To say that crypto payment processing in 2024 is the cat’s pyjamas is an understatement.

Gone are the days of clunky crypto transactions with fiddly, long addresses and whopping slippage. Now, crypto processing is widespread, sleek, cheap, and fast. It’s convenient for both merchants and consumers and has never been more important, noting skyrocketing crypto adoption throughout the world.

However, for many of you, the idea of crypto processing is an alien one.

What is crypto processing? Why would a merchant want to integrate a modern cryptocurrency payment gateway into their operations? How exactly does it stand to benefit both the business and its clientele?

Indeed, in light of these questions, this article delves into the intricate workings of cryptocurrency payment gateway, underscoring its advantages and showcasing its implementation through a practical example.

Sponsored

Also, we’ll be highlighting the crypto payments provider nominated as the best one to use and why.

Let’s get started.

What is a Cryptocurrency Payment Gateway?

A crypto payment processor is a system that enables businesses to accept transactions in cryptocurrencies such as Bitcoin, Ethereum, and others as payment for goods and services. Such systems typically convert digital currencies to the merchant’s bank account in their preferred fiat currency (e.g., USD, EUR). However, merchants also have the option to retain the payments in cryptocurrency.

Despite the seemingly straightforward integration of a crypto processing gateway, the question remains: why would a merchant opt to accept crypto payments in the first place?

The answer is lengthy but fascinating.

Firstly, cryptocurrencies are international, allowing businesses to accept payments from almost anywhere in the world without concern for currency exchange rates or international transaction fees. What’s more, depending on the cryptocurrency used, these transactions can be confirmed more quickly than traditional bank transfers. This efficiency and global reach can enhance cash flow and customer satisfaction worldwide.

