- Coinbase released Base to the public exactly one week ago today.

- In its first week, the network has seen significant adoption.

- Still, the excitement around the project has also attracted bad actors.

On August 9, Coinbase officially entered the Ethereum Layer-2 race, releasing the Base mainnet to the public. A week later, the blockchain has been anything but devoid of activity, attracting attention from both good and bad actors.

Base Adoption Soars

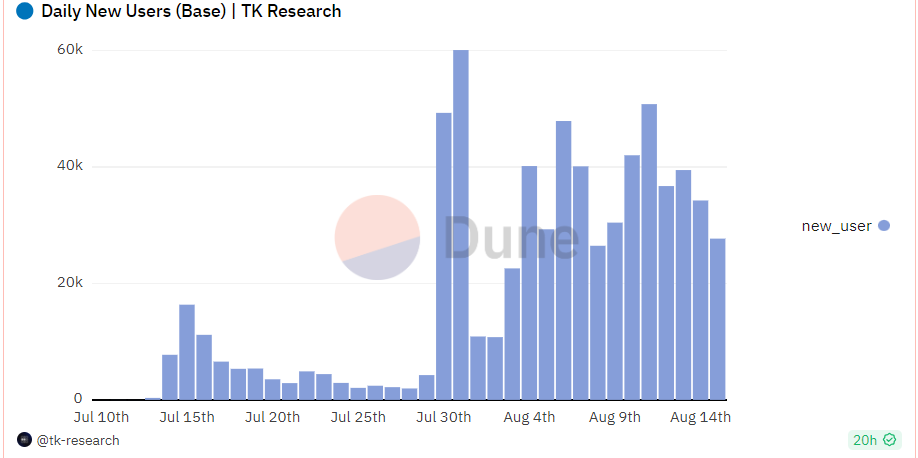

Amid the excitement surrounding the project and Coinbase’s Onchain Summer event that has featured NFT mints from brands like Coca-Cola, Base has attracted 261,278 new users since its public launch, according to data from TK Research’s Dune Analytics dashboard, bringing the total number of users on the network to 683,196. These users have bridged $236 million worth of assets to the network.

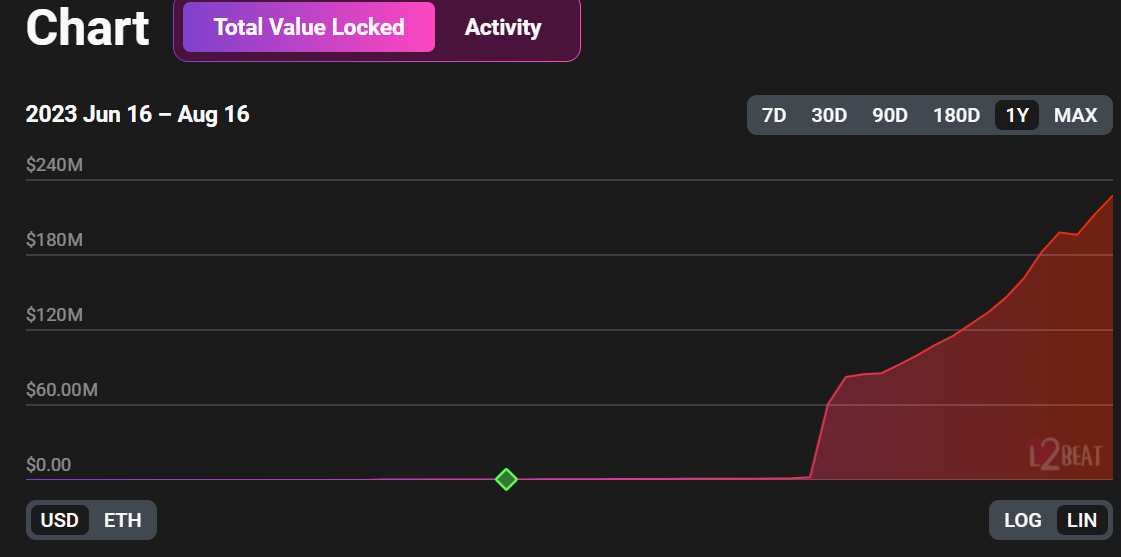

The network has also boasted an average of 112,000 active users daily, generating $1.23 million in fees since its public release. With the growing activity, Base’s TVL has surged to $231 million, representing a 65.79% increase in the past seven days per data from L2Beat at the time of writing.

Despite these positive growth markers, it has not all been smooth sailing for the Coinbase incubated network. Bad actors have also looked to capitalize on the hype and heightened activity.

Exploits and Rugpulls

Over the last 48 hours, at least one project on Base has been hacked while another has been rugged, costing users over $1 million.

On Tuesday, August 15, RocketSwap, a decentralized exchange on Base, confirmed that it had suffered a brute-force attack, with PeckShield estimating the losses at around 471 ETH worth over $860,000 at the time of writing. According to PeckShield, the exploiter launched two memecoins, LoveRCKT and LoveRCKT 2.0, which they rugged shortly after.

Less than 24 hours after the RocketSwap exploit, on Wednesday, August 16, PeckShield disclosed that SwirlLend had been rugged on Base and Linea, another newly launched blockchain. The scammers made off with at least $462,000 from both blockchains as the protocol TVL on Base plummeted to about $49 from a $784,000 peak.

While it is still early days, rugpulls and exploits are becoming a regular occurrence on Base. Before the network’s public launch, BALD, one of its earliest memecoins, was rugged by its developers. Similarly, CertiK disclosed that multiple pools on LeetSwap, one of the network’s earliest decentralized exchanges, had been compromised.

On the Flipside

- Base developers maintain that the network will not have a native token.

- Base conducted multiple security audits in the months before its launch.

Why This Matters

Base was incubated by Coinbase, one of the most trusted crypto exchanges in the world. The network is recording significant activity and adoption but is also seeing a prevalence of bad actors. The network’s rollercoaster start further highlights the need for crypto investors to tread carefully during peak excitement and with new, untested protocols.

Read this to learn more about Base’s launch:

Coinbase’s Layer-2 Base Kick-Offs’ Onchain Summer’ with Public Release

Find out why Binance’s decision to stop its crypto payment service has sparked derision:

Binance Sparks Derision with Decision to Shutter Payment Service