- Conflict between Iran and Israel sent crypto markets tumbling.

- Markets bounced back on Monday, but Bitcoin dominance unexpectedly fell.

- Contradictory calls on the arrival of altseason exist.

The crypto markets were sent reeling over the weekend as geopolitical tensions in the Middle East reached a boiling point. In a tit-for-tat escalation, Iran launched a retaliatory drone and missile attack on Israel, responding to the April 1 bombing of the Iranian embassy in Syria, which Tehran had blamed Israel for.

The crypto markets, ever sensitive to macro events, reacted with a swift and brutal sell-off, as the total crypto market cap plunged over 15%, and many coins were hit with double-digit percentage losses. With markets bouncing back from the carnage on Monday, Bitcoin dominance took an unexpected fall.

Bitcoin Dominance Takes a Dip

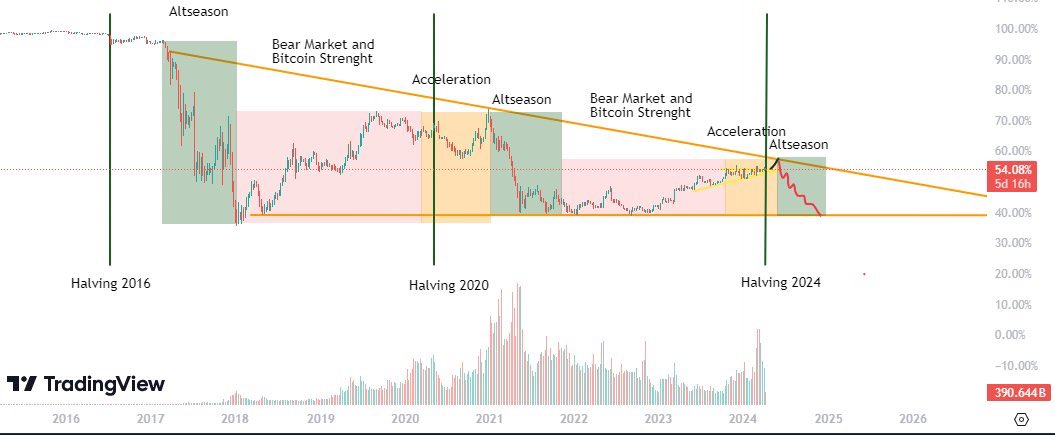

Crypto investors tend to flock to the perceived safety of Bitcoin in times of market carnage. While the latest turmoil saw Bitcoin dominance spike to 57.02% on Saturday evening (UTC,) marking a 158-week high, this uptick soon fizzled out, dropping to as low as 55.27% by Monday, against expectations.

This puzzling development caught the attention of X influencer Crypto Phoenix, who concluded that Bitcoin may have hit its pre-halving peak during the weekend sell-off, signaling that the start of the long-awaited altcoin season could be close by.

This was echoed by Altcoin ₳ardvark, who drew similar conclusions about Bitcoin dominance, adding that the situation with altcoins is “already gravy out there, and it’s about to get a whole lot better.”

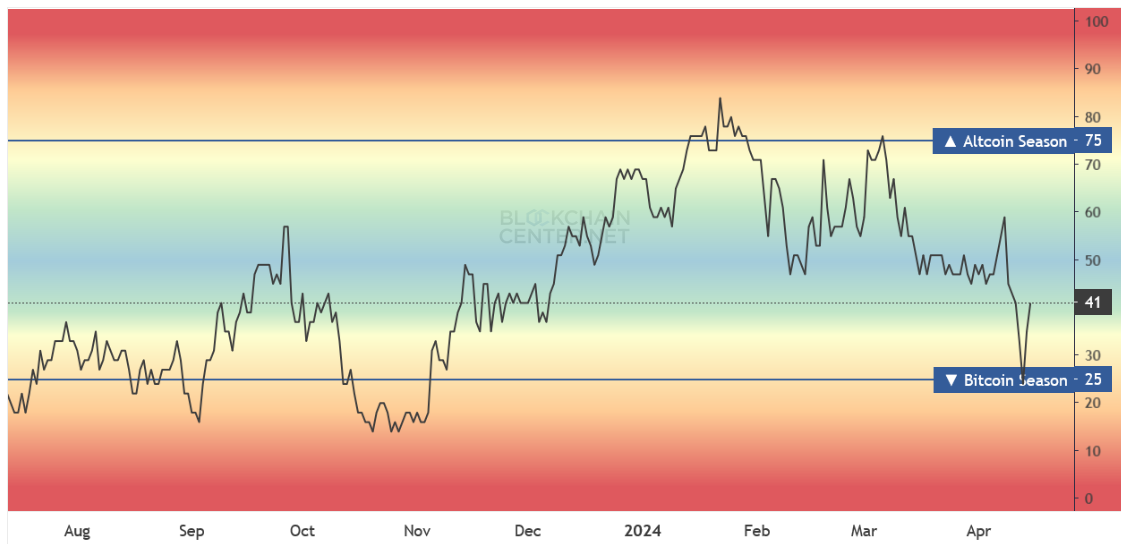

However, the altseason calls from Crypto Phoenix, and Altcoin ₳ardvark contradicts the Altseason Index from the Blockchain Center.

It’s Closer to Bitcoin Season

While the decline in Bitcoin dominance has stoked excitement about the potential onset of altcoin season, Blockchain Center’s Altseason Index shows the market is closer to Bitcoin season than it is to altseason.

Sponsored

The Altseason Index, which defines an altseason as a period where 75% of the top 50 altcoins outperform Bitcoin over the last 90 days, currently sits at a reading of 41% of large caps, outperforming the market leader. The weekend turmoil saw the Altseason Index dip as low as 25%, but a strong bounce suggests that markets do not expect an escalation of tensions between Iran and Israel.

The top three performing altcoins over the last 90 days were WIF, FET, and AR. They posted gains of 928%, 238%, and 189%, respectively, far outpacing Bitcoin’s 57% growth over the same period.

On the Flipside

- The crypto bounce has yet to fully recover the losses triggered by the weekend turmoil.

- BTC dominance has not dipped below 39% since May 2018.

Why This Matters

The conflict-led market sell-off and subsequent dip in Bitcoin dominance demonstrates the highly changeable nature of cryptocurrency investing. Although Bitcoin dominance decreased over the weekend, the possibility of an imminent altcoin season seems distant.

Read about the last significant pullback in Bitcoin dominance here:

Altcoins Poised to Explode as Bitcoin Dominance Wanes?

NEO leads the top 100 cryptos after weekend carnage. Read more here:

NEO Leads Crypto Market Bounce Post-Weekend Crash