Since the beginning of 2023, a sole token burn wallet on the Tron blockchain has returned at least $24.5 billion to its donors’ addresses.

The massive amount consisted of at least four of the highest-ranking stablecoins. In all cases, more stablecoins left the wallet than were sent to burn.

DailyCoin takes a look at where the funds flow further.

A Generous Burn Wallet

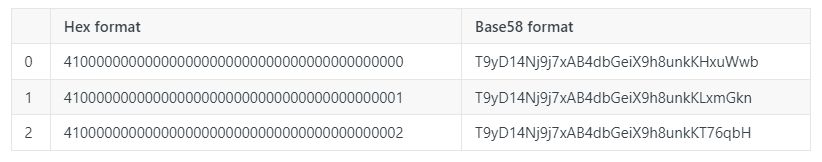

Open-source blockchain explorers label the cryptocurrency wallet address T9yD14Nj9j7xAB4dbGeiX9h8unkKHxuWwb as a Black Hole. They only assign such labeling to burn wallets, which permanently lock assets and prevent them from leaving.

Sponsored

Burn wallets are meant to remove tokens from circulation, usually to control supply, increase scarcity, and enhance the value of the remaining digital assets. They have no private keys to ensure the tokens sent to burn addresses cannot be accessed or retrieved.

But not the above-mentioned burn wallet.

Sponsored

Tether used it four years ago to burn five billion mistakenly issued USDT stablecoins. Paolo Ardoino, then Chief Technology Officer at Tether-associated crypto exchange Bitfinex, clearly called these USDT transfers “burn transactions” in a tweet in July 2019.

The Tronscan link he shared illustrated that the wallet, labeled a Black Hole, received the exact amount of condemned stablecoins. Tron’s official page for developers mentioned the above-mentioned wallet as one of three official asset destruction addresses on Tron’s blockchain.

“A destruction address is an address that is not controlled by anybody, that is, no one has the private key of the address,” they wrote.

Twelve months ago, the HTX (former Huobi) crypto exchange named T9yD14Nj9j7xAB4dbGeiX9h8unkKHxuWwb as the address to burn tokens. There are more than enough examples to assume that this particular burn wallet is truly intended to remote tokens from circulation.

But as it turns out, this Black Hole keeps moving various stablecoins in and out.

Stablecoins Come and Go

Today, the Black Hole burn wallet holds slightly more than $183 million in various assets, mostly in FTX Users’ Debt token, FUD ($182.8 million), and Tron, TRX ($351.3K). Yet, since its inception in late 2018, billions of dollars have been deposited and withdrawn from the Black Hole. Most of them were transfers in stablecoins, including Tether USDT, USDCoin (USDC), TrueUSD (TUSD), and USDD, a stablecoin issued by the TRON DAO Reserve.

At least 100 large-scale transactions solely in stablecoins occurred during 2023, each with a minimum value of $1 million. In many cases, the funds circled back to their originating wallets, with outgoing amounts consistently surpassing incoming ones.

For example, $15 billion in USDT, accounting for 16% of Tether’s entire on-chain reserves, returned to a Tether-affiliated multi-signature wallet. This year, the latter deposited $4.3 billion worth of USDT into the Black Hole, marking a substantial 249% increase.

A 25% bonus, or at least $3.5 billion in USD Coins (USDC), returned to Circle’s hot wallet, contributing approximately $2.8 billion worth of USDC deposits to the Black Hole since the start of the year.

Smaller but consistent amounts have been circulating between the Tron-based burn wallet and USDD Vault address. The latter has transferred $254 million in USDD to the alleged burn wallet this year and received a noteworthy 45% more, totaling $368.5 million in USDD.

However, the Black Hole showed exceptional generosity by returning a staggering 663% increase, equivalent to $424 million in TrueUSD (TUSD) to a Justin Sun-associated address. In contrast, Sun’s wallet deposited only $12.39 million in Wrapped BitTorrent (WBTT) and $55.57 in TUSD.

Accordingly, almost $6 billion in TUSD left the Black Hole and settled into unidentified whale wallets on Binance and Huobi.

Uncertain Purpose Raises Suspicions

A burn wallet serves as an address where funds become irretrievable once transferred. The burn wallet should not show any outbound activity if it is genuine.

If a so-called burn wallet regularly moves stablecoins or any assets further, it raises questions about its true purpose. This is according to Certik, a Web3 smart contract auditor, in an email to DailyCoin.

“Regular transactions from such a wallet could indicate that it is not a true burn wallet but perhaps a wallet for another purpose, potentially even a fraudulent one.”

According to Certik, the only plausible scenario is if the designated burn wallet were related to the treasury address, which serves as the repository for the collateral asset backing the issued tokens. In such a case, stablecoin movements within both wallets could represent routine adjustments in collateralization.

However, the question arises: why does the address, once used by Tether to burn five billion USDT, receive different stablecoins and move them away to wallets associated with different entities?

As smart contract auditors told DailyCoin, burn wallets are usually associated with a specific cryptocurrency or project, which manages its own token supply independently. Yet, several well-known burn wallets, labeled as black holes, are utilized by many different projects.

Such wallets are some of the highest-profile burn addresses, meaning any movements from them would quickly be noticed. According to Certik, if a burn address is truly irrecoverable, its use by multiple projects is not suspicious.

