- BTC has been going through a lackluster phase prompting a pressing question.

- A major Bitcoin options expiry event will occur today, with a staggering $2.08 billion notional value.

- Community sentiment has been divided as historical patterns reveal a potential Bitcoin breakout.

During this rather lackluster phase in BTC’s history, characterized by a price resembling that of a stablecoin rather than a dynamic cryptocurrency, many enthusiasts ponder a pressing question: When Lambo?

Sponsored

Delving into this lateral market, we aim to unveil intriguing developments that could be early indicators of imminent market volatility, and in pursuit of this goal, we bring you the Bi-Weekly DailyCoin Regular on Bitcoin, expertly crafted by our expert on the subject, Kyle Calvert.

News and Events: Understanding Impacts

Major Volatility Expected as 10,000 Bitcoin Inflow to Exchanges

July 27 witnessed a substantial influx of over 10,000 Bitcoins flooding into exchanges, hinting at the potential arrival of “major volatility” in the cryptocurrency market. This massive inflow marked the most significant one-day surge in several months.

Massive Bitcoin Options Today with 71,000 BTC Contracts Set to Expire

Today, July 28th, marks the most substantial Bitcoin options expiry event for the next two months, with a staggering 71,000 BTC contracts reaching their expiration date. This event carries an impressive notional value of $2.08 billion, making it one of the most significant occurrences in recent times.

FOMC Announces Anticipated 0.25% Increase in Fed Funds Target Rate

On Wednesday, July 26th, the Federal Open Market Committee (FOMC) made a predicted announcement of a 0.25% increase in the Fed Funds target rate, bringing it to a range of 5.25-5.50%. As anticipated by 99.5% of analysts, the rate hike unfolded exactly as expected, and Chairman Jerome Powell’s speech mirrored this predictability.

Current Outlook

As of the time of writing, Bitcoin has seen a 0.8% increase in its price over the last 24 hours, being traded around the $29,300 area. While trading down 3% since the last DailyCoin Bitcoin Regular, two weeks ago. Despite encountering obstacles around the crucial resistance level of $29,750, BTC exhibits tenacity as it strives to regain its bullish trajectory.

Sponsored

As the market dynamics continue to evolve, one cannot help but observe that Bitcoin’s largest-volume investor cohort, commonly called “whales,” are in flux amid the prevailing uncertainties. The overall market sentiment remains somewhat unclear, prompting both caution and curiosity among these prominent players.

Community Sentiment

DXY continues to pique the interest of BTC traders fascinated by historical patterns. One such trader, Moustache, has unveiled a copycat Bitcoin/DXY scenario that bears a resemblance to past Bitcoin bull markets. He says a Bitcoin breakout appears imminent; it’s merely a waiting game.

Bitcoin’s price might experience a classic weekend move, according to analyst Michaël van de Poppe. He envisions a probable retest of the support level at $28.3k, followed by a rebound toward $31k. Nonetheless, cautioning against the bears’ influence, the analyst indicates a potential dip to $27.1k, which could create room for altcoins to rally.

Quick Fire Targets

Level up your understanding of market dynamics with these key levels to keep an eye on. Monitoring these levels allows you to gain valuable insights into the market sentiment and potential price movements.

Support

First on our list is the initial support level at $28,935. Moving on, we have the second support level at $28,720. Lastly, we have the third support level at $28,350. These support levels are subject to change based on market conditions and should be used as a reference for analysis rather than definitive predictions.

Resistances

First on our list is the initial resistance level at $29,519. Moving on, we have the second resistance level at $29,890. Lastly, we have the third resistance level at $30,100. These resistance levels are subject to change based on market conditions and should be used as a reference for analysis rather than definitive predictions.

Fear and Greed

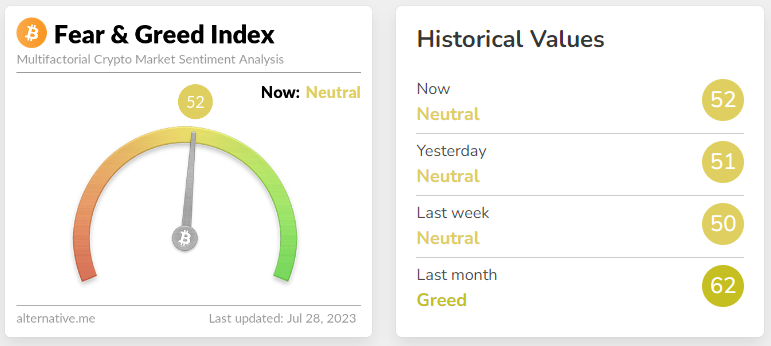

The way people feel significantly impacts the cryptocurrency market. To navigate these emotions, the Fear and Greed Index plays a crucial role. This index is built upon two fundamental concepts:

- Extreme fear suggests a potential buying opportunity.

- Excessive greed signals an overheated market.

The index ranges from zero to 100, with zero representing extreme fear and 100 indicating extreme greed.

Today’s Fear and Greed Index stands at 52, indicating a decrease of eight points compared to the reading from two weeks ago. It is crucial to note that the Fear and Greed chart undergoes daily fluctuations; therefore, it is essential to stay updated by regularly monitoring it.

On the Flipside

- The influx of 10,000 Bitcoins into exchanges may not necessarily lead to “major volatility,” as various factors can influence market movements beyond this single event.

- Bitcoin currently faces challenges around the resistance level of $29,750, and there’s no guarantee of an immediate bullish trajectory.

- While the Fear and Greed Index is a useful indicator of market sentiment, it should not be the sole factor influencing investment decisions, as market sentiments can change rapidly and do not always align with price movements.

Why This Matters

The recent influx of over 10,000 Bitcoins into exchanges and the significant options expiry event signal potential market volatility ahead. As the Federal Open Market Committee confirms a rate hike and key support and resistance levels challenge Bitcoin’s trajectory, investors must closely monitor these developments for strategic decision-making.

To learn more about the recent US House’s Stablecoin Regulation Bill and its impact on the crypto market, read here:

US House’s Stablecoin Regulation Bill Passes Despite Bipartisan Tension

To learn more about Ripple and its legal chief brushing off a potential SEC appeal with confidence, read here:

Ripple’s Legal Chief Brushes Off SEC Appeal Threat with Confidence