The Crypto Fear and Greed Index is an essential tool that helps newcomers gauge vibes and market sentiment in the blockchain industry.

Let’s be honest; the cryptocurrency market is an emotional space. One moment, the waters are calm. Bitcoin’s price is in the green, crypto’s future is looking bright, and life is good.

The next, a storm of fear and uncertainty rolls in, cutting the value of your altcoins in half before you even realize what’s happened.

Sponsored

What if there was a way to cut through the noise and keep a steady, data-driven course through the emotional turmoil of the crypto market?

In this guide, we’ll introduce you to the Crypto Fear and Greed Index and provide some helpful context on how to use this powerful tool.

Table of Contents

What Is the Crypto Fear and Greed Index?

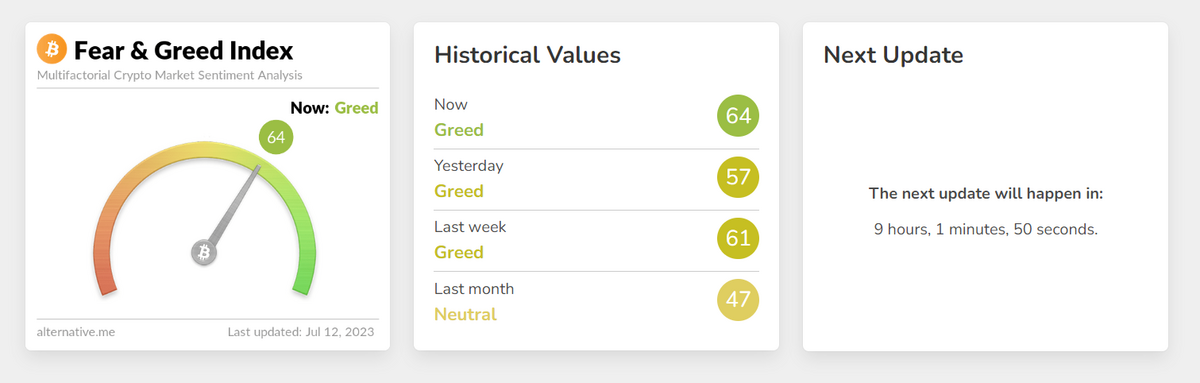

The Crypto Fear and Greed Index measures the emotional state of the cryptocurrency market. It’s a spectrum that analyzes the prevailing sentiment among crypto investors, ranging from extreme fear to extreme greed.

To simplify things, the index operates on a scale from 0 to 100. A score of 0 represents a market gripped by “Extreme Fear,” a state of panic and pessimism where investors probably doubt why they ever bought these stupid magic internet coins.

Sponsored

On the other end of the spectrum, a score of 100 signifies “Extreme Greed.” This is when you start hearing outrageous price predictions suggesting Ethereum (ETH) is heading to $100,000. Euphoria and FOMO are at all-time highs.

You can think of the Crypto Fear and Greed Index as a kind of emotional weather report, providing investors with a snapshot of the market’s mood at any given moment. This sentiment analysis is helpful for making informed decisions in the digital asset market.

How is the Crypto Fear and Greed Index Calculated?

As you can (hopefully) imagine, the Crypto Fear and Greed Index isn’t just a random number some crypto enthusiast plucked out of thin air. It’s a carefully calculated algorithm that pulls from various metrics and data sources, each providing a unique insight into the market’s emotional state.

Volatility

In the world of cryptocurrencies, volatility refers to the rate at which the price of a crypto asset increases or decreases for a set of returns. Crypto markets are notoriously volatile, with prices capable of making dramatic leaps and plunges in a matter of hours.

Most crypto index providers argue that a volatile market is a fearful market, so an unusual surge of volatility swings the Crypto Fear and Greed Index’s ticker toward Fear. Market volatility is calculated by measuring current price volatility against averages from the last 30 and 90-day periods.

Market Momentum and Volume

Momentum refers to the speed at which cryptocurrency prices change, while volume is the number of coins traded. Together, they provide a snapshot of the market’s activity level.

Buying volume outpaces the long-term market momentum and generally indicates a strong market sentiment. Investors are feeling greedy and buying up assets, hoping to ride the wave of positive momentum and ward off the fear of missing out.

On the other hand, if prices are falling quickly in high trading volume, it indicates that fear is in control. This is often called panic selling or capitulation, as investors try to avoid or minimize potential losses.

Social Media Sentiment

In the digital age, social media platforms have become the first place where people share their thoughts. This is particularly true in the world of cryptocurrencies, where platforms like Twitter and Discord buzz with discussions about the latest trends in the crypto market.

The Crypto Fear and Greed Index taps into this rich vein of information by analyzing social media posts reactions, search queries and hashtag frequency. If the chatter is overwhelmingly positive, it suggests that greed is in the air. If the sentiment is largely negative, it indicates that fear is taking hold.

Surveys

Some Crypto Fear and Greed Indexes also run surveys and polls as a sentiment indicator. The responses to these surveys can provide direct insight into the mood among market participants. In theory, surveys help capture the subjective sentiments of crypto investors, adding another layer of depth to their analysis.

It’s worth noting, however, that the results of these surveys are easily manipulated. Consequently, some providers have removed survey result weighting from their index.

Bitcoin Dominance

In many camps, Bitcoin dominance serves as a measuring stick for the overall health of the crypto market. It’s calculated by taking the percentage of the Bitcoin market cap in relation to the market cap of the entire cryptocurrency market.

When Bitcoin’s dominance is high, it often indicates a fear in the market. During times of uncertainty, investors often flock to Bitcoin as something of a ‘safe haven.’ On the other hand, when Bitcoin’s dominance is low, it suggests a state of greed, as investors are more willing to take risks on lesser-known cryptocurrencies in search of higher returns.

In some circles, low BTC dominance means we’re in the midst of an altcoin season, where Bitcoin liquidity trickles down to prominent cryptocurrencies like Ethereum and BNB Coin before rotating to through to mid-caps and micro-caps.

Trends

The final piece of the puzzle in calculating the Crypto Fear and Greed Index is trends, specifically trends in Google searches for Bitcoin. The logic is simple: the more people are searching for Bitcoin, the more interest there is in the crypto market, signaling rising greed.

Google Trends data provides a measure of the public’s interest in Bitcoin, which can be a helpful indicator of the overall sentiment toward the crypto market.

How to Use the Crypto Fear and Greed Index

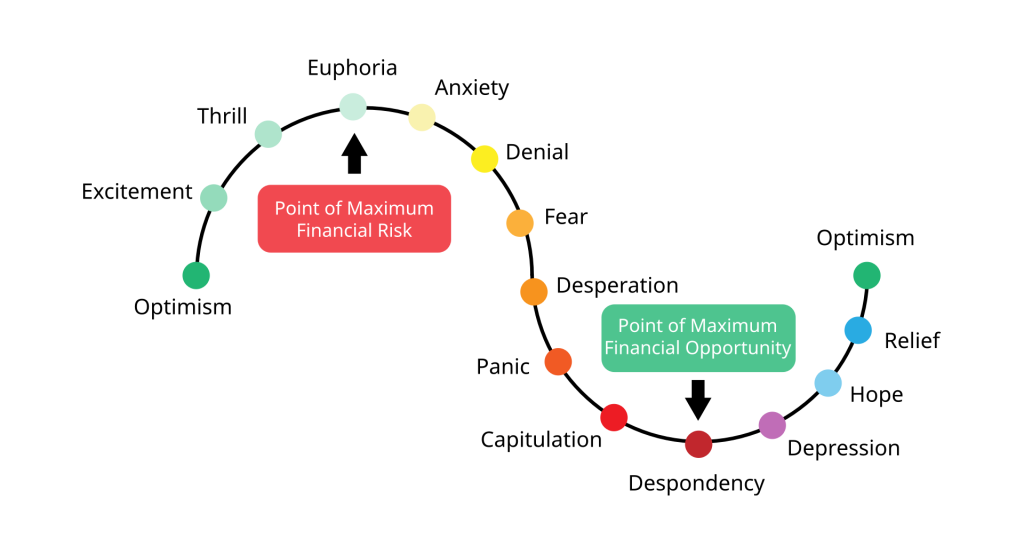

Legendary stock market investor Warren Buffett hit the nail on the head: “Be fearful when others are greedy and greedy when others are fearful.” The easiest way to take advantage of the Crypto Fear and Greed Index is to remember that it’s a contrarian indicator. Let’s break down what that means.

When the index is high, indicating a state of “Extreme Greed,” it signals that investors are getting overly optimistic. Prices may be inflated, and a correction could be on the horizon. This could be an excellent time to consider taking profits or exercising caution with new investments. If you’re taking screenshots of your trades or portfolio gains, that’s a great time to reevaluate.

On the other side, when the index is low, showing “Extreme Fear,” it’s a sign that investors are becoming overly pessimistic. If you’re thinking that ‘Crypto is dead’, that’s usually a good sign that we’re at peak fear. Prices may be undervalued, and a market rebound could be imminent. Most experienced investors would consider this a buying opportunity.

Let’s put things back in perspective before loading up your crypto exchange account with funds and getting ready to buy fear and sell greed.

It’s crucial to remember that the Crypto Fear and Greed Index is just a straightforward tool among dozens of frameworks and investment strategies. Instead of blindly taking financial advice from a sentiment algorithm, try cross-referencing it against other crypto analysis tools to get a clearer overview of the entire crypto market.

Is the Bitcoin Fear and Greed Index Reliable?

The reliability of the Crypto Fear and Greed Index, like any other tool, depends on how you use it. It’s a measure of market sentiment, which is inherently subjective and can be influenced by a multitude of factors.

One of the key things that people often forget is that the Crypto Fear and Greed Index only analyzes the current state of the market. It might suggest that the market is driven by Greed, but it doesn’t give an indication of how long that might persist. On top of that, following the Bitcoin Fear and Greed Index might put you on the sidelines over extended time frames.

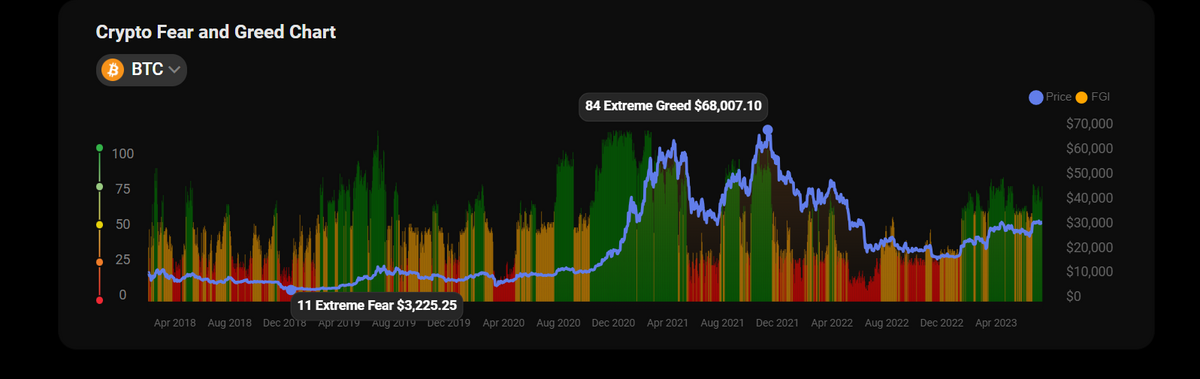

For example, imagine if you’d sold Bitcoin at just over $10,000 USD when the index flipped ‘Greedy’ back in October 2020. You’d probably end up sitting out the entire 2021 crypto bull run just waiting for the fear to strike back and miss Bitcoin running to its all-time high.

Crypto Fear and Greed Index History

What many people don’t know is that the original Fear and Greed Index was created by CNNmoney in 2012 to track traditional financial markets, like the stock exchange.

Six years later in 2018, alternative.me adapted the tool to suit the needs of the crypto market and the Crypto Fear and Greed Index was born. It came at a welcome moment following the whirlwind volatility of the 2017 bull cycle, during a time when the crypto market was suffering through a brutal crypto winter.

Today, there are dozens of different Crypto Fear and Index providers, each with slightly different metrics. Some, like Coinstats, let you track market sentiment for a wide variety of crypto assets, like Solana (SOL), Aptos (APT), and Dogecoin (DOGE).

Despite its short history, the Crypto Fear and Greed Index has quickly gained popularity among crypto investors. Its ability to provide a snapshot of market sentiment has made it a valuable tool for those looking to understand the emotional dynamics of the crypto market.

Pros and Cons of the Crypto Fear and Greed Index

The Crypto Fear and Greed Index has its own advantages and disadvantages. Understanding these can help investors use the index more effectively and avoid potential pitfalls.

Pros

- Tracks Market Sentiment – The Crypto Fear and Greed Index provides a data-driven snapshot of the emotional state of the crypto market.

- Contrarian Indicator – The index can serve as a contrarian indicator, potentially highlighting buying opportunities when fear is high and selling opportunities when greed is high.

- Pulls from various data sources – The index considers various factors to provide perspective and wide coverage.

Cons

- Sentiment and emotion are subjective – The index measures market sentiment, which is inherently subjective and is easily manipulated and influenced.

- Short History – The Crypto Fear and Greed Index is relatively new, having been around since 2018. This short history may limit its effectiveness, especially considering the length of crypto market cycles.

- Limited conclusions – Designed by the masses, the Index doesn’t offer great depth of analysis. For experienced crypto enthusiasts, there a plenty of other tools that provide greater detail.

On the Flipside

- It’s essential to understand its limitations. The Crypto Fear and Greed index is not a magic crystal ball that can predict the future. Instead, it should be used as part of a broader investment strategy, complementing other forms of analysis and research.

Why This Matters

The Crypto Fear and Greed Index is an excellent tool for beginners looking to understand the basics of market sentiment.

FAQs

The first official Crypto Fear and Greed Index was created by alternative.me and is the most commonly referred to sentiment indicator in the crypto space.

The Crypto Fear and Greed Index is useful for gauging market sentiment and emotion, but doesn’t predict future cryptocurrency price movements.

Sites like Coinstats provide detailed Fear and Greed Indexes for a variety of crypto assets, including Ethereum.