- On-chain data showed long-term Bitcoin holders were calm during the flash crash.

- The long-term supply hit a new all-time high amid the panic.

- Falling Bitcoin Dominance suggests greater diversification into altcoins.

The price of Bitcoin suffered a flash crash down to $25.3k on August 17, sparking panic across the cryptocurrency markets. Despite that, on-chain data from Glassnode showed that long-term holders were unfazed by the event.

Long-Term Holders Undaunted

Glassnode has published its latest weekly newsletter, in which it summarized the August 17 flash crash. The report covered several points from the perspective of on-chain analysis, including information on the technical price damage suffered and the impact on the derivatives market.

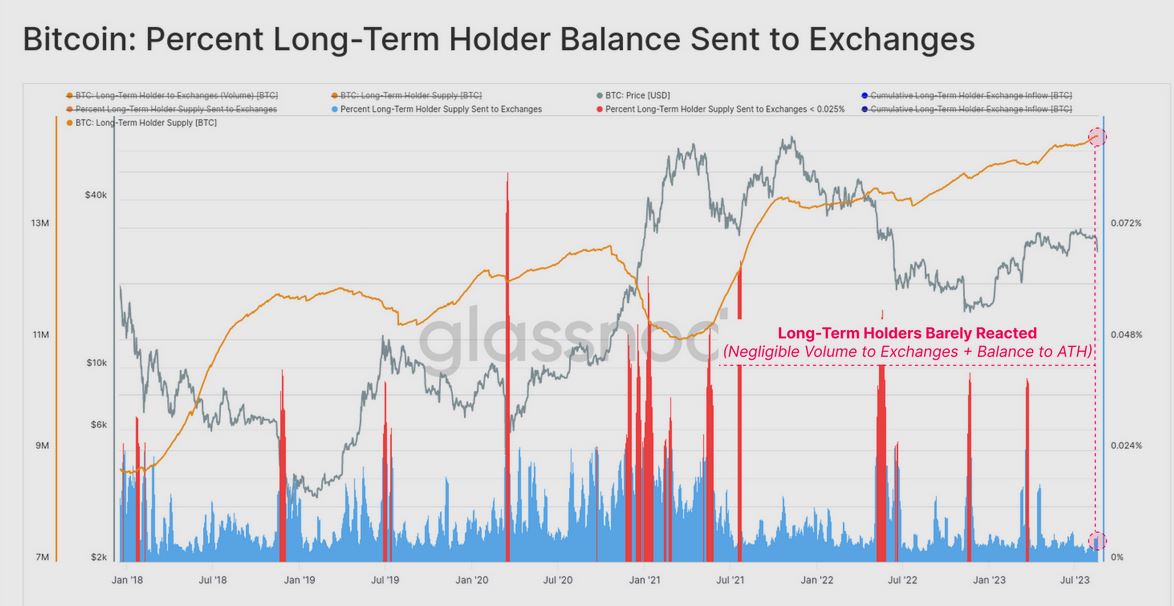

Most notably, Glassnode also included an analysis of the reaction of long-term holders (LTHs), who exhibited “almost no response” to the sell-off. This was evidenced by the lack of volume sent to exchanges, denoting that LTHs have not abandoned their positions, and the aggregate balance held by LTHs moving to an all-time high, suggesting supply is continuing to be “soaked up” by believers.

Sponsored

The chart below showed the recent flash crash was accompanied by a negligible volume of around 0.005% sent to exchanges. Furthermore, during the panic, the Long-Term Holder Supply reached a new ATH of 14.5 million coins.

Contrasted with the TerraUSD stablecoin de-peg in May 2022, the percentage sent to exchanges was significantly greater, at approximately 0.05%. While the Long-Term Holder Supply was much lower at around 13.6 million coins.

Bitcoin Dominance Dips

Despite the conviction displayed by LTHs, Bitcoin Dominance dipped below 50% during the flash crash – suggesting a shift in crypto market dynamics, with altcoins gaining greater prominence during the market uncertainty.

Sponsored

On August 20, market data specialists Santiment tweeted about the jump in XRP whale activity, with wallets holding between 10 million and 1 billion XRP, now collectively accounting for 16.13 billion tokens.

On the Flipside

- The flash crash highlighted general market weakness and a high degree of uncertainty.

- Falling Bitcoin dominance suggests that crypto investors are diversifying away from the market leader.

Why This Matters

Crypto is often accused of being an echo chamber, leading to the reinforcement of strongly held beliefs. While long-term Bitcoin holders have demonstrated a high degree of certainty in BTC’s future, time will tell the outcome.

Read more on the shifting Bitcoin-altcoin dynamics:

Bitcoin Dominance Plummets During Crypto Market Mayhem

Discover how Cardano whales are reacting to the market downturn: