- Bitcoin ETFs saw a rough market day on Wednesday.

- Eight funds recorded zero inflows.

- Grayscale’s BGTC fund continued to bleed.

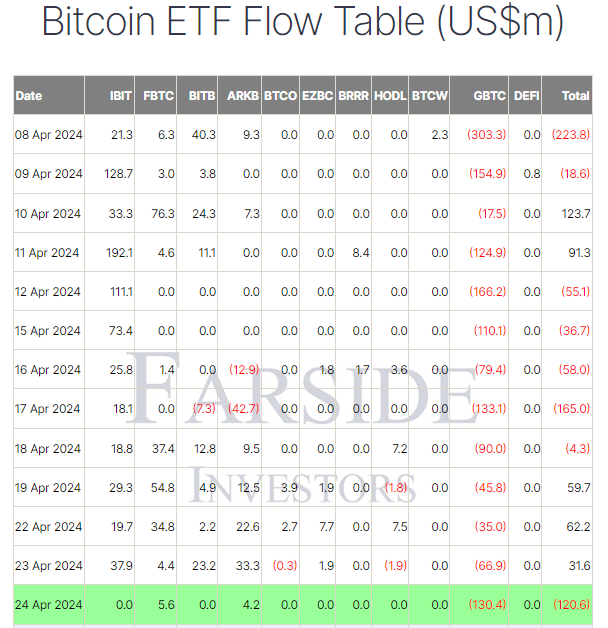

U.S.-listed spot Bitcoin exchange-traded funds (ETFs) seemingly fell out of favor with investors on Wednesday as eight products witnessed zero inflows.

The development coincided with Bitcoin’s price tumbling over 5% in the last 24 hours to bottom at $63,702 before recovering some of its losses to exchange hands at $64,051 as of press time. The choppy moves in the world’s largest crypto asset came four days after the halving event.

Among the Bitcoin funds that recorded $0 inflows on April 24, BlackRock’s IBIT stood out.

BlackRock’s IBIT Records First $0 Inflows

According to preliminary data published by Farside Investors, BlackRock’s IBIT fund closed Wednesday trading with zero inflows, and seven other funds followed suit. They include Bitwise’s BITB, Invesco’s BTCO, Franklin’s EZBC, Valkyrie’s BRRR, VanEck’s HODL, WisdomTree’s BTCW, and Hashdex’s DEFI.

While it isn’t uncommon for other Bitcoin ETF products to record zero inflows, such as Fidelity’s FBTC, which has seen three days of $0 inflows in the last two weeks, it was the first time for BlackRock’s IBIT since its launch on January 11.

Since its debut, the IBIT fund has consistently attracted daily inflows in the millions, accumulating as much as $15.5 billion in 71 days. On April 23, the fund registered a 70th consecutive day of inflows to rank among some of the most successful ETFs in history, a milestone Bloomberg’s Eric Balchunas predicted a day earlier.

Sponsored

Despite the eight funds’ non-performance, it was a relatively successful day for Fidelity’s FBTC and the ARK 21Shares’ ARKB Bitcoin ETFs, which registered inflows of $5.6 million and $4.2 million, respectively.

Meanwhile, Grayscale’s GBTC fund hemorrhaged $130.4 million, contributing to the day’s cumulative outflow of $120.6 million.

Stay updated on this Bitcoin whale’s recent market moves:

Bitcoin Whale “Mr. 100” Sells BTC: Beginning of the End?

Read about Changpeng Zhao’s apology ahead of sentencing:

Former Binance CEO “CZ” Issues Apology Ahead of Sentencing