Funds Flow Within Enclosed Network

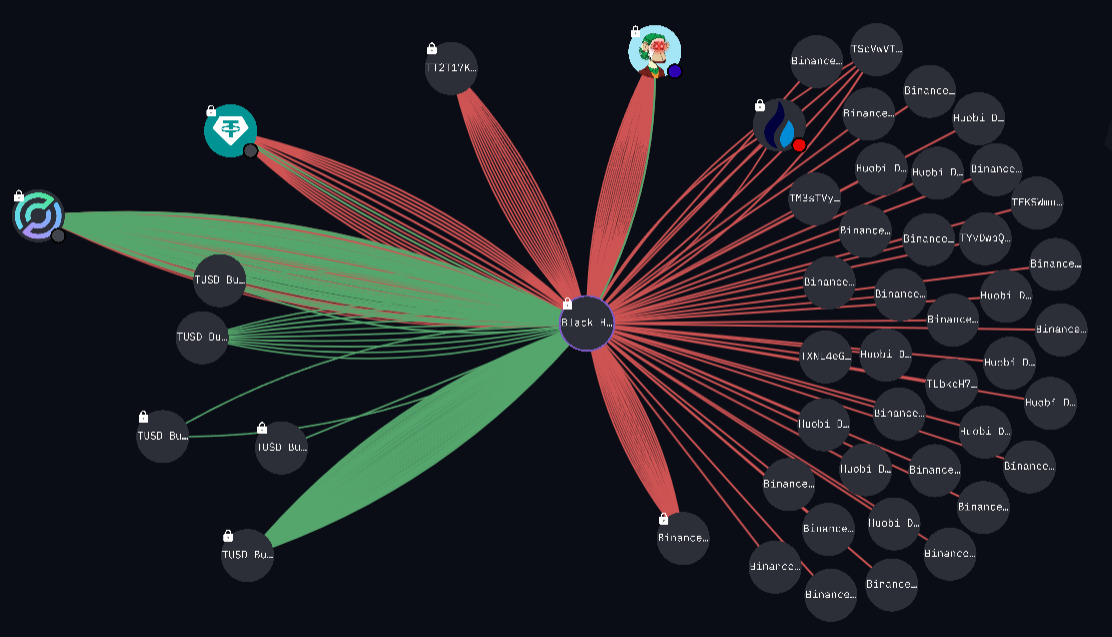

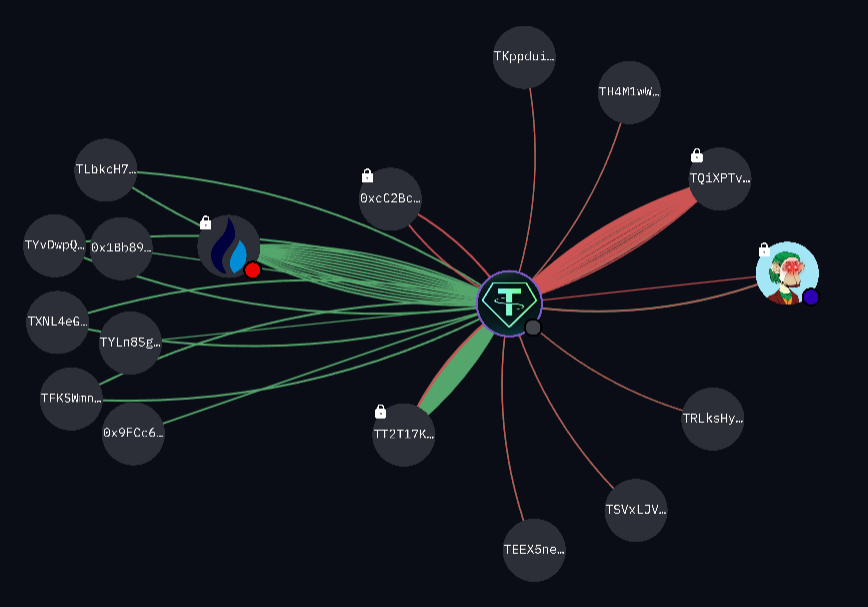

Apart from the donors mentioned above, the main sources of the Black Hole’s incoming funds are wallets dedicated to locking TrueUSD stablecoins. They all receive transfers from exchange-linked wallets and instantly channel stablecoins into the Black Hole, the mother of all burn wallets.

The Black Hole accumulates funds from at least four such addresses. These wallets have transferred $3.75 billion in TUSD to it since the beginning of 2023.

From here, things become interesting as Black Hole sends stablecoins away to numerous unrelated recipients that only act as intermediary addresses.

DailyCoin identified that at least $2.2 billion in TUSD was delivered to multiple Binance deposit addresses, and $880 million in TUSD landed in Huobi (now HTX) deposit wallets. All of them transferred funds further to the whale wallet on Binance and Huobi, the crypto exchange reportedly acquired by Tron’s founder, Justin Sun, in late 2022.

$424 million in regular smaller transactions dropped into a wallet related to Justin Sun itself.

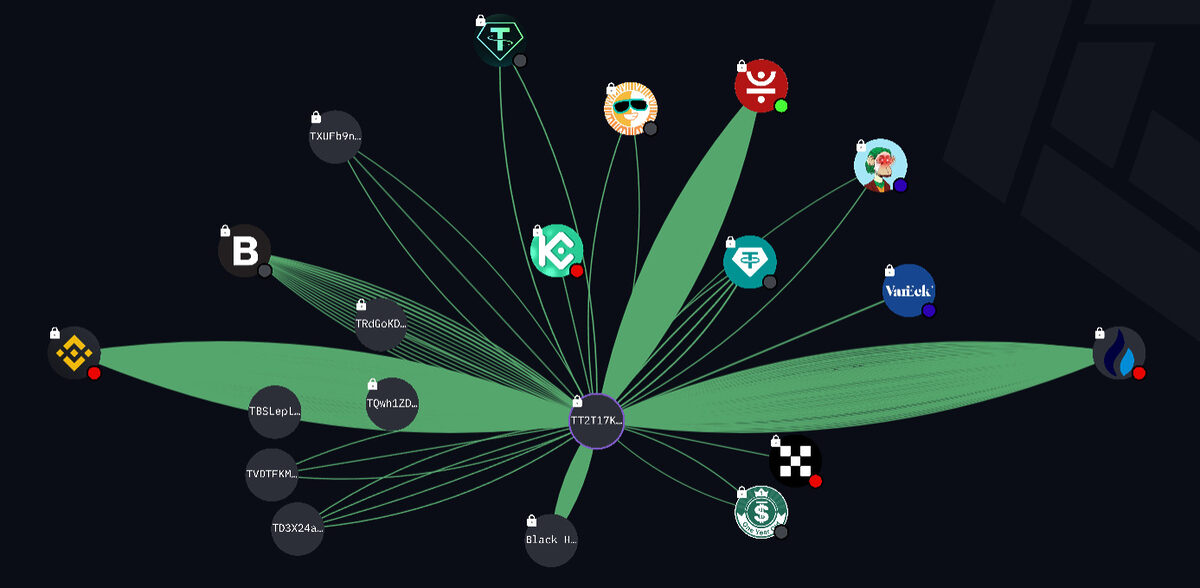

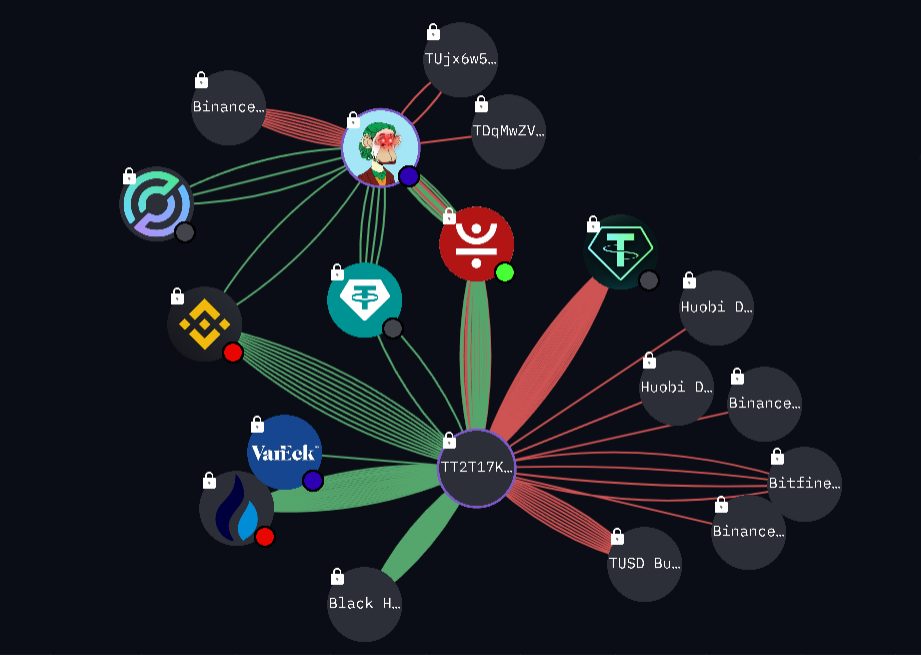

Another $611 million landed into a mysterious wallet, TT2T17KZhoDu47i2E4FWxfG79zdkEWkU9N (TT2T), which plays a pivotal role in connecting Black Hole, Tether, and Justin Sun’s empire.

Trails Lead to Sun

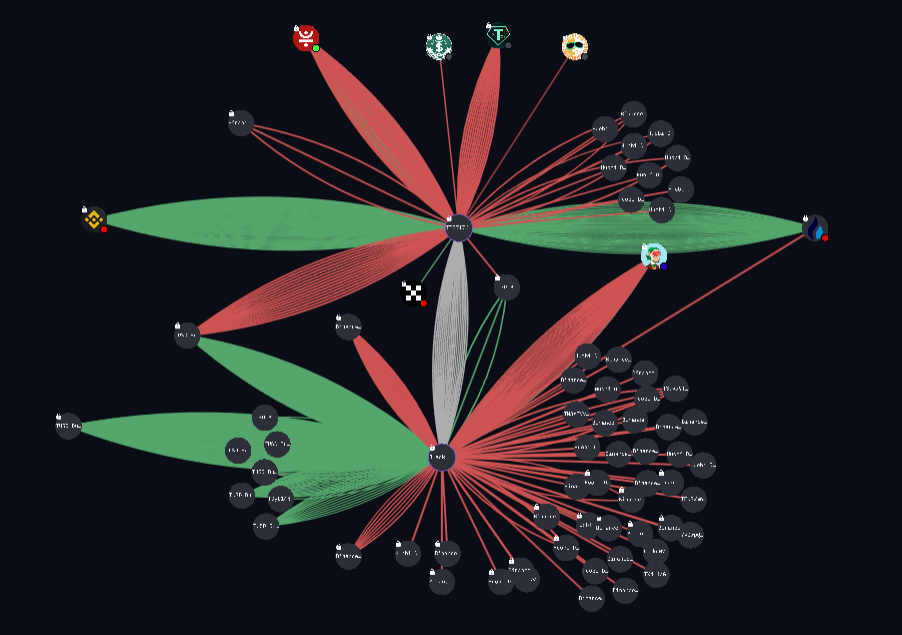

The TT2T wallet stands out as a central hub, accepting funds from the Black Hole, Tether, or two major whale wallets and distributing them where necessary.

It accepted funds from the Tether Multisig wallet, which is among the direct fund destinations of Black Hole. Sums are infrequent and relatively small, totaling $250 million USDT, but they come.

It also accepted over $2.26 billion in TUSD from two unidentified whales on Binance and Huobi, who both received slightly over $1.26 billion from Black Hole burn wallet in 2023.

Even BitTorrent’s wallets fund mysterious middleman from time to time, although their deposits do not exceed $150 million.

Meanwhile, the sums that leave the TT2T wallet are larger and lead to new destinations.

$4.25 billion in USDT has flowed into Tron’s largest lending ecosystem, JustLend. The platform currently boasts a total asset value of over $7.4 billion, predominantly in wrapped staked TRC20 tokens. It asserts that it will provide users with Staked Tether (stUSDT) in exchange for their USDT holdings.

According to Patrick Tan, a General Counsel for blockchain intelligence firm ChainArgos, USDT transfers were compromised when JustLend failed to stake received USDTs and sent them further into a system controlled by Justin Sun.

While looking into on-chain data, it becomes evident that the JustLend wallet has shifted roughly $1 billion worth of USDT to Sun’s wallet, only to receive back a 55% lower amount of just $417 million.

At least $2.22 billion worth of USDT was returned to the middleman wallet (TT2T).

Meanwhile, wallets associated with Staked Tethers (stUSDT) accumulated an extra $2.41 billion from the middleman TT2T: a yield protocol asserts governance under the RWA DAO, which officially is under the custody of the JustLend DAO.

The stUSDT-related addresses did send back $40 million to TT2T. However, most of the money, $640 million, kept moving through different middlemen before finally ending up in the TUSD burn address and the Huobi whale wallet – that same one that routinely feeds the Black Hole and accumulates stablecoins meant for burning.

Long-Lasting Connections

The on-chain data reveals that the Black Hole wallet is controlled by the smart contract TR7NHqjeKQxGTCi8q8ZY4pL8otSzgjLj6t.

This is the same address that Tether started to use when issuing its USDT stablecoin on the Tron blockchain back in April 2019.

Tron’s founder, Justin Sun, has a long-lasting connection with Tether. Sun was the largest individual buyer of USDT. He directly acquired more than $200 million worth of Tether’s stablecoins in 2021, far exceeding other individual buyers.

At the time of publishing, the Tron network holds the most USDT compared to all other blockchains, with over $47.8 billion. This surpasses the amount of USDT on Ethereum by more than $6.8 billion.

The Black Hole burn wallet address remains active, receiving $40 million worth of TrueUSD just two days ago. Six days ago, $13.03 million worth of USDC left Tron’s asset destruction address for Circle’s hot wallet.

Find out more about the Bkex crypto exchange:

How to Make a Crypto Exchange Disappear? BKEX May Know a Trick

Check out what lawyers say about Proof of Reserves auditing:

Post-Binance Reality: Is Proof of Reserves Idea Compromised?