- COIN saw an almost double-digit percentage decline right after the SEC sued Binance.

- Coinbase itself is in a legal war against the SEC.

- COIN is trending higher in the premarket.

Centralized crypto exchanges have had tough two years during the bear market. Multiple have gone bust, and others have experienced decreased volumes.

Meanwhile, other exchanges have been suffering from a harsh regulatory environment.

Coinbase Impacted by SEC’s Move Against Binance

Coinbase, the second largest cryptocurrency exchange, was in a weird situation yesterday after the U.S. Securities and Exchange Commission (SEC) sued its rival, Binance.

Sponsored

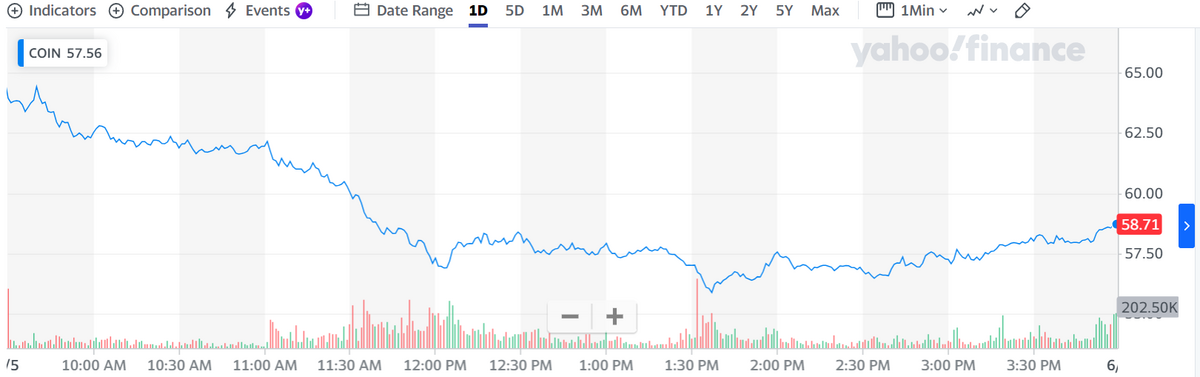

Right after the SEC announced the lawsuit, Coinbase shares started plummeting. At one point, COIN was down around 10%. It ended the trading day trading at $58.71, down 9.05%, according to data from Yahoo! Finance.

COIN is currently up by 0.50% in the premarket.

BNB, Binance’s native token, decreased by about 8% following the news. It’s currently trading at $279, according to data from CoinGecko.

Sponsored

Coinbase itself has been fighting against the SEC for quite some time now. In March, Coinbase received a Wells Notice from the SEC, informing the exchange that the regulatory agency might be taking legal action.

Coinbase responded to the Wells Notice by suing the SEC on the grounds that the agency hasn’t provided clear crypto rules. The exchange seeks the SEC to clarify whether crypto assets are securities or not.

The SEC has been seeking to dismiss the case.

On the Flipside

- COIN is still up by almost 100% since the start of the year.

Why This Matters

COIN dumping after the SEC lawsuit against Binance indicates what investors think about what might happen to Coinbase regulation-wise in the near future.

Read more about Rocket Pool’s deployment on zkSync Era:

Rocket Pool to Allow Users to Stake ETH on Ethereum Layer-2 zkSync Era

Read more about Circle deploying USDC on Arbitrum: