- Bitcoin surprises by climbing back above $60,000.

- Several factors contribute to Bitcoin’s impressive comeback.

- With the storm subsiding, Bitcoin appears confident in maintaining its rally.

Echoing the prevailing market anxiety triggered by escalating tensions in the Middle East and soaring inflation in the US, the crypto market has been anything but stable. Bitcoin and other altcoins have plunged to fear-inducing depths and liquidated billions of dollars over the past weeks.

However, with long positions squeezed out and open interest resetting, it appears the market is after short positions as Bitcoin resurges following its tumultuous roller coaster ride.

Bitcoin Surprises After Scaring Everyone

On Friday, Bitcoin surprised everyone by climbing back to $63,000 following its fall to $56,000 earlier this week.

Sponsored

The rally comes after positive market sentiments towards the reigning crypto king had waned when it plunged to a two-month low, primarily fueled by the FUD following news of Binance’s former CEO Changpeng ‘CZ’ Zhao, receiving a four-month sentence and the Federal Reserve’s non-commitment to its promise of introducing rate cuts this year.

With the market now appearing much calmer, Bitcoin surged by 12% to reach a high of $63,343, closing the business week positively. Over $200 million in short positions were liquidated during this ascent, with Bitcoin shorts accounting for a significant $90 million.

It appears multiple factors have contributed to Bitcoin’s pullback, including the US’ latest job report, Grayscale’s comeback, and the Whales’ shopping spree.

Underwhelming Job Report Pushes Bitcoin

Friday’s US job report played a major part in Bitcoin’s recent rally after it underwhelmed onlookers by falling short of economists’ expectations, adding only 175,000 new jobs last month instead of the anticipated 243,000. The report also revealed that wages had increased by only 3.9% over the 12 months through April, below the expected 4.0% gain following a 4.1% rise in March.

Sponsored

The development is particularly bullish because it could pressure the Federal Reserve to cut rates sooner this year. Despite the FOMC maintaining interest rates steady since July 2023, it has yet to commit to its promise of rate cuts. Fed chair Powell asserted that the committee is vigilantly analyzing data; however, with inflation stubbornly hovering at 3.5% as of March, the outlook remains uncertain, hindering progress towards the Fed’s target 2% inflation rate.

In addition to the disappointing job report, the ETF industry saw a rare occurrence– GrayScale experiencing net inflows.

Grayscale Bitcoin ETF Sees New Money Come In

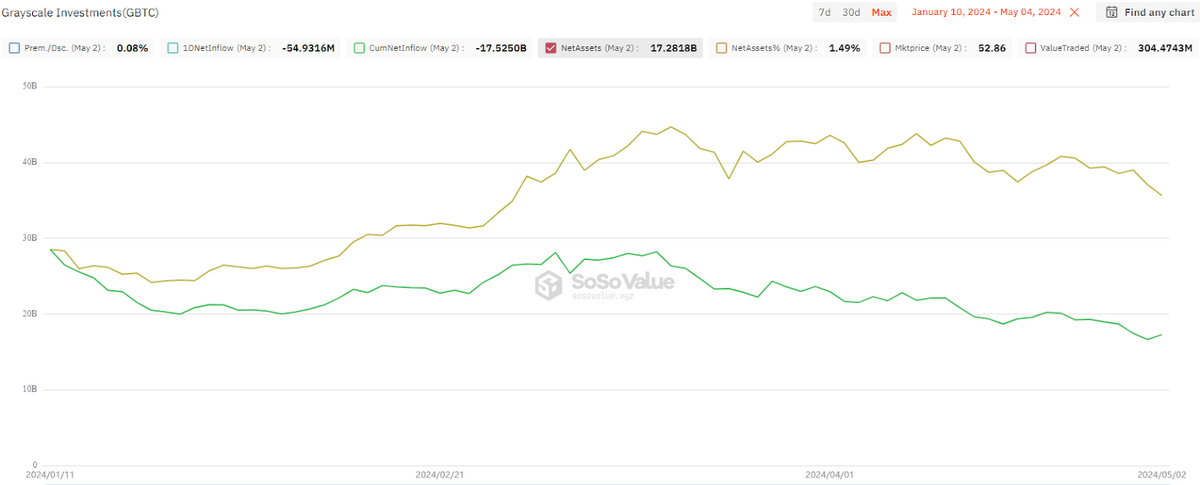

Grayscale also surprised everyone with a sudden influx of fresh capital from investors, marking the first daily increase since the product’s debut in January. On Friday, the ETF registered a net inflow of $63 million.

While Grayscale is a veteran in the crypto space, having operated a $27 billion bitcoin trust since 2013, which later converted into an ETF, it royally hindered its prospects with its exorbitant 1.5% fees.

Competitors like BlackRock and Fidelity took advantage of the high fees, offering minimal fees and capturing market share. Since debuting, GrayScale has seen nearly $11 billion in outflows, whereas its major competitor, BlackRock, has accumulated over $15 billion in the same period.

The Friday inflow not only ended the streak of net GBTC withdrawals but also heralded a highly encouraging development for the ETF and the crypto industry, leading to Bitcoin’s surging.

Whales Splurge on Bitcoin

Speaking of new money, the Whales, who had been cautiously biding their time, have seized the opportunity to launch their hunt. Following Bitcoin’s recent stumble, large wallets have amassed a staggering 47,000 bitcoins, valued at $3 billion, in just the past day.

While it remains uncertain whether these wallets belong to institutions, this development bodes well for the market, hinting at growing investor confidence as the storm subsides. The Whale accumulation may also pave the way for a surge of retail investors entering the fray, potentially driving Bitcoin even higher in the coming weeks.

On the Flipside

- Experts suggest that Bitcoin’s dip to $56,000 was largely due to many long positions opening after the halving.

- Market dynamics can be unpredictable, so it is essential to consider alternative perspectives and opinions when evaluating the potential future performance of Bitcoin.

- Given the Federal Reserve’s delays, interest rate traders predict there’s a 48% chance September is likely when the FOMC introduces rate cuts.

Why This Matters

Bitcoin’s price performance is a barometer for the broader crypto market’s trajectory. Its recent rally, fueled by its string of positive developments, could lead to investors gaining confidence and rotating towards other cryptocurrencies.

Why is Jack Dorsey’s fintech firm under attack?

Jack Dorsey’s Block Lands Under Federal Investigation

Learn more about Exverse’s launch

Exverse Amps for Alpha with Big Token Listing and Tournament