- Crypto markets saw panic selling.

- Bitcoin Dominance dropped, indicating altcoin strength amid the market panic.

- Evergrande’s bankruptcy filing was blamed for the sell-off.

Bitcoin’s “boring” consolidation phase over the past seven weeks was broken on August 17, as it experienced a 9% downside swing on the hourly candle to bounce off $25.3k support.

The ensuing market panic saw $62.4 billion wiped from the total crypto market cap, in addition to Bitcoin Dominance (BTC.D) tanking.

Bitcoin Dominance Drops

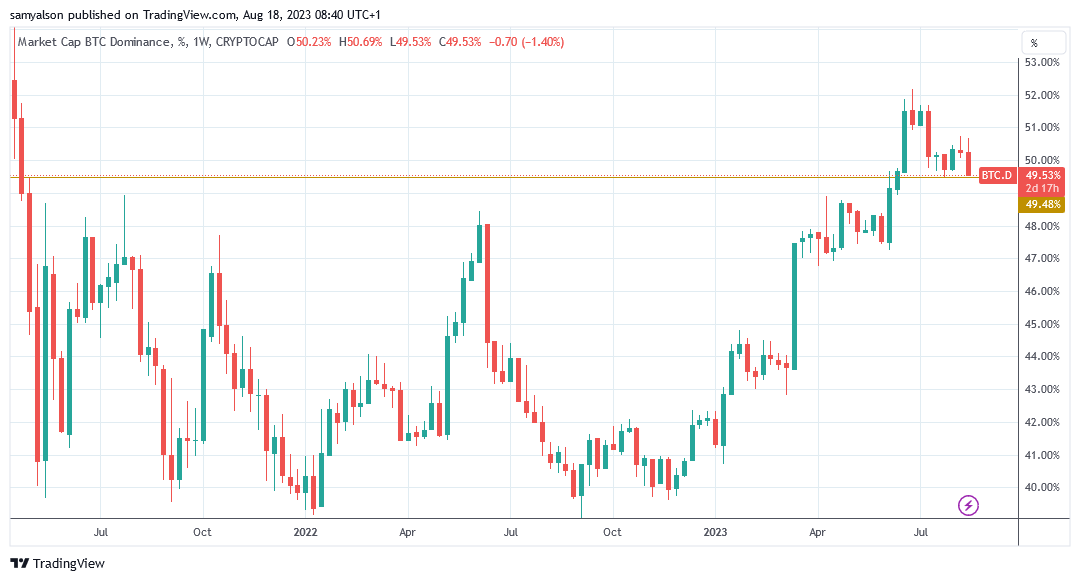

BTC.D is calculated by dividing the BTC market by the total crypto market cap. This provides a measure of Bitcoin’s strength against altcoins, such that falling BTC.D indicates that altcoins, as a whole, are gaining value relative to the market leader.

Sponsored

The chart below shows BTC.D at 49.53% of the crypto market at the time of writing and on track to test 49.48% support. Should this break, the next level of significant support exists around the 48.93% level.

Commenting on the situation, the Founder of Crypto Capital Venture, Dan Gambardello, predicted further drops in BTC.D to come.

Since the start of the year, BTC.D had been trending higher, moving from an opening value of 42.04% to a year-to-date peak of 52.21% in late June – but has been trending downwards since then.

Sponsored

The week commencing March 13 saw the largest daily candle in 2023, moving from 43.61% to close at 47.52% due to several US banks collapsing.

At the time of the banking crisis, the price of Bitcoin and BTC.D moved higher based on a narrative that “cash is trash” and investors should ditch it in favor of “hard assets” that cannot be printed, such as Bitcoin and gold. This situation highlights that cryptocurrency is not isolated from legacy markets, despite protests to the contrary from some quarters.

Crypto Market Panic

Thursday’s crypto market flash crash was blamed on news that Chinese property developer Evergrande had filed for bankruptcy protection. Figures state the company has $19 billion of overseas liabilities, underscoring the potential international impact of the situation.

The ripple effect saw the total crypto market cap sink from $1.099 trillion to bottom at $1.037 trillion, according to CoinMarketCap. Bulls stepped in to lift the total market cap to $1.074 trillion by 00:00 BST on Friday, but prices have since been edging lower.

On the Flipside

- The regulatory environment is more favorable to Bitcoin, which may be a factor in re-asserting its dominance over alts.

- Macroeconomic uncertainty persists, leading to pressure on speculative assets, including cryptocurrencies.

Why This Matters

Falling BTC.D suggests investor sentiment is flipping towards altcoins, challenging the convention of seeking safety during times of uncertainty.

Find out more on Evergrande’s past impact on crypto markets:

Evergrande and Crypto: Just How Intertwined Are They?

Discover the latest on Grayscale’s bid for a Bitcoin ETF:

Grayscale Bitcoin ETF Approved? Job Listing Sparks Speculation