- Groundbreaking XRP revelations have propelled an altcoin surge.

- Bitcoin’s movement has been precarious, and community sentiments have been divided.

- The impending expiration of weekly options has introduced an element of uncertainty for Bitcoin.

The industry has been swept up in a tidal surge of noteworthy developments as the present landscape bears witness to massive altcoin gains ignited by the latest revelations surrounding XRP. To provide insights into these groundbreaking developments, we bring you the Bi-Weekly DailyCoin Regular on Bitcoin, expertly crafted by our expert on the subject, Kyle Calvert.

News and Events: Understanding Impacts

Victory for Ripple Labs: Court Declares XRP Isn’t a Security

Ripple Labs emerged victorious on July 13th, securing a substantial triumph in the persistent legal battle brought against them by the SEC. The court ruling, delivered by the esteemed Judge Analisa Torres, decisively asserted that XRP, the digital asset at the heart of the dispute, lacks the fundamental attributes typically associated with securities.

Bitcoin Liquidates $50M in Short Positions

Bitcoin swiftly responded to breaking news confirming a United States judge’s favorable ruling on altcoin XRP, asserting its non-security status. In the aftermath of this development, Bitcoin efficiently liquidated an impressive $50 million worth of short positions. Despite this positive turn of events, it is worth noting that the bears could potentially regain control as the weekly options expiration looms.

Bitcoin Unmoved by Positive CPI Data

The CPI data showed that inflation was still rising but slower than in previous months. This should have been positive for the Bitcoin market, as higher interest rates are bearish for cryptocurrencies. However, Bitcoin maintained its stagnant trading pattern, hovering around the $30,700 area.

Current Outlook

As of this writing, Bitcoin resides at around $31,250, exhibiting a promising upswing in its price trajectory compared to its position two weeks ago.

Bitcoin’s recent rally to new yearly highs has left traders questioning whether its price performance is compelling.

However, the expiry of Bitcoin weekly options could tip the scales of market sentiment and result in a breach below the critical support level of $30,000.

Sponsored

While the spot Bitcoin exchange-traded fund (ETF) requests initially sparked a bullish surge, the overall macroeconomic data has been less favorable for risk-on assets. As such, it becomes paramount to delve into market sentiment analysis to assess the likelihood of Bitcoin maintaining its position above $30,000 come July 14.

This level serves as a decisive threshold that could offer lucrative opportunities for bears, potentially allowing them to profit up to a staggering $120 million through the weekly option expiry.

Community Sentiment

Altcoins have captured the spotlight, relegating Bitcoin to the sidelines and prompting the community to redirect their attention. This shift has left trader Crypto Tony feeling exasperated by Bitcoin’s inability to make a decisive move beyond its well-established trading range.

In a display of frustration, Crypto Tony expressed his disappointment on Twitter, emphasizing the absence of a suitable entry point due to Bitcoin’s rejection from the upper boundaries of the range. He underscored the necessity of a robust reversal before considering involvement in this market, stating that he would be disheartened if Bitcoin failed to accomplish this crucial flip.

Meanwhile, other community members are chiming in, suggesting that we may be entering the era of altcoins.

This sentiment is reinforced by the fact that Bitcoin’s dominance experienced a decline of 3% on Thursday, the 13th of the month.

Quick Fire Targets

Level up your understanding of market dynamics with these key levels to keep an eye on. Monitoring these levels allows you to gain valuable insights into the market sentiment and potential price movements.

Support

First on our list is the initial support level at $30,570. Moving on, we have the second support level at $29,660. Lastly, we have the third support level at $29,100. These support levels are subject to change based on market conditions and should be used as a reference for analysis rather than definitive predictions.

Resistances

First on our list is the initial resistance level at $32,000. Moving on, we have the second resistance level at $32,670. Lastly, we have the third resistance level at $33,570. These resistance levels are subject to change based on market conditions and should be used as a reference for analysis rather than definitive predictions.

Fear and Greed

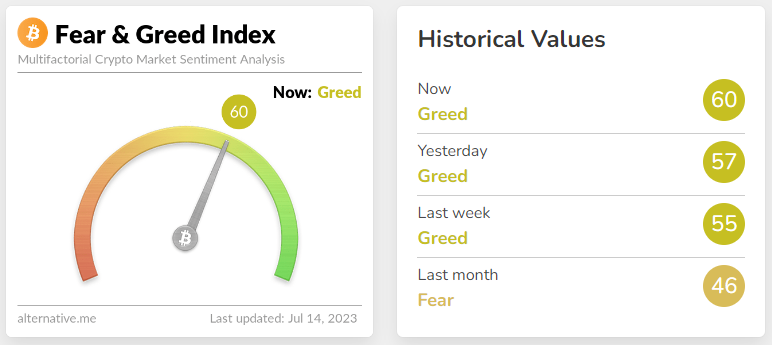

The way people feel significantly impacts the cryptocurrency market. The Fear and Greed Index plays a crucial role in navigating these emotions. This index is built upon two fundamental concepts:

- Extreme fear suggests a potential buying opportunity.

- Excessive greed signals an overheated market.

The index ranges from zero to 100, with zero representing extreme fear and 100 indicating extreme greed.

Today’s Fear and Greed Index stands at 60, indicating an increase of 4 points compared to the reading from two weeks ago. It is crucial to note that the Fear and Greed chart undergoes daily fluctuations; therefore, it is essential to stay updated by regularly monitoring it.

On the Flipside

- While Bitcoin has stagnated in its trading pattern, many altcoins have captured the spotlight.

- While providing a snapshot of market sentiment, the Fear and Greed Index should not be the sole determining factor for investment decisions.

- The court ruling in favor of Ripple Labs may set a concerning precedent, potentially blurring the line between digital assets and securities.

Why This Matters

The recent focus on altcoins, Bitcoin’s stagnant state, and the impending expiration of weekly options underscores a pivotal juncture in the cryptocurrency market. The outcome of these events could reshape market sentiment, potentially paving the way for new opportunities or rekindling the dominance of Bitcoin.

To learn more about how inflation rates lower than predicted have impacted Bitcoin’s volatility, read here:

Inflation Rates Lower Than Predicted: Bitcoin Reacts with Volatility

To learn more about the implications of Ripple’s recent victory and why the SEC lawsuit is still ongoing, read here: