Real-World Assets (RWAs) represent one of the biggest growth opportunities and potential use cases for decentralized finance (DeFi) and the cryptocurrency industry. Bringing tangible assets like real estate and high art opens doors for fractional ownership and new investment opportunities.

It’s a win-win for everyone. RWAs bring traditional finance on-chain, lowering the barrier to entry and making historically illiquid assets more fluid. The DeFi ecosystem enjoys wider adoption, deeper liquidity and gives people the opportunity to invest in asset classes that were previously unavailable to them.

Sponsored

But how does tokenizing Real-World Assets even work? Is this a breakthrough for blockchain technology, or just a speculative pipedream in an emerging market?

What are Real World Assets in Crypto?

Real-World Assets are physical, tangible assets in traditional finance and the world around us. These assets represent a significant portion of TradFi (Traditional Finance) and have been used for decades in the financial system as collateral for lenders and borrowers.

Before the onset of blockchain technology and digital tokens, ownership of these real-world assets was recorded on paper, and eventually, computer files. Seems rather insecure, no? Do you still own your house if a governing body or central authority loses your title deed in a fire?

Bringing these Real-World Assets on-chain and storing them as digital assets like cryptocurrencies or non-fungible tokens (NFTs) gives them a secure, permanent home where they’re tamper-proof. It also gives these assets far more utility, making them financially liquid and available for fractionalization.

How Can Tokenization of Real-World Assets Help DeFi?

Amidst the excitement and chaos of crypto news, it’s easy to forget that the crypto market is just a blip on the global financial system’s radar. Look at it this way, the real estate industry was valued at over $326 trillion USD in 2020. The market cap of gold is worth $13 trillion.

Sponsored

Bitcoin (BTC), Ethereum (ETH), and every other cryptocurrency under the sun? Just over $1 trillion USD. We still have a long way to go, but DeFi has a lot to offer that TradFi cannot provide.

While the amount of TVL (Total Value Locked) in DeFi has been dwindling since the end of the 2021 bull run, Real-World Assets can bring trillions into the DeFi ecosystem. Not only does this deepen on-chain liquidity, but it also creates unique opportunities for investors thanks to blockchain smart contracts.

Tokenizing real-world assets gives owners greater flexibility and control over their wealth. With fractionalized ownership, investors can overcome the expensive barriers to entry that prevent millions of people worldwide from getting on the property ladder.

This isn’t limited to the property market alone. Hamilton Lane, a celebrated private equity fund, partnered with Securitize to tokenize its flagship fund on the Polygon blockchain. These security tokens were available with a minimum investment of $50,000 instead of the usual $5M minimum buy-in.

Asset owners can use decentralized applications (dApps) to provide RWAs as collateral and borrow stablecoins and other digital currencies against them without paying high-interest rates to third-party intermediaries.

What RWAs Can Be Turned into Digital Assets?

When tokenizing real-world assets and bringing them on-chain, the only limits are your imagination and what traditional finance accepts as a genuine asset class. Here are a few of the most commonly suggested RWA opportunities.

1. Real Estate

The global real estate industry is one of the largest markets in traditional finance. Tokenizing property into digital assets brings this multi-trillion-dollar field into the DeFi ecosystem and gives owners greater control and utility.

Property has always been an exclusive and illiquid market. Tokenizing real estate makes this financial behemoth far more liquid and makes real estate investment accessible to everyone.

2. High Art

Tokenizing fine art pieces and collectibles is a way of breaking down famous artworks and allowing curators and collectors to own fractionalized shares of historical pieces. Blockchain technology provides an immutable record of ownership, protecting the art from forgery and making tracing fraudulent transactions easier.

Many people don’t know that some famous pieces have already been tokenized and distributed on-chain. Sygnum, a Swiss bank, fractionalized Picasso’s Fillette au béret into 4,000 digital tokens. Legal ownership of the painting is now recognized on the blockchain.

3. Intellectual Property

Intellectual Property rights are notoriously complicated to manage. Transferring IP rights into digital assets makes them far easier to monetize and transfer between legal entities.

These IP tokens can also be deployed into DeFi protocols, expanding their utility.

DeFi Protocols Using RWAs

The tokenization of Real-World Assets is great in theory, but which innovative teams are putting these ideas into motion? Let’s take a quick look at some of the top crypto startups leveraging Real-World Assets in crypto.

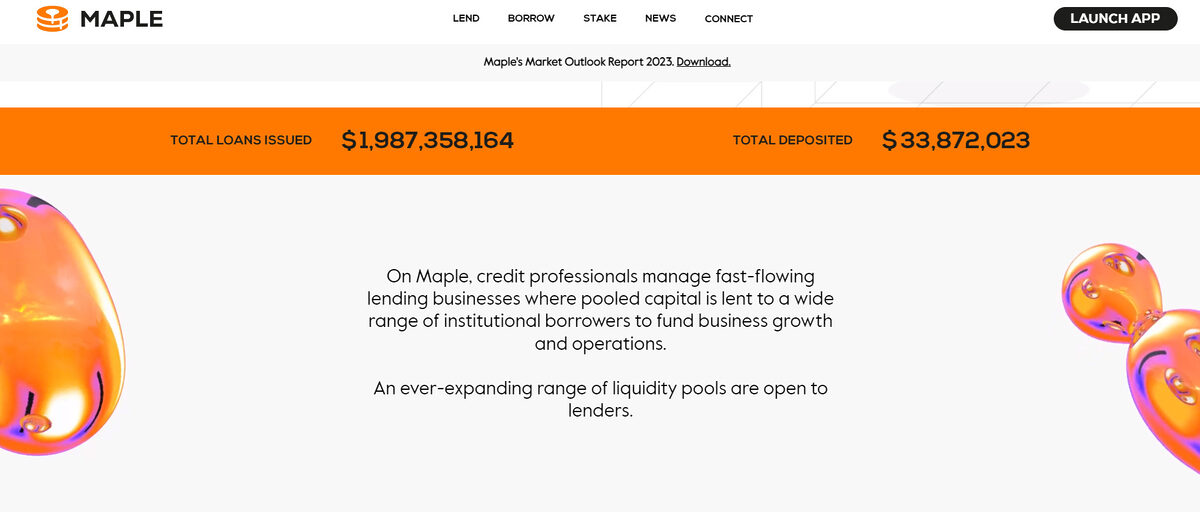

1. Maple Finance

Maple Finance is one of the leaders in the RWA niche and provides a corporate credit market with borrowing and lending pools. The protocol’s unique framework allows real-world institutional businesses to borrow capital within the DeFi ecosystem.

Maple’s Pool Delegates strictly vet all borrowers. These Pool Delegates carry out the necessary due diligence and underwriting procedures that secure the loan, including KYC (Know-Your-Customer) and AML (Anti-Money Laundering) measures.

Lenders can then loan funds to these real-world businesses and earn yield from the loan’s generous interest rates.

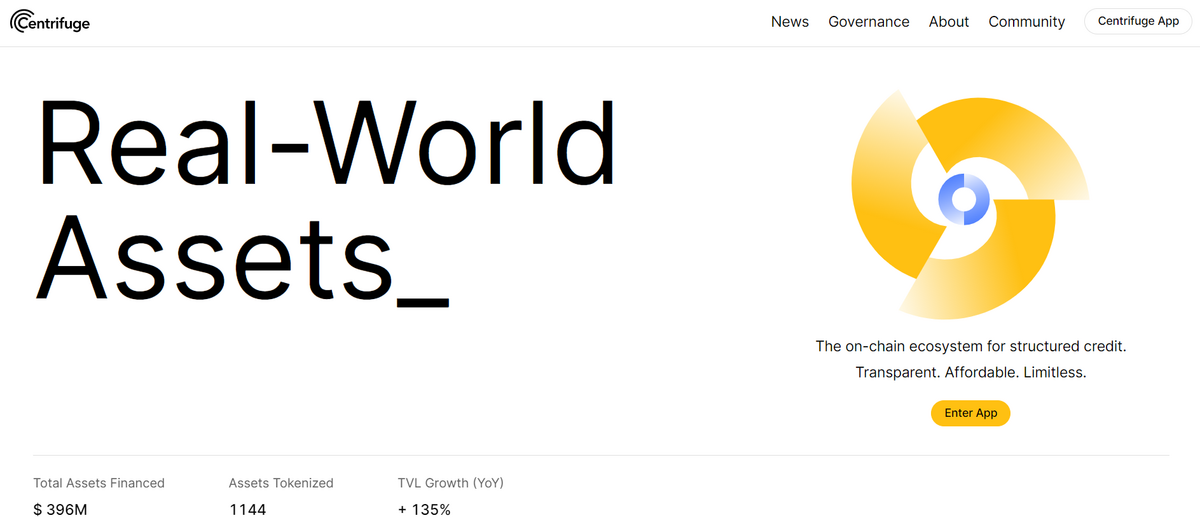

2. Centrifuge

The Centrifuge protocol helps tokenize Real World Assets by converting them into blockchain-based NFTs backed by correct legal documentation. After the issuer has minted the RWA into an NFT, they create decentralized asset pools using the tokenized asset as collateral.

The range of real-world assets that can be converted into Centrifuge pools is staggering, with real estate, royalties, and invoices being compatible with the platform.

3. GoldFinch

A direct competitor to Maple Finance, Goldfinch serves a similar function by allowing DeFi users to loan stablecoins like USD Coin (USDC) to real-world businesses in exchange for yield on loan repayments in real-time.

Goldfinch is backed by some of the biggest investment funds in the cryptocurrency industry, including Andreessen Horowitz and Coinbase Ventures.

Tokenizing Real World Assets: Pros and Cons

Like all corners and niches within the cryptocurrency world, the tokenization of real-world assets is not without its faults. Let’s compare the pros and cons of blockchain-based RWAs.

Pros

- Grows the DeFi Ecosystem – Bridging the world of traditional finance into the blockchain industry provides a massive boost of liquidity and utility to the DeFi ecosystem.

- Provides new opportunities for investors – People previously excluded from certain investment fields, like real estate, enjoy lower barriers to entry.

- Solidifies crypto’s image – As more traditional financial systems migrate to a blockchain-based framework, the industry’s reputation will improve.

Cons

- Regulatory friction – Just because RWAs can be brought on-chain doesn’t mean that every jurisdiction worldwide will support or recognize them as genuine, tangible assets.

- Loan defaults – Just like in traditional finance, loan defaults are commonplace. The inherent volatility of the crypto market naturally adds a layer of risk to these platforms, so please do your due diligence before loaning funds or converting your own RWAs to digital tokens.

- Underdeveloped niche – While its potential is impressive, tokenizing real-world assets is still in its infancy. If RWA applications struggle to find users, these protocols will inevitably fade into obscurity.

On The Flipside

- Traditional financial systems are well established and typically don’t take well to disruptive technologies. This is especially true of cryptocurrency, which aims to reinvent how many of these TradFi platforms operate. Just because both TradFi and DeFi will mutually benefit from the tokenization of real-world assets doesn’t mean that they will play nicely and see it to fruition.

Why This Matters

Putting real-world assets on the blockchain and integrating them into decentralized finance is one of the biggest potential use cases of cryptocurrency and Web 3 technology. Learning about RWAs and how they work now can keep you informed and ahead of the crowd when these platforms attract users en masse.

FAQs

Popular examples of real-world asset tokenization include real estate, art, commodities, private equity, and intellectual property.

An RWA in crypto refers to a real-world asset that has been tokenized and represented on a blockchain by a digital token.

Yes, real estate title deeds can be minted as NFTs and stored on the blockchain to represent property ownership.

While some might disagree, NFTs are considered a financial asset. They hold financial value and are traded between market participants.