- Base Chain has seen an exceptional surge in adoption for a project released two weeks ago.

- The Layer-2 network outpaced Cardano with ease, trumping it on multiple fronts.

- However, it’s worth noting that comparing the two networks is like comparing apples with oranges.

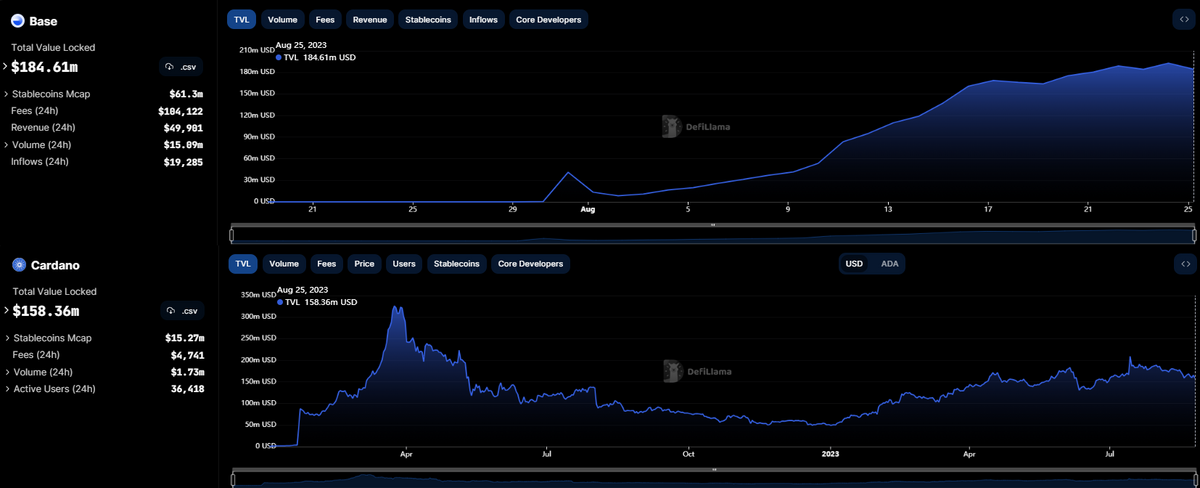

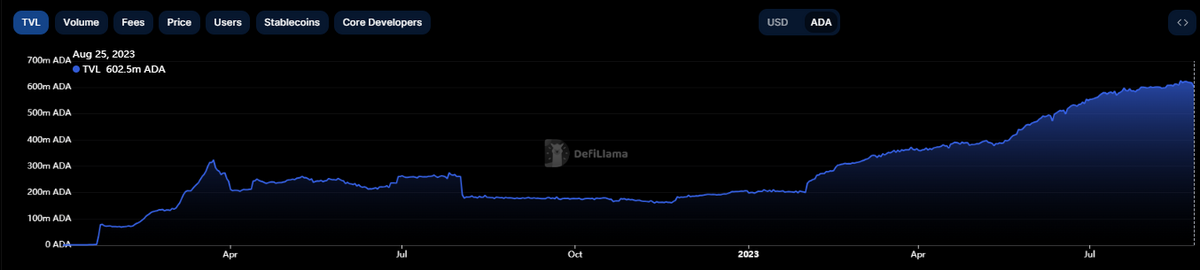

Cardano’s DeFi ecosystem has experienced a remarkable year in terms of development and growth. It has consistently registered new all-time high Total Value Locked (TVL) figures, even when ADA has shown weakness.

However, it appears Cardano is running out of steam, as Base Chain, a network launched only weeks ago, has already outperformed the Proof-of-Stake network despite its massive head-start.

Base Propels Past Cardano

Since launching on August 9th, Base Chain has been anything devoid of activity, attracting attention from some of the biggest names in the mainstream industry, including Coca-Cola.

Sponsored

In just two weeks, Base Chain has surpassed the 1 million user milestone, boasting an impressive average of 100,000 daily active users. Its explosive growth has propelled it to surpass seasoned veteran Cardano on multiple fronts, including TVL, total protocols, and more.

At press time, Cardano’s DeFi TVL stood at $160 million and ranked 14th overall. In contrast, Base Chain boasted a $184 million TVL and placed 12th on the ladder. Despite Cardano having a head-start, Base Chain’s DeFi ecosystem has grown four times as large, boasting 79 protocols compared to the former’s more modest 24.

The newly launched Layer-2 network also trumps Cardano’s 36,000 user base. Putting things into perspective. Friend.so, a Base Chain DApp, averages over 40,000 daily users. Adding to the list of achievements, in just two weeks, Base Chain has also outperformed Cardano in network activity, completing more transactions in its first week than the latter does in an entire month.

Sponsored

While Base Chain is showcasing remarkable growth and momentum, it’s worth noting that comparing the two chains at this point is like comparing apples with oranges.

Comparing Base with Cardano

Cardano takes a very meticulous approach to its ecosystem. This is because the Proof-of-Stake chain fundamentally differs from most blockchains, making it less interoperable with a majority of DeFi projects, which are based on top of Ethereum. The network dons a different smart contract environment, transaction model, and signature scheme, making it very hard to communicate with other blockchain networks in the industry.

In contrast, Base operates as a Layer-2 chain built on Ethereum, rendering it EVM-compatible. This exposes it to a larger pool of well-established DeFi Protocols such as UniSwap, SushiSwap, Stargate, and more, which have already solidified their presence in their industry.

Still, despite its lack of interoperability and protocols, Cardano’s DeFi TVL peaked at $200 million this year, propelling it into the top 15 rankings. However, with ADA having a hard time since the August 16 market-wide flash crash, plummeting by 18%, its DeFi TVL has substantially decreased.

Making matters worse is the ongoing bearish market conditions triggering an investor exodus and a massive decline in Cardano’s Daily Active Addresses and network activity, leading to more struggles.

Nevertheless, it’s important to highlight that its TVL in terms of ADA remains at an all-time high, exceeding 600 million ADA. Should Cardano’s price recover to its pre-market crash level of $0.31, its DeFi TVL could reach $186 million, surpassing that of Base Chain.

On the Flipside

- Cardano recently was dubbed a ‘zombie chain’ for falling behind Base.

- Recent Santiment data named Cardano the industry’s top dev platform at press time, eclipsing competitors Polkadot and Kusama.

- Since launching on August 9, Base has experienced three major rug pulls on its network.

Why This Matters

Cardano is a veteran in the industry and has cemented its position as a solid project. Although slow in development, the network is the third-largest blockchain, trailing Bitcoin and Ethereum. Cardano still has a long way to go, and falling behind Base Chain isn’t worrisome.

More on Cardano:

Ethereum Influencer Takes Shot at Cardano DeFi, Calls it Zombie Chain

More from Charles Hoskinson:

Cardano’s Hoskinson Claims SEC’s Crackdown Driven By Politics