- Cardano released its Layer-2 scalability solution, Hydra.

- Hydra introduces a novel scaling solution that challenges Bitcoin, Ethereum, and others.

- According to Charles Hoskinson, Cardano’s new solution could make it the fastest, most scalable network.

Cardano has long been vying for a spot among the top cryptocurrency projects. Now, with its scalability solution Hydra up and running, it has solidified its position as a major player in the industry, standing alongside its more established peers, Bitcoin and Ethereum.

Hydra, the Layer-2 solution from the Proof of Stake (POS) Chain, is one of the most highly anticipated upgrades. Now that it is here, people are excited to see it deliver Cardano’s promise of being the fastest and most scalable payment network in the world, challenging the likes of Bitcoin and Ethereum.

What Is Hydra?

The Hydra Head Protocol or Hydra is Cardano’s open-source Layer-2 scalability solution that, according to Charles Hoskinson, would make Cardano the fastest payment network in the world.

Sponsored

Announced in September 2019, after much anticipation, delays, and hurdles, Hydra finally made it to the Cardano main chain in May 2023, thanks to engineers from the Cardano Foundation and IOHK.

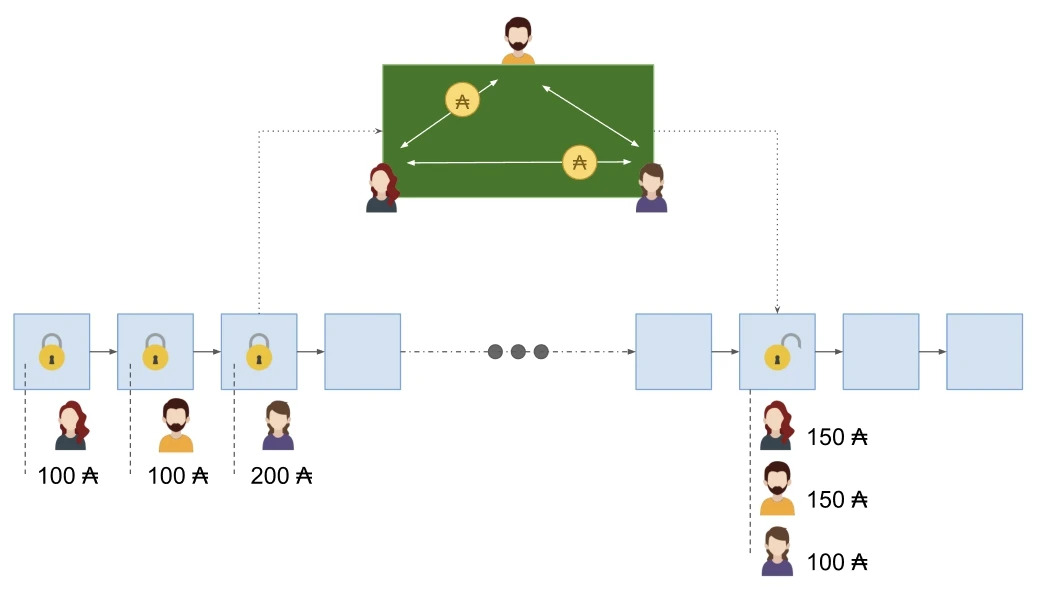

Hydra is an isomorphic scaling solution. This means it replicates Cardano’s functionality and security guarantees on an off-chain ledger network while maintaining communication between the two layers.

It operates almost similarly to state-channel solutions such as Bitcoin’s Lightning Network and Ethereum’s Raiden Network. Users can securely and instantly perform transactions on their private networks, in this case, Hydra heads, and settle the result on the main chain, enabling faster and cheaper transactions while keeping the integrity and security of the network.

Sponsored

What’s unique about Hydra is that off-chain ledgers through Head nodes can act as special dApps for developers who look to scale their apps. With Hydra, developers can independently run on-chain scripts or software stack on their private nodes and securely publish the result on the main chain instantly and at a low price.

Hydra brings a solid solution, allowing Cardano to compete with Ethereum and Bitcoin.

In Contrast with Other Scalability Solutions

Both Bitcoin and Ethereum have long established themselves in the cryptocurrency world, with the latter powering a myriad of Layer-2 protocols. Additionally, Ethereum’s sharding and Bitcoin’s lightning network are some of the best solutions in the space, earning the networks a collective market cap of $807 billion.

Although Cardano is often compared with Bitcoin and Ethereum, its string of delays and issues drew much criticism from the community, leading to slow growth evident with its $13 billion market cap. However, with Hydra in the mix, it can finally sit at the table with its solution.

Ethereum, Cardano, and Bitcoin Compared

While Ethereum Sharding, Bitcoin Lightning Network, and Cardano’s Hydra solution may come from the same family or operate similarly, comparing or saying one is better wouldn’t be fair. Each scalability solution has its pros and cons and addresses different challenges.

Sharding is a Layer-1 solution that focuses on increasing the network’s capacity and increasing the overall transaction throughput of the network. It breaks the blockchain into shards that process transactions parallel to the main chain.

However, according to Charles Hoskinson, Sharding is “very complex.” Because of this complexity, network security and performance drastically defer because it operates on the main chain. Additionally, it requires a lot of resources and can be expensive to implement.

Hydra, on the other hand, creates an independent off-chain ledger network that replicates the security and functionality of the Cardano chain, allowing it to maintain both security and performance without congesting the main chain. It doesn’t rely on soft or hard forks, making it inexpensive and straightforward to implement.

Conversely, Bitcoin Lightning Network is a Layer-2 solution on top of Bitcoin, which uses bi-directional off-chain payment channels between users, enabling fast, cheap, and scalable transactions.

However, because it uses payment channels, it only supports asset transfer, unlike Hydra, which allows developers to run scripts and elaborate transactions instantly off-chain as it would on the main chain.

On the Flipside

- An Ethereum founder accused Cardano Founder of contributing nothing to Ethereum.

- Many competitors called Cardano’s EUTXO design a security flaw; Hoskin replied that the model made it more secure.

Why You Should Care

Cardano’s Hydra solution brings competition to the space. The better the competition, the better the solutions, leading to greater adoption. Cardano’s new protocol could significantly elevate the network’s status in the cryptocurrency industry and attract more developers to build apps on the network.

FAQs

Hydra is Cardano’s Layer-2 scaling solution that creates independent off-chain ledgers with functionality, features, and security similar to the Cardano main chain.

Yes, Hydra is built on Cardano. It is a Layer-2 scaling solution that processes transactions on an off-chain ledger and settles the result on the main chain.

Yes, Hydra is a Layer-2 solution on Cardano. It operates on top of Cardano to maximize the throughput and functionality of the underlying blockchain.

In blockchain-speak, Layer-1 is the base blockchain where all network activity and transactions are validated and finalized. Cardano is Layer-1.

Read about other blockchains’ developments:

How Flare’s New Blockchain APIs on Google Cloud Impact Web3

Read what Charles Hoskinson has to say:

Cardano Founder Charles Hoskinson Responds to Jab by Ethereum Co-Founder