All major crypto exchanges experienced issues with customer withdrawals this year. But while massive withdrawal freezes are rare, individual account or fund transfer suspensions are an everyday business.

When do crypto exchanges have the right to halt their customers’ funds? What are the common customer mistakes that lead to crypto withdrawal suspensions? And what precautions should users take on digital asset exchanges?

Withdrawals Suspended Because of Customer Fault

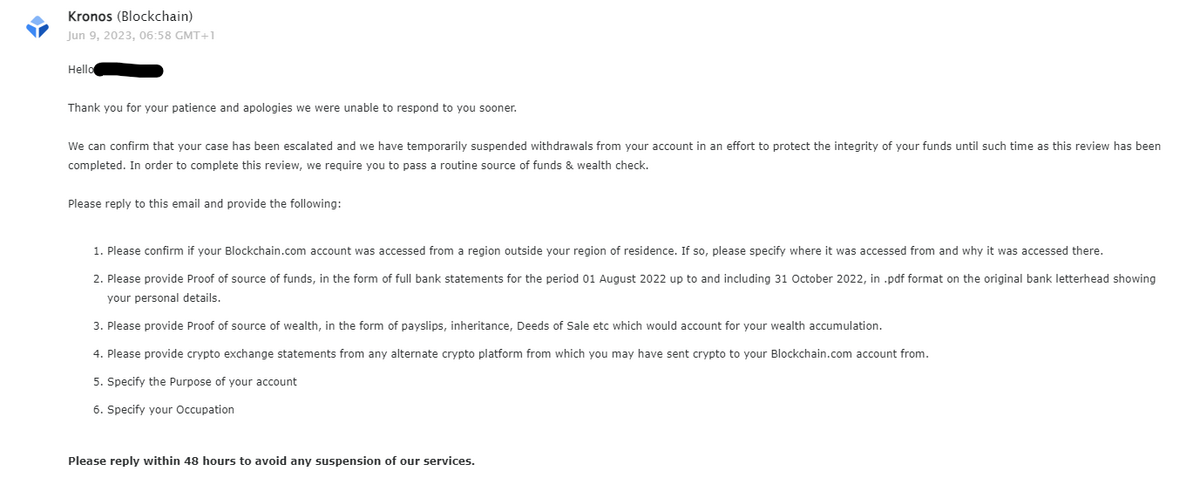

Earlier this year, crypto exchange Blockchain.com unilaterally suspended one of their customer’s accounts. His Bitcoins were suddenly frozen, and all the withdrawals became impossible, the account owner has told DailyCoin.

Sponsored

The man, who requested not to disclose his name, said Blockchain.com suspended his transfers because of unusual login activity to his account.

“The platform explained that they spotted logins from different locations. This was enough to assume that the account “may be compromised” and to restrict custodial services,” the Blockchain.com customer told DailyCoin.

Blockchain.com then asked him to create a new custodial wallet, which had to pass the higher-level verification process. However, this was where the platform’s customer got stuck for the second time.

Verification approval lasted days, and the platform requested more and more data to pass their routine “source of funds” check. Two weeks later, it unexpectedly removed account restrictions, although the client had not provided any additional documentation.

Sponsored

The unusual story raised questions about when and why crypto exchanges apply additional security measures to their customer accounts.

As we found out, there are two main reasons why crypto exchanges treat the accounts with suspicion. There are also reasons why their support teams may be slow and reserved from sharing the details with you.

VPN Usage Raises Suspicions

Traditional financial institutions comply with strict regulatory requirements, like AML and KYC rules, and must know whether clients log in from banned or sanctioned countries.

As they need accurate information about their clients’ identities and locations, TradFi service providers typically do not allow them to use Virtual Private Networks (VPN) that encrypt internet connections and hide IP addresses.

Crypto exchanges are more flexible with VPNs and typically do not ban their customers from using them.

“VPN alone is not a reason to suspect unusual activity. If an IP out of pattern is identified, the user is asked if a VPN is used and the country selected to ensure full control of the account,” Blockchain.com’s spokesperson messaged to DailyCoin.

On the other hand, if crypto exchanges comply with the regulations and laws in their jurisdiction, local law decides whether users can access crypto exchanges through VPN.

Larger Transfers Require Greater Attention

Besides VPN, the size of transactions is another area that falls under the “unusual or suspicious activity.”

Like any financial service provider, crypto exchanges face risks related to breaking laws and rules, which could result in legal trouble or financial penalties. To avoid that, they categorize clients based on their AML risk assessment.

Low-risk clients typically have solid reputations and clear income sources. Medium-risk ones come with more complex financial structures or are involved in higher-risk industries. High-risk customers include those in industries prone to money laundering and those with a history of non-compliance. Diligence measures differ for each category.

However, crypto exchanges apply different risk management techniques than traditional financial service providers. They do not categorize clients based on risk level and instead focus on the transfer size.

“The larger the transfer, the more scrutiny it attracts. Thus the platform may ask for additional actions, like for source of funds or source of wealth proofs.

Everything depends on the individual platform and its own AML and risk management methodology,” a founder of an electronic money institution has told DailyCoin.

Every crypto trading platform sets a specific threshold to classify transactions as large transfers. When this threshold is met, their compliance teams increase scrutiny on fund transfers.

They monitor large-value transfers more closely than smaller amounts because of the higher associated risks, as large-value transactions present a greater potential for financial crimes such as money laundering, fraud, or illicit activities.

The Law Forbids Disclosing Investigation Details

Last but not least, suspended accounts are not the only obstacle customers must overcome. Victims complain about the silence or poor communication from customer support teams whenever their withdrawals get frozen.

Crypto exchanges respond that they have legal reasons to act in such a way. Like all financial institutions, they are required by law to investigate certain issues and file a suspicious activity report with the responsible financial authorities. In the meantime, their mouths are shut.

“During this period, which can vary depending on the case and jurisdiction, we are prevented by law from informing the customer about the reason for potential restrictions, nor can we disclose further information or offer a set timeframe when the functionalities will be enabled again,” commented Blockchain.com

This means crypto exchanges will not disclose any details to prevent potential compromise of the ongoing investigation, which otherwise may result in a solid financial penalty for the platform itself.

On the contrary, exchanges might perform enhanced due diligence checks on their users if they detect any unusual activity, suspect illicit funds or their client falls victim to a scam.

Account verification can be only allowed if the due diligence checks have been completed and passed, claims Blockchain.com.

Yet the lack of communication may simply mean poor customer service. Some crypto exchanges are only accessible via email, and their customer support teams are unavailable 24/7. At times, they may not have enough staff to handle the needs of millions of customers.

Withdrawals Suspended Because of Exchange

Unfortunately, not all withdrawals and crypto accounts are suspended because of their owner’s fault. Sometimes, it is crypto exchanges to blame.

For example, Bkex. The popular crypto exchange suspended all fund withdrawals for millions of its customers in May 2023, citing an ongoing money laundering probe. It then shut down its website, apps, and customer support and vanished.

However, no law enforcement agency in the jurisdictions where Bkex exchange operated has confirmed any ongoing investigation against it. Customer support ignored numerous victims’ attempts to approach them.

“Five months and withdrawals are still blocked for us. No response to inquiries. I assume we were cheated,” says Zakaria, a former user of Bkex whose $60,000 worth of assets remains locked on Bkex.

DailyCoin later discovered that transfers from the crypto exchange were incredibly active the final week before it shut down. Millions of Tron (TRX) left the platform and settled into the unidentified Binance whale wallet. The latter is a common destination of funds that regularly leave the burn wallet associated with Tether.

However, millions of cryptocurrency users found themselves deprived of their life savings. According to law enforcement, their chances of recovering anything from loosely regulated, offshore-registered exchanges are slim.

The good thing is that warning signs help make a better-informed decision when opening an account on crypto exchanges.

Negative Feedback

A positive reputation fosters trust and credibility among customers; it is a fundamental element in finance. Crypto exchanges also care about their public image and do their best to avoid negative feedback.

Thus, Googling certain exchanges should be a step of utmost importance. Critical reviews on internet forums, customer complaints, shady founders, and any history of user feedback could be rewarding pieces of information that help you avoid expensive mistakes.

Look for exchanges with a proven track record and positive reviews from users. Collect as much open-source data as possible to make a better-informed decision.

Security Incidents

Crypto exchanges, as well as their clients, are a common target of hackers and scammers.

In 2022 alone, cybercriminals stole a record $3.8 billion in cryptocurrencies, according to blockchain analytics Chainalysis. Three of the top five largest cryptocurrency thefts in history occurred on crypto exchanges, with $570 million alone stolen from Binance. DeFi protocols and decentralized crypto exchanges remain the common target for hackers and scammers.

Before entrusting your funds with a platform, prioritize exchanges with robust security features, such as two-factor authentication (2FA) and cold storage, to protect against hacking attempts.

Check out how regularly the exchange conducts security audits. Choose those platforms that undergo regular audits by reputable third-party cybersecurity firms. These audits help ensure the exchange’s security measures are up to industry standards.

Exchanges with security track records are considered more trustworthy than ones with a history of repeated or unaddressed security incidents.

User Verification Processes

More and more people are using stolen identities for scams. In 2022, the US Federal Trade Commission got 2.4 million fraud reports, 42% higher than the previous year. About 1.1 million of these cases were related to identity theft.

As global regulatory requirements grow more complex, user verification is needed to prevent fraud and identity theft. Thus, crypto exchanges applying thorough user verification processes, like Know Your Customer (KYC), show they are committed to regulatory compliance and have a safer trading environment.

“Criminals and fraudsters are always trying to open fake accounts in crypto exchanges, neobanks, gambling web pages. There is no single day we are not catching criminal stuff in this activity. One to two percent of overall verifications in the neobanks are fraudsters. It’s a huge percentage,” Artūras Kurginian, a CEO of leading compliance service provider GlobalPass, has earlier told DailyCoin.

Certified KYC procedures – collecting customer data, verifying key information, and determining potential risk factors before opening their accounts, are now mandatory for most crypto exchanges.

They act as one of the first layers to protect financial institutions and crypto exchanges against fraud, money laundering, corruption, or other financial crimes.

Customer Support Quality

Reliable customer support is crucial. Exchanges that provide timely and helpful assistance can be more trusted, especially during technical issues or account inquiries.

A responsive customer support team addresses issues promptly, enhances security, and builds trust in the platform.

A lack of responsiveness or poor customer service indicates otherwise. So does a lack of communication channels to approach it. Email communication, without a live chat option, might not be enough for cases that require immediate action.

Bottom Line

Various factors lead to frozen user withdrawals from an exchange, whether due to individual actions, such as using a VPN, or due to the exchange’s reputational problems. Knowing these risks is important for making better-informed decisions and choosing the right cryptocurrency exchange for your digital assets.

Check out the story about the Bkex crypto exchange and how it disappeared:

How to Make a Crypto Exchange Disappear? BKEX May Know a Trick

Learn about the fraudulent crypto signal trading schemes:

“Sell on My Signal:” Crypto Trading Scheme Revealed