Amassing over $600M in market cap and blowing Ethereum (ETH) NFT trading volume out of the water, BRC-20 Tokens and Ordinal inscriptions are here to stay. Initially considered an experimental flash in the pan, BRC-20 tokens have exploded onto the market, redefining how we use Bitcoin (BTC).

The Bitcoin blockchain may be the forefather of the entire crypto industry, but you cannot deny that it lacks utility. Compared to modern, smart contract-capable platforms like Ethereum and Solana (SOL), there’s not much you can do with BTC other than HODL it or send it to another wallet.

Until now.

Sponsored

What are BRC-20 Tokens? Are they reinventing BTC forever, or is the BRC-20 token standard polluting the Bitcoin network and leading the crypto world down a dark path?

Table of Contents

What are BRC-20 Tokens?

An extension of Casey Rodarmor’s Ordinals protocol, the BRC-20 token standard creates fungible tokens on the Bitcoin blockchain. Created by Domo, a pseudonymous blockchain developer, BRC-20 is an experimental token standard that inscribes text or other fungible data onto individual Satoshis.

But why is this important, and why have the first BRC-20 tokens like ORDI, VMPX, and meme coins like PEPE (not that PEPE) exploded in value?

Sponsored

Since it was originally launched in 2009, the Bitcoin network has provided a rather narrow range of utilities. BTC can be stored in a self-custodial wallet or sent to another Bitcoin wallet in exchange for value.

Network upgrades like the Lightning Layer 2 Network might have helped Bitcoin become faster and more affordable, but the basic functions remain the same.

BRC-20 tokens flip the script by adding greater complexity and utility to the Bitcoin network. In the same way that smart contracts govern innovative applications using the ERC-20 token standard on Ethereum and other EVM networks, BRC-20 tokens open a new world of possibilities on the Bitcoin blockchain, including decentralized finance.

Tapping into Bitcoin’s unmatched market depth and liquidity, the BRC-20 token standard means that fungible satoshis can be traded directly on the Bitcoin network. As such, this novel phenomenon offers huge potential to expand the capabilities of the Bitcoin ecosystem.

How Do BRC-20 Tokens Work?

Instead of using smart contracts like Ethereum’s ERC-20 tokens, the BRC-20 protocol works by embedding custom JSON (JavaScript Object Notation) scripts onto individual satoshis, the smallest unit of BTC.

This allows BRC-20 tokens like SATS and TRAC to be traded natively over the Bitcoin blockchain or used as collateral and borrowed against in Bitcoin-based DeFi protocols. This on-chain functionality is perhaps one of the biggest advancements in the history of the Bitcoin network, providing previously unimaginable use cases for Bitcoin.

Are BRC-20 Tokens the Same as Ordinals?

At this point, we need to make a clear distinction. While BRC-20 tokens use the foundational technology behind Bitcoin Ordinals, they’re not quite the same thing. Technically speaking, BRC-20 tokens are Ordinals because they’re created by inscribing data to individual Satoshis.

Despite this, BRC-20s and Ordinals have one key difference: Fungibility.

While each Bitcoin Ordinal is non-fungible and designed to be completely unique and distinguishable from each other, BRC-20s with the same name are interchangeable and bear the same value.

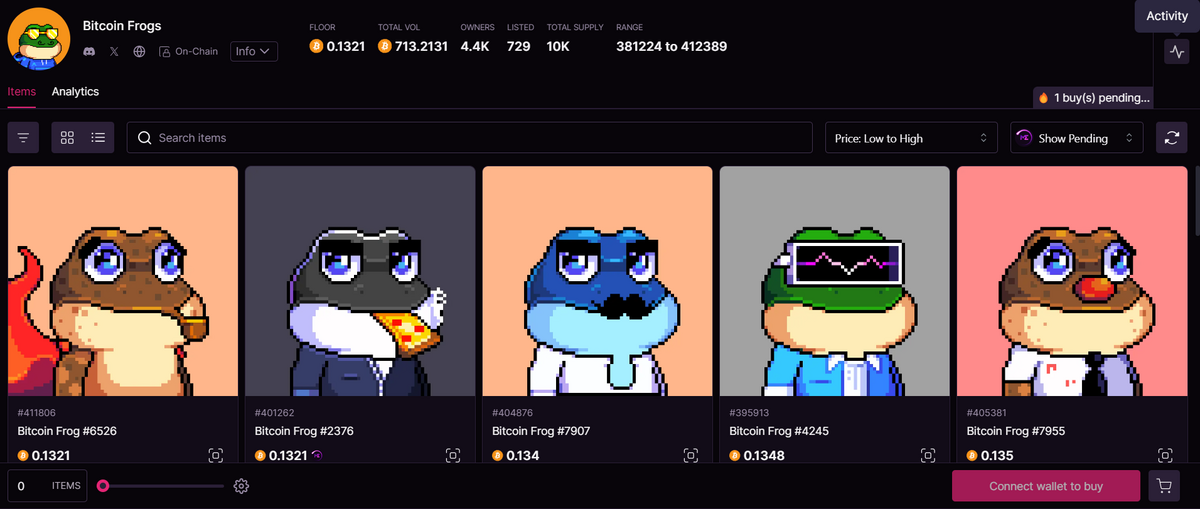

For example, let’s look at one of the most popular Bitcoin Ordinal collections. As you can see, each and every one of these Bitcoin Frogs is different. Due to having different traits, some might be worth more than others.

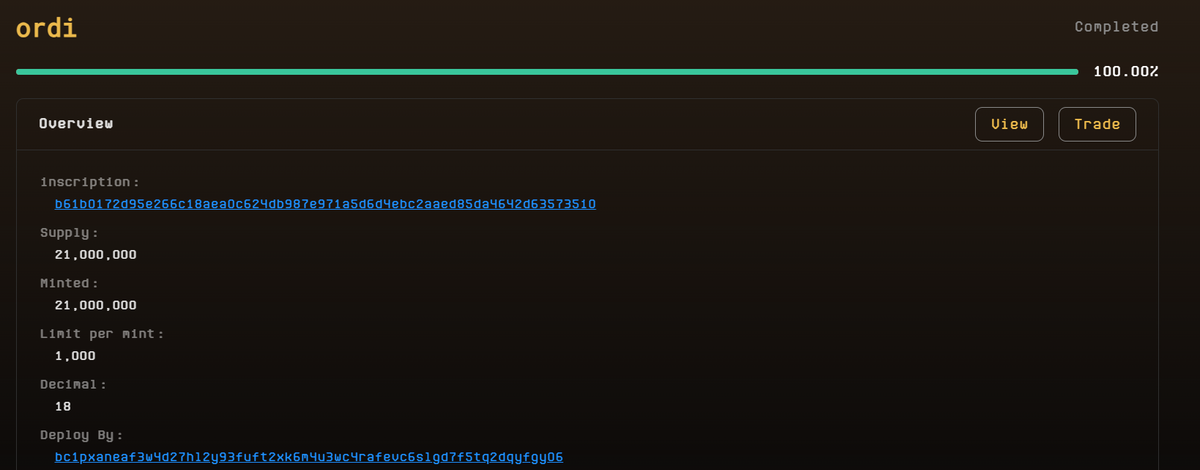

ORDI tokens, on the other hand, are all the same. If I loan a friend 100 ORDI tokens, they don’t need to pay me back the specific coins I gave them for the loan to be repaid. The 100 ORDI tokens I lent my friend are exactly identical to any other 100 ORDI tokens in the supply.

How to Trade BRC-20 Tokens

At this stage, dozens of permissionless marketplaces have cropped up all across the cryptocurrency space, allowing BRC-20 enthusiasts to trade to their heart’s content.

Some top-performing BRC-20 tokens with the highest trading volume and liquidity have even found their way onto top exchanges like Binance, KuCoin, and OKX.

For those who prefer an on-chain experience, you’ll need a funded Bitcoin wallet supporting Taproot. Popular choices amongst the BRC-20 community include:

- Unisat Wallet

- Xverse Wallet

- Leather Wallet

- OKX Wallet

Once you’ve withdrawn some BTC to your Ordinal and BRC-20 compatible wallet, the easiest way to get involved is through BRC-20 trading sites like the Unisat Marketplace. From there, you can scan the range of tokens available and place orders on coins as you see fit.

How to Mint BRC-20 Tokens

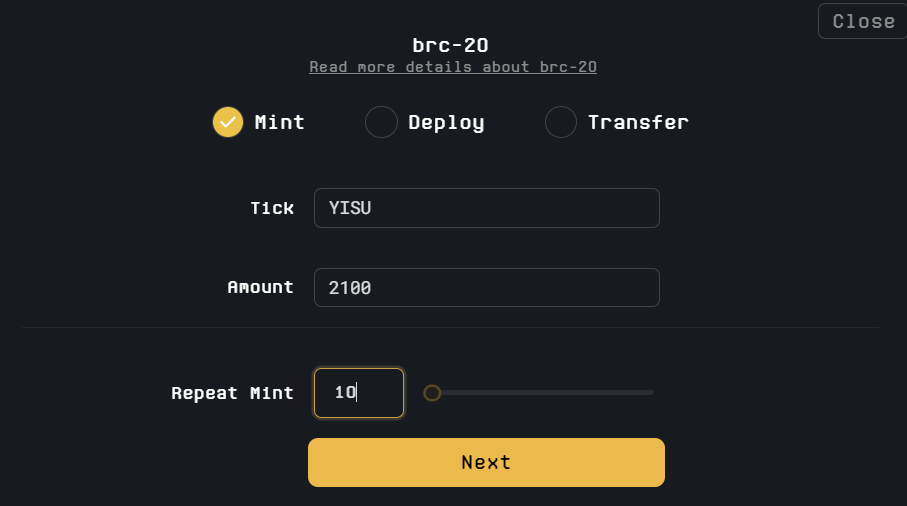

If you have a higher risk for appetite, minting BRC-20 tokens is like partaking in an ICO. After a developer has registered a new BRC-20 token, you’ll be able to inscribe the JSON scripts to Bitcoin satoshis yourself using platforms like Unisat.

For the purposes of this explanation, let’s say I wanted to mint some YISU tokens. I’d find YISU in the list of ongoing mints, review the token’s information, and then click ‘Mint Directly’.

As you can see, this particular token only allows me to mint 2,100 inscriptions at a time. However, if I wanted to mint more than that, say 21,000, I’d need to set the mint transaction to repeat 10 times.

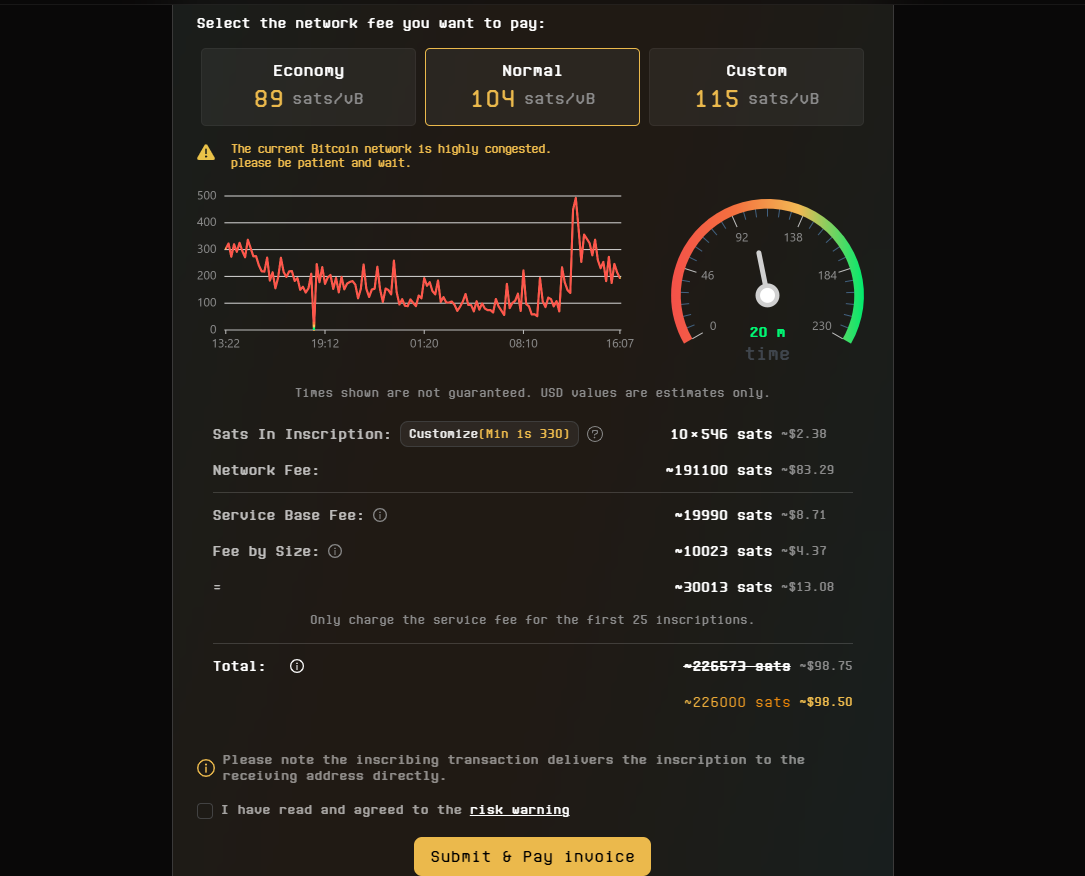

From there, input the BRC-20 compatible Bitcoin address where you’d like to receive your tokens and set your preferred transaction fee based on network congestion.

Hit ‘Submit & Pay Invoice’ and confirm the transaction in your wallet. If you paid enough gas, your freshly inscribed BRC-20 tokens should appear in your wallet within 30 minutes.

Disclaimer: YISU was randomly selected from the list of ongoing BRC-20 mints and is not endorsed by DailyCoin in any way, shape, or form.

BRC-20 Token Concerns

Despite being a huge step forward for blockchain technology in the Bitcoin ecosystem, these new digital assets have caused plenty of controversy within the Bitcoin community.

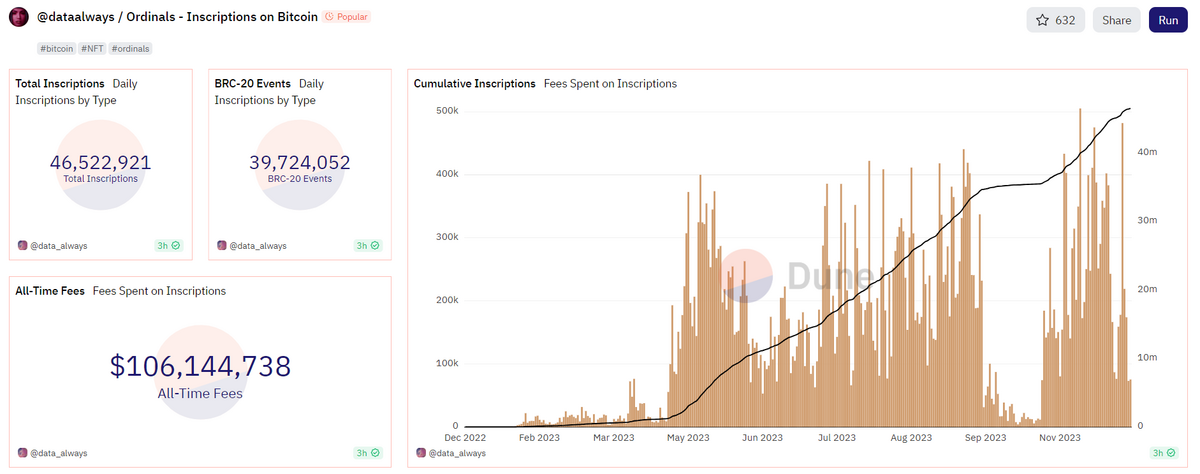

The Bitcoin Ordinal protocol, and by extension, BRC-20 tokens, demand enormous energy and resources. Inscribing immutable data onto individual satoshis is no easy feat, with the Proof-of-Work suffering debilitating network congestion that has sent Bitcoin transaction fees to all-time highs.

Bitcoin maximalists have been particularly scathing of the Ordinal and BRC-20 movement, arguing that these new tokens are polluting the network and detracting from Bitcoin’s primary ethos.

The hype and excitement around BRC-20 tokens have also led to a massive influx of rug pulls, speculative pump-and-dumps, and scams. On top of that, the Bitcoin network’s long block time (10 minutes) makes it easier for other users to front-run transactions by supercharging their gas payments. As a result, many users suffer from failed transactions when interacting with BRC-20 protocols.

BRC-20 Pros and Cons

BRC-20 tokens and Bitcoin Ordinals may herald a new utility age on the Bitcoin network, but they’re far from faultless. Let’s objectively examine the pros and cons of BRC-20 tokens.

Pros

- Bringing new utility to Bitcoin – BRC-20 tokens open a world of possibilities with the Bitcoin ecosystem and provide a wealth of new use cases to Bitcoin.

- Driving progress in blockchain technology – An experimental protocol, BRC-20 tokens prove that there are always new ways to expand and overcome blockchain’s limitations.

- Increases potential for new crypto projects – Keen investors who unearth emerging BRC-20 projects with genuine utility can make strong investment returns.

Cons

- Complex – Navigating the BRC-20 ecosystem is still extremely complicated, meaning those not well-versed in the technology might make costly mistakes.

- Energy-intensive – The BRC-20 token standard is to blame for surging transaction costs and failed transactions on the world’s largest cryptocurrency network.

On the Flipside

- The success of the BRC-20 protocol has inspired a litany of inscription services of almost all other major chains, including Polygon, Solana, and the Ethereum network.

Why This Matters

BRC-20 tokens and the Ordinal protocol are arguably the biggest developments on the Bitcoin network in years. Staying abreast of these unfolding advancements is critical to understanding the use cases of Bitcoin as a whole.

FAQs

The ERC-20 token standard is used for tokens on Ethereum-based networks. Meanwhile, BRC-20 tokens are strictly used to manage fungible tokens on the Bitcoin blockchain.

You can buy top BRC-20 tokens like ORDI on leading crypto exchanges. Otherwise, you’ll need to withdraw BTC to a BRC-20 compatible wallet and trade on BRC-20 platforms like the Unisat Marketplace.

The BRC-20 token standard brings various potential new cases for Bitcoin, a digital asset that previously offered a limited range of utilities.