- U.S.-listed Bitcoin ETFs continued their slow performance on Thursday.

- Only one fund recorded an inflow.

- Fidelity’s fund posted its first outflow.

The Fidelity Wise Origin Bitcoin Fund (FBTC) witnessed a massive outflow on Thursday, marking the first day investors drained funds from the Bitcoin ETF since its debut on January 11.

FBTC’s record outflow comes after BlackRock’s IBIT fund fell out of favor on Wednesday, breaking a 71-day inflow streak after posting $0 flow. Seven of the other 10 ETFs followed IBIT’s lead and recorded zero inflows.

Fidelity’s FBTC First Outflow

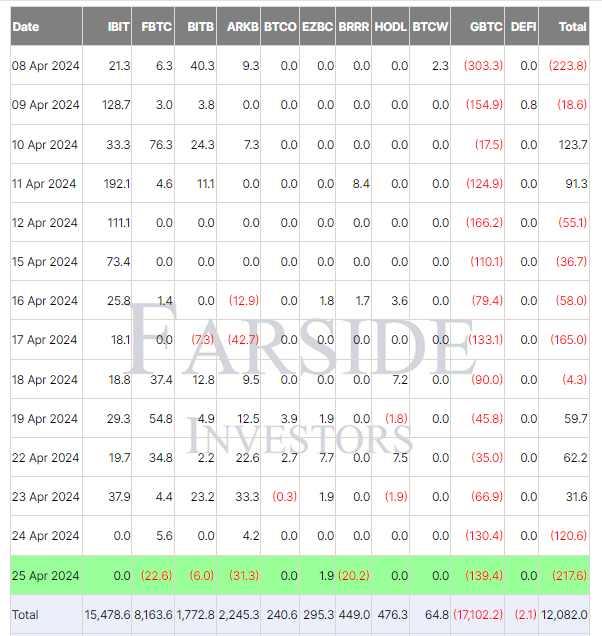

According to preliminary data by Farside Investors, Fidelity’s FBTC saw outflows totaling $22.6 million on April 25, an underperformance compared to April 24 when the fund was among the only two ETFs with an inflow. On Wednesday, FBTC accounted for $5.4 million of the day’s $9.8 million total inflow.

Sponsored

Other casualties of Thursday’s market turmoil included ARK 21Shares’ ARKB, Valkyrie’s BRRR, and Bitwise’s BITB funds, which witnessed outflows of $31.3 million, $20.2 million, and $6 million, respectively.

Franklin Templeton’s EZBC fund was the only Nasdaq-listed spot Bitcoin ETF that recorded an inflow on Thursday, attracting $1.9 million from investors as Grayscale’s converted ETF bled a staggering $139.4 million.

Sponsored

As for BlackRock’s IBIT fund, the ETF witnessed zero inflows on Thursday, just as it did the previous day. Other funds that followed suit with zero amount of flows on Thursday include Invesco’s BTCO, VanEck’s HODL, WisdomTree’s BTCW, and Hashdex’s DEFI.

Read how Morgan Stanley wants to supercharge Bitcoin ETF demand:

Morgan Stanley To Supercharge Bitcoin ETF Demand: Here’s How

Stay updated on Russia’s steps toward crypto regulation:

Russia Advances “Know Your Crypto Client” Tests with Banks