bitcoin’s price movements are intriguing, but it’s essential to approach such comparisons with caution, as the cryptocurrency market has evolved significantly over time.

Why This Matters

Bitcoin’s recent resurgence and the growing interest in spot ETFs highlight the crypto market’s resilience and adaptability. This shift in sentiment and evolving regulatory landscape could potentially set the stage for broader acceptance and adoption, ultimately shaping the future of digital assets.

To explore further insights into Bitcoin’s Uptober surge and its highest monthly close since May 2022, check out the following article:

‘Uptober’ Surges BTC to Highest Monthly Close Since May 2022

For a closer look at how Solana has outshone both Bitcoin and Ethereum with its remarkable 22% price spike, delve into the article: