A remarkable bull rally. Gargantuan gains within half an hour. A chance of getting rich quickly. This is how a Telegram-based crypto signal trading group tempts new subscribers.

However, the anonymous group’s administrators do not reveal their ulterior objective of deceiving their unsuspecting members for financial gain.

Tempting Gains Serve as Bait

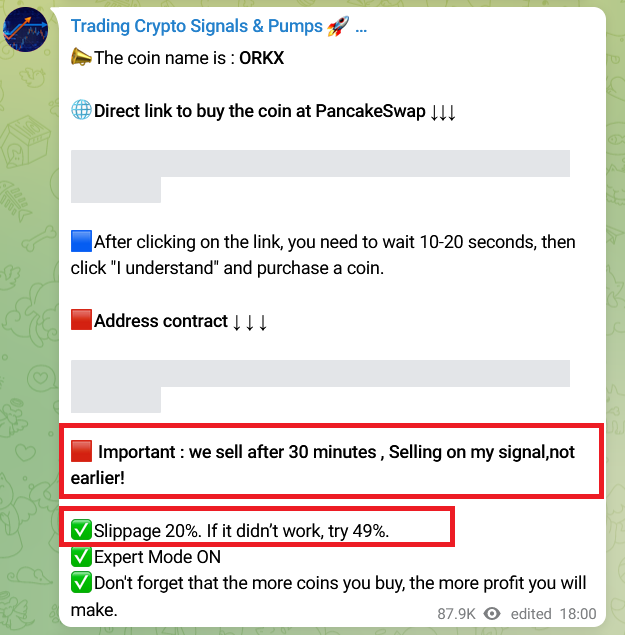

Trading Crypto Signals & Pumps is one of the many groups on the Telegram messaging platform focused on artificially inflating cryptocurrency prices and profiting from the inorganic increase.

Sponsored

Its goal and the operating model are simple. Like any other pump group in the crypto space, this specific one aims to make a profit fast. To achieve this goal, the group must organize mass purchases of micro market app altcoins and coordinate traders’ buying and selling time.

Here’s when signal trading comes into place. The admin of the 141,000-member group signals to buy certain coins and triggers the surge in demand, rapidly increasing the targeted asset’s price. This is the pump.

Those who buy before the coin price peaks sell at a profit and win. At Trading Crypto Signals & Pumps, the gains can reach 2,000 percent within half an hour. These are the ambitious goals that group members are regularly reminded about.

As the group organizes altcoin pumps every two days, one can only imagine the profits that could be earned by participating in just three pumps a week.

Sponsored

Let’s do the math. Imagine you buy Coin A for $1 just before the first pump and successfully sell it with a 2,000% profit, thus for $21. You then purchase Coin B for $21 and successfully sell it with a 2,000% profit. You’ve made $420 in just half an hour. Why stop there? Buy Coin C for $420, sell with the same 2,000% profit, and voila, $8,400 is in your wallet!

Who could miss this life-changing, easy money-making opportunity? Unfortunately, things are not as white and fluffy as they appear.

The Mechanics of Crypto Pump Trading

Pumps organized by this group operate on a conveyor principle, just like in a factory. As soon as one finishes, the next one starts immediately.

But what all the new pumps have in common is the fact they are built on the Binance Chain and paired with Binance Coin (BNB). Group admins claim that up to 90% of the pumped coins are supported with BNB. They are all listed on PancakeSwap’s decentralized exchange, the group’s key platform for trade.

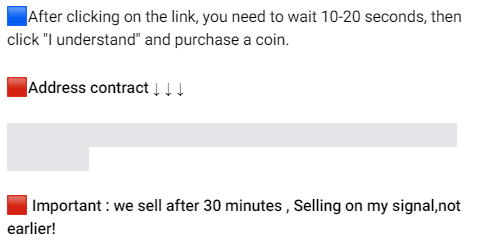

Buying and selling starts strictly on the admin’s signal. This is the group’s fundamental rule; members are regularly reminded whenever a new pump is announced.

Each new pump announcement includes the exact start time, the name of the coin, the contract address, and a link to buy the coin on PancakeSwap.

Participants must have Trustwallet or MetaMask wallets containing BNB to trade quickly for pump coins when the time comes.

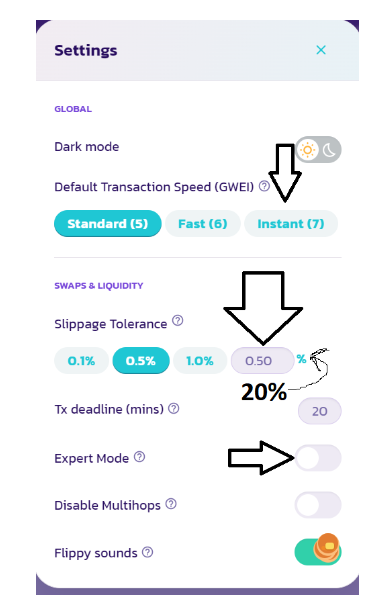

Finally, pump members are asked to adjust the slippage tolerance settings for smoother trade. Slippage, or the difference between the expected and the actual outcome of the trade, should be adjusted to 20% or 49% – if 20% does not work. This is approximately 20 times the slippage normally recommended for inexperienced traders.

When the preparation is done, the pump time comes, and the admin gives the signal to buy. It’s usually a Telegram message saying “Buy now”. Following this, there is typically a 30-minute window before the admin tells group members to sell. The contract address is immediately concealed from the post minutes after the pump ends.

The Hidden Scheme: Signals Intended to Lose

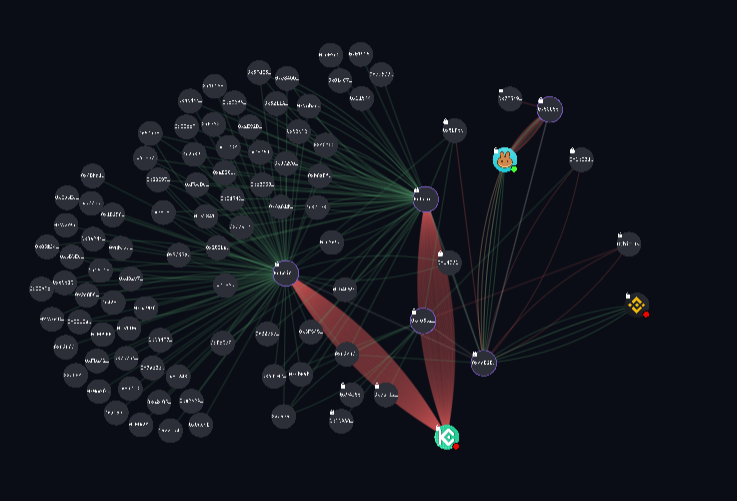

DailyCoin examined several of the group’s latest pumps to uncover its working model. We also followed how the funds move. We discovered that a pattern repeated in these cases, revealing how pump organizers manipulated participants.

The creator adds liquidity to the pool before the pump, imitating demand, and then moves it away right ahead of a sell signal, leaving no chances to profit for those who followed his rules.

As an illustration, let’s look at the recent ORKX token pump and the timeline of how everything transpired.

On October 8, 16:52 GMT, a wallet (let’s name it an Alpha Wallet for clarity) creates a contract address for ORKX coin on the Binance Chain.

After two days, on October 10, 17:23, the Alpha Wallet receives 22.86 BNB ($4.75K) and, within a minute, transfers the 22.84 BNB into the PankeSwap liquidity pool. Simultaneously, the Alpha Wallet adds seven million ORKX liquidity into another pool it created.

Another three minutes later, at 17:27, Trading Crypto Signals & Pumps announces an upcoming ORKX token pump. Its start is set for October 12 at 17:00. The given contract address matches the one created by Alpha Wallet on October 8.

On October 12, 17:00, the admin gives a buy signal, and the ORKX token pump officially starts. Traders are reminded to set slippage at 20% or 49% “if it didn’t work.”

For 18 minutes, the admin repeatedly posts status updates, reminders about the 2,000% growth target, and urges members to buy now.

Meanwhile, five minutes after the pump starts (17:05), Alpha Wallet initiates a series of liquidity-removing transactions. Within 19 minutes of the pump, it transfers more than 1.78 million ORKX tokens from PancakeSwap’s liquidity pool into an Alpha Wallet account.

At 17:18, the Telegram group signals to sell right after liquidity is removed from the pool.

ORKX’s price, which pumped by more than 646% within the first 15 minutes of the trade, according to CoinMarketCap, instantly crashed to zero after the pump ended.

But what if group members decided to sell coins before the sell signal? Most probably, they would also incur losses.

Remember the admin’s requirement to set slippage tolerance at a 20% or even 49% level? This is an extremely risky tolerance level never recommended for inexperienced traders. As slippage acts as a sort of safety margin that traders allow for price changes, a 49% slippage means only one thing: the asset’s actual price could differ by 49% from the expected price when a sell order is executed. And usually not in favor of the seller.

Where Are the Pump Funds Moving Next?

Since its inception in August 2021, the group has organized over 350 coin pumps. Today, it connects more than 140,000 members. Although each post is seen more than 50,000 times, sometimes individual pump volumes are insignificant.

Nevertheless, pumping constantly for two years accumulates substantial amounts.

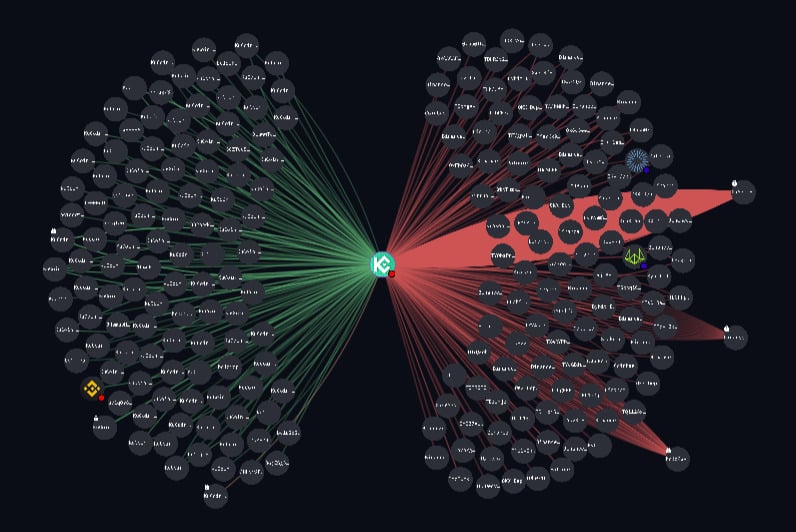

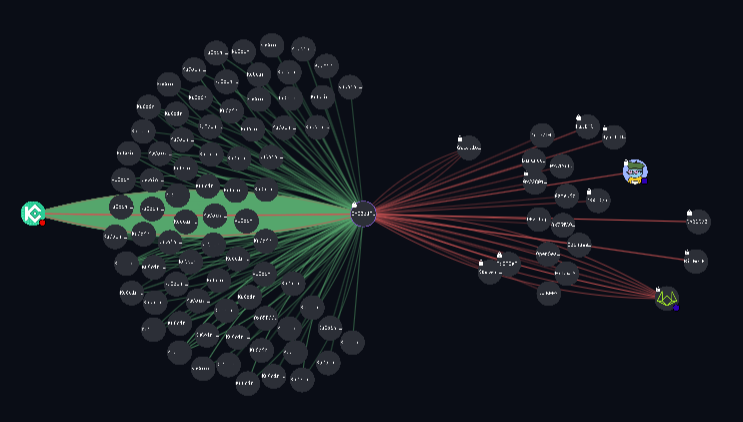

Creator wallets, which deploy contract addresses for pump coins, transfer amounts of various sizes to other deposit wallets, usually on the KuCoin exchange. Those intermediate deposit addresses move the funds to a centralized or “mother” wallet on KuCoin.

The mother wallet manages 35 contract addresses related to different cryptocurrencies. It is also quite active in large money movements based on the number of transactions performed.

The Arkham Intelligence blockchain tracker shows the mother wallet received a cloud of deposits larger than $10,000 from numerous KuCoin deposit addresses since the end of 2021.

Simultaneously, it kept large-scale funds moving further. The wallet often transfers over $10K worth of crypto into the same three intermediary accounts, sending hundreds of thousands worth of crypto further.

DailyCoin identified three larger than $400K transactions made to Wintermute, BitGo, and an unidentified address that frequently interacts with Wintermute.

The Bottom Line

The crypto market may remain flat, yet the desire for rapid gains and the thrill of trading remains. And wherever there’s demand, there will be a supply. Crypto pump signal trading groups on Telegram and Discord are not a rarity; many are uniting tens, sometimes hundreds of thousands of members.

However, as DailyCoin’s research revealed, not all these signal trading groups are driven by the sole intention of aiding their members in attaining swift and breathtaking profits. Their admins and coordinators might have their own plans. In light of this context, it is crucial for each of us not to blindly trust shiny promises but to critically assess and thoroughly scrutinize before investing our funds.

Check out the most dramatic crypto pumps in history:

6 Most Dramatic Pump and Dump Scams in Crypto History

Learn about what crypto exchange audits are missing:

Proof of Reserve Audits: Smoke, Mirrors, or Real Transparency?