- Bitcoin has recently surged near to $38,000, marking its highest point in 18 months.

- The cryptocurrency grapples with trading volume issues as it endeavors to reach the $40,000 milestone.

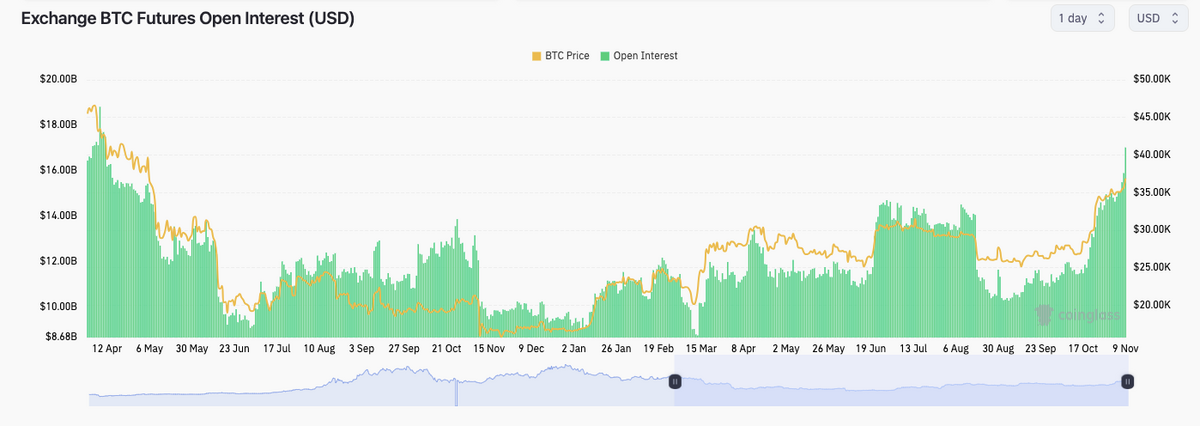

- Open interest in Bitcoin futures has reached an impressive $17 billion.

Bitcoin has flirted with the $38,000 mark, marking its highest point in 18 months. However, traders are casting a skeptical eye on BTC’s current price dynamics trajectory. Following rapid gains at the start of the trading day, Bitcoin is slowly climbing, aiming to conquer obstacles on its ascent toward the coveted $40,000 threshold.

Could Year-End Bring Market Shakeup?

As per TradingView data, BTC/USD grasped at $38,000 after breaching the $37,000 barrier when Wall Street opened its doors. Despite a 5.4% surge in November, the foremost cryptocurrency is catching some market players off guard with its resilience, having already accrued almost 30% in October. Bitcoin is holding steady at $37,000, poised for potential turbulence ahead.

A glaring red flag emerges as we observe price appreciation amidst diminishing trading volume. Historically, such a scenario often leads to unfavorable outcomes. Nevertheless, the unfolding events necessitate a vigilant watch to discern whether this instance will deviate from the norm.

Escalating OI Fuels Bitcoin’s Upward Swing

While the upward momentum has been robust, substantial volume support seems conspicuously absent. Thanks to a new plunge protection measure, the safety net is currently pegged at $33,000. Meanwhile, the resistance at $40,000 has shifted its ground to the $42,000 vicinity.

In other areas, a noteworthy development is the escalating open interest (OI), the linchpin behind sudden upward movements in recent weeks and months. According to data sourced from the monitoring platform CoinGlass, the total open interest in Bitcoin futures has surpassed $17 billion at the time of this report, marking the highest valuation since mid-April.

On the Flipside

- Despite the apparent upward momentum, skeptics point out the absence of robust volume support at existing levels.

- Some see the shift in resistance from $40,000 to the $42,000 range as an indication of heightened market volatility.

- Past instances of price appreciation coinciding with a decline in trading volume have often led to less favorable outcomes.

Why This Matters

As Bitcoin navigates this delicate balance, its performance could ripple through the wider cryptocurrency sphere, influencing trading strategies and shaping the collective outlook of the crypto community.

To delve deeper into the potential impact of a spot Bitcoin ETF approval on user engagement, explore the insights shared in this analysis:

What a Bitcoin Spot ETF Approval Could Signify for Users

Curious about Bitcoin’s recent surge toward $37,000 amidst the buzz surrounding spot ETF approval? Gain additional perspectives by checking out the details here:

Bitcoin Nears $37K Amid Spot ETF Approval Buzz

Sponsored