- Cardano has been on a persistent downtrend since it lost the $0.30 support.

- ADA has dropped by a staggering 30% in August.

- With the altcoin market showing weakness, investors are growing concerned about their holdings.

Cardano Bulls are nowhere to be found as ADA slips through the cracks into the depths. After suffering a heavy blow in the market-wide flash crash, the token has been struggling to regain its footing.

Registering a brutal 30% drop over the past week, investors are now growing increasingly worried about their ADA holdings, questioning if the Bulls will come out of hiatus or if the Bears will push their beloved asset toward the yearly lows.

Cardano Continues to Struggle

Cardano’s hurdles have only intensified after ADA plummeted in the market-wide crash on August 16th. The token has since struggled to establish stability as it seeped through historical demand zones without encountering much resistance from buyers.

Sponsored

Now with Bitcoin and the altcoin market showing weakness, market participants are looking to exit on every bounce, worsening matters for assets across the board.

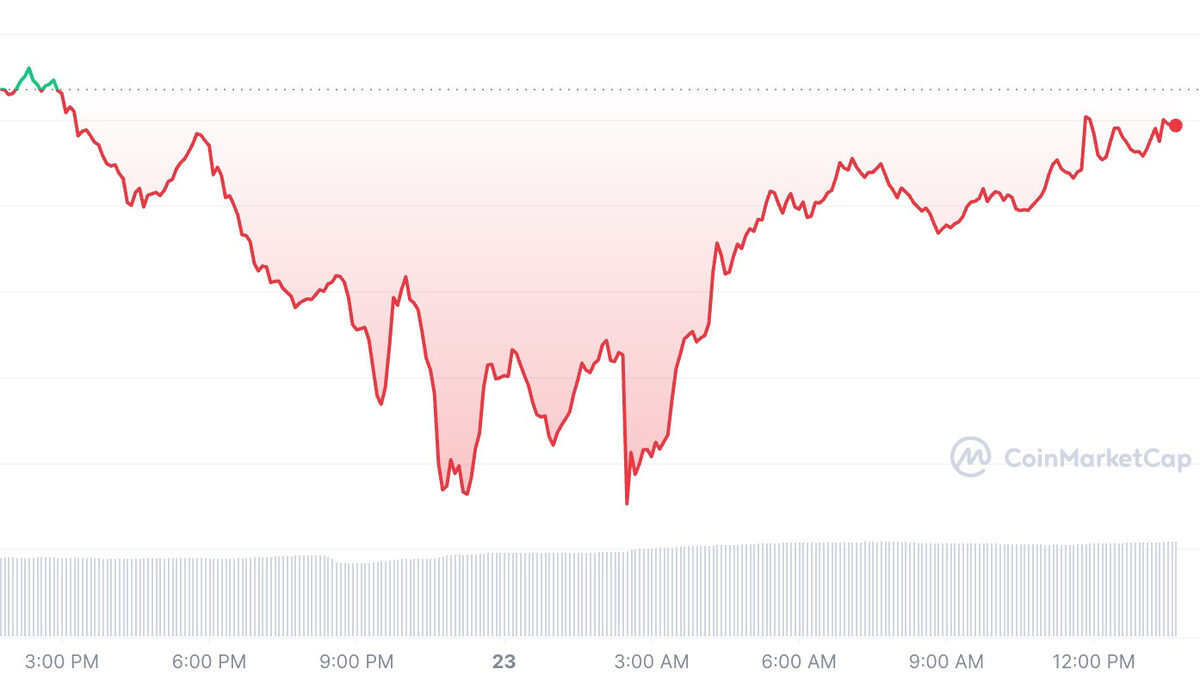

While ADA swiftly rebounded to the $0.27 range after tapping the $0.23 mark, it has been unsuccessful in maintaining momentum from the temporary buy pressure. This is because, given the prevailing bearish sentiment across the market, retail investors have been exiting their positions, leading to Cardano trickling below $0.26.

At press time, ADA exchanged hands at $0.256, with a daily trading volume exceeding $213 million. Considering investor sentiment and the mounting apprehension among Cardano holders, the Bears will likely test this year’s lows at $0.21. However, for that to happen, Bitcoin, alongside the altcoin market, has to plunge again in the following weeks.

Sponsored

Amidst rumors of the FOMC considering rate hikes in September, the crypto market could be poised for another leg down. Adding to the complexity is ‘Redtember,’ the historical trend of September being unfavorable for the crypto market. However, bullish news like BlackRock’s ETF approval could flip the bearish bias and spark another rally.

It’s worth noting that until something major happens on the macro level, ADA is expected to consolidate within the 0.25 and 0.27 range for the rest of the year.

On the Flipside

- Despite its underwhelming price action, Santiment crowned Cardano as the top dev platform in August.

- It’s worth noting that Cardano is 92% down from its all-time high, and over 90% of its holders are in losses.

- CoinGlass reported that traders had lost over $12 million across ADA-tracked futures over the past two weeks.

Why This Matters

Cardano’s price action holds significance for its investors. How it performs in the following weeks will be crucial in determining if it retains its holders. Should ADA continue to underwhelm, market participants will likely look to exit.

More on Cardano:

Cardano Clinches #1 Dev Platform Title From Polkadot, Kusama

Read how Cardano outclassed Ethereum:

Cardano Threatens Ethereum’s Reign as NFT Floor Prices Surge