AMP crypto claims that it provides a more stable, fast, secure payments network than existing blockchains. Better yet, the Ampera protocol promises to reward collateral providers with generous staking rewards.

Fully open-source and decentralized, the development of the DeFi platform has been passed on to the Ampera Foundation, an independent, not-for-profit organization. Is this just a fancy way of saying that AMP is a community-led project?

What is a collateralized payment network, and how does it work? Can the AMP crypto project truly bring secure digital asset transfers to retail merchants, or has a hyper-competitive market left them behind?

Table of Contents

What Is AMP?

AMP, a creative player in the DeFi space, is an open-source, decentralized protocol that offers collateral as a service. Within the crypto market, Ampera serves as a digital collateral token that provides instant, verifiable assurances for any kind of value transfer.

AMP aims to bridge the gap between real-world businesses and crypto payments by creating a payment system that is backed up by collateral assets.

It offers a versatile platform for verifiable collateralization through token partitions and collateral managers. These partitions can be designated to collateralize any account, application, or even transaction, and carry balances that are directly verifiable on the Ethereum blockchain.

But what does that even mean? Think of Ampera protocol as a tool that people can use to make sure that when they send or receive money, everything goes smoothly and safely.

Sponsored

Imagine Ampera as a kind of safety net that guarantees both sides of a digital asset transfer uphold their end of the agreement. In keeping with the ethos of decentralized finance, all balances and transactions are visible on-chain, creating a trustless environment.

How Does Ampera Work?

When AMP is staked to a partition, it’s been prepared to collateralize a digital currency transfer. This process involves using collateral pools, decentralizing the risk of asset transfer, making it particularly suitable for fraud-proof networks and real-world applications.

Collateral managers, on the other hand, are handled using blockchain smart contracts. They can lock, release, and redirect collateral within these token partitions as needed to support value transfer activities between accounts. This means that AMP can provide a secure and efficient platform for any form of value exchange.

If there’s an issue with the transfer, the network will reimburse any costs to the merchant. If the merchant doesn’t receive the required crypto assets, then the amount of AMP necessary to cover the losses is liquidated, with the staked AMP tokens acting as collateral. This system ensures that both buyers and sellers are protected from fraudulent activity and potential losses.

Today, the potential of value exchange is limited to digital assets like Bitcoin (BTC), Ethereum (ETH), and AMP coin. What has AMP supporters so bullish about the Ampera protocol is that in the future, value exchange might also include loan distributions and real-world assets, like property or luxury art.

What are AMP Tokens Used For?

AMP tokens serve a crucial role in the AMP ecosystem. They are the backbone of the collateralization process, acting as insurance for any value transfer. When staked to a partition, AMP tokens are ready to collateralize a transfer, providing instant, verifiable assurances for transactions.

First and foremost, AMP’s main use case is to secure transactions on the Flexa network, a digital payments network that allows merchants to accept a variety of cryptocurrencies. If a payment confirmation on the Flexa network encounters an issue, the required amount of AMP is liquidated in real-time to cover the losses, ensuring that the merchant is not left out of pocket.

But if AMP is simply used to shore up payment issues for merchants, what is the benefit of holding AMP tokens? In addition to securing transactions, AMP tokens can also be staked to earn rewards. This incentivizes people to participate in the AMP ecosystem and provides collateral.

AMP History: From Flexa Network to AMP

The story of AMP is intertwined with the evolution of the Flexa Network, a blockchain payments company based in New York. Flexa, co-founded in 2018 by Trevor Filter, Zachary Kilgore, and Tyler Spalding.

Tyler Spalding, who serves as Flexa’s CEO, launched the AMP project with the support of the Flexa team. Spalding envisioned a digital collateral token that could provide instant, verifiable assurances that would give real-world users a sense of trust in the crypto space.

This began in 2018 with the launch of Flexa Coin (FXC). However, as the project developed, it soon became apparent that the existing smart contracts couldn’t support the complexity of a collateralized payment network.

The team opted for a full rebrand and migrated the FXC token to the ERC-20 token standard on Ethereum. Flexa Coin investors were able to swap FXC tokens for AMP tokens at a 1:1 ratio, and AMP was born.

In February 2023, Spalding formed the Ampera Foundation, a fully-independent, not-for-profit organization working towards the future growth and development of AMP.

AMP Ecosystem Apps

The AMP Coin has found a home within 2 main applications: Flexa Network and SPEDN. The team has designed both of these applications to facilitate secure payment networks.

Flexa Network

The Flexa Network is a digital payments network that allows retail merchants to accept a variety of cryptocurrencies. The Flexa Network takes advantage of AMP’s collateralization capabilities to secure transactions, providing instant, verifiable assurances for all transactions.

This ensures that merchants can accept digital payments with confidence, knowing that they are protected against fraudulent activity and potential losses.

What separates Flexa Network from other digital payment networks is that it supports both cryptocurrency and fiat currency payments. The Flexa Network is a prime example of how AMP can be used to facilitate secure and efficient digital transactions in real-world applications.

SPEDN

Another key player in the AMP ecosystem, SPEDN is a digital wallet app developed by Flexa that allows users to spend cryptocurrencies at a variety of retailers. SPEDN integrates with the Flexa Network and uses AMP tokens to secure transactions, providing users with a seamless and secure way to spend their cryptocurrencies in the real world.

The app is user-friendly and supports a range of cryptocurrencies, making it an accessible and convenient option for crypto users. Building off the AMP ecosystem, SPEDN is helping to bridge the gap between cryptocurrencies and traditional retail.

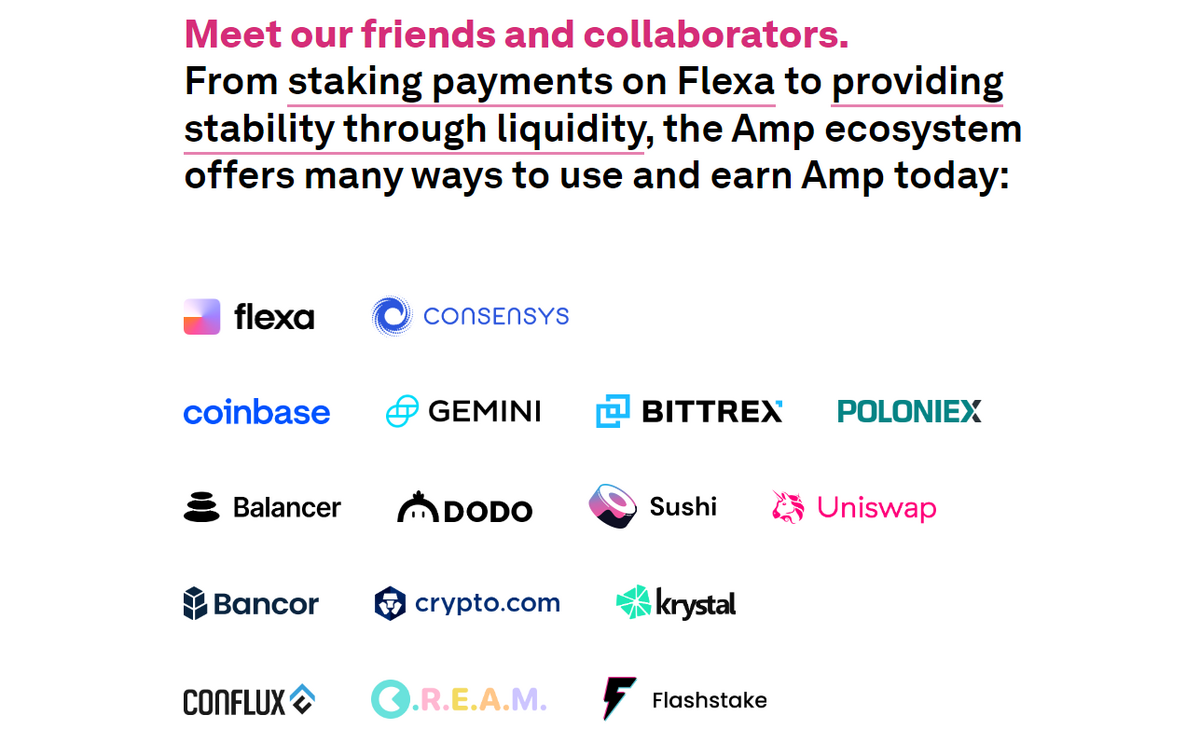

Ampera Partnerships

Ampera’s innovative approach to collateralization has not gone unnoticed. The project has attracted interest from a variety of DeFi companies and organizations, leading to a number of significant partnerships.

Boasting partnerships from reputable blockchain companies like Consensys and Flashstake not only validate AMP’s potential but also expand its reach and potential use cases. At the same time, these partnership and collaborator claims need to be taken with a grain of salt. Any ERC-20 token can be listed on DEXes like Uniswap, Sushi or Balancer, so calling the relationship a collaboration is a bit of a stretch.

AMP Concerns

Here’s the thing. Reading about the potential of creative DeFi protocols is all well and good, but we also need to ask why they’re needed. Frankly, AMP’s main use case seems almost redundant.

Blockchain technology and cryptocurrency are designed to create secure payment networks. Part of that means that you can’t force transactions to pass with less value than has been coded into the transfer. Every transaction is clearly visible on-chain, and all parties can see that assets pass from one wallet to the other.

Why do we need collateralized networks when merchants cannot be left out of pocket when receiving digital currencies on-chain? On top of that, automatically liquidating AMP tokens to cover merchant losses presents unbalanced sell pressure.

Where does the underlying value come from if the incentive to buy and hold AMP tokens is to contribute them to collateralized AMP markets and earn staking rewards? Staking rewards alone aren’t a sustainable incentive long term.

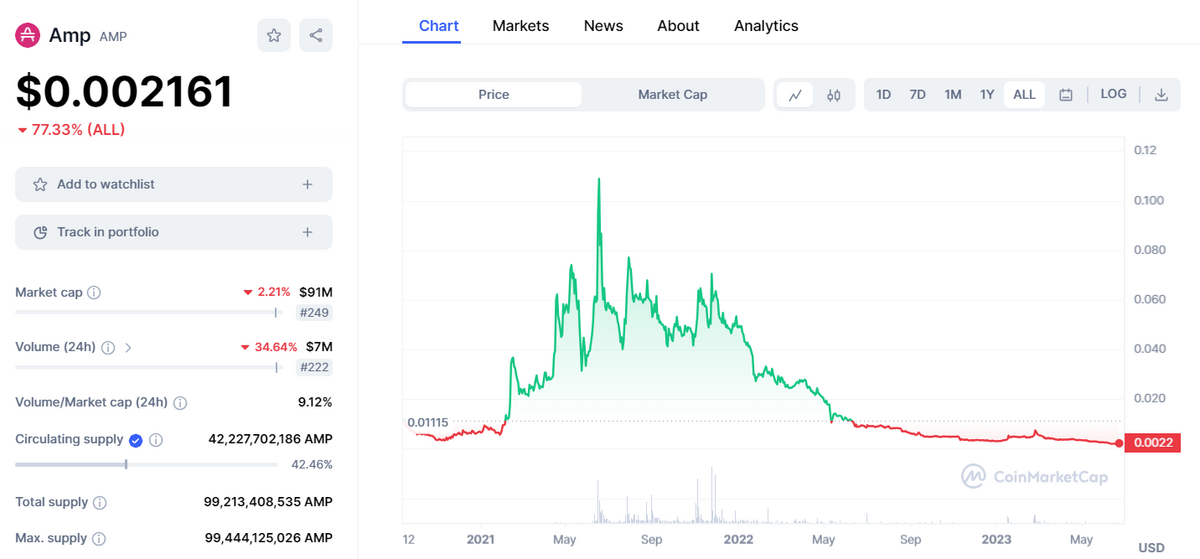

At the time of writing, the current price of AMP is down roughly 98% from its all-time high of $0.12 AMP/USD in June 2021. AMP token liquidity on decentralized exchanges and trading volume has been trending down ever since, meaning that volatility and momentum have not been on Ampera’s side for a long time.

AMP Crypto Pros and Cons

Like any technology, AMP comes with its own set of advantages and potential drawbacks. Understanding these pros and cons is crucial for anyone considering getting involved with Ampera.

Pros

- Fast and Efficient – AMP provides instant, verifiable assurances for any kind of value transfer, making it an efficient platform for digital transactions.

- Versatile Use Cases – AMP’s system of collateral partitions and managers can potentially collateralize all kinds of value transfer, from digital currencies to real-world assets.

- Secure – AMP tokens act as collateral for transactions, providing a layer of security that protects both buyers and sellers from fraudulent activity and potential losses.

- Open-Source and Decentralized – Led by the Ampera Foundation, the platform is open-source, allowing anyone to contribute to its development.

- Staking rewards – Users can stake AMP tokens to earn rewards, providing an incentive for participation in the AMP ecosystem.

Cons

- Redundant Utility – Blockchain payments are inherently secure and don’t really need collateralization.

- Dependence on Flexa Network – AMP’s main utility is to secure transactions on the Flexa network. If the Flexa network were to face issues, AMP price would likely suffer.

- Complexity – Ampera is complicated even by the standards of a DeFi app. This could potentially limit AMP’s adoption among a broader user base.

- Competitive field – The DeFi space is highly competitive, with numerous projects vying for market share. AMP might struggle to siphon users from more established protocols.

On the Flipside

- Ampera protocol aims to bridge the gap between real-world merchants and cryptocurrency payments. In this day and age, almost every crypto exchange offers a crypto debit card of sorts and there are plenty of payment gateways for accepting crypto payments. Has AMP been beaten out by more established businesses?

Why This Matters

Decentralized finance is a wild world of innovation and creative financial tools. Learning about the enormous variety of applications available can help us to be objective when exploring new crypto projects.

FAQs

You can buy AMP tokens on top crypto exchanges like Binance, Coinbase, and Gemini. For those who prefer to trade crypto assets on-chain, AMP is listed on Uniswap.

At Dailycoin, we will never give price forecasts or investment advice. If AMP were to reach $100, it would have a market cap of around $9 trillion USD. This would make AMP’s market capitalization around 5x larger than the entire crypto market. A $100 AMP price prediction is extremely unlikely.

According to Coinmarketcap, AMP’s all-time high is $0.12 USD. This was recorded on June 16, 2021.

AMP has a total supply of 99,213,408,535 tokens. Of that figure, around 42% are currently in circulation, giving AMP a circulating supply of approximately 42B tokens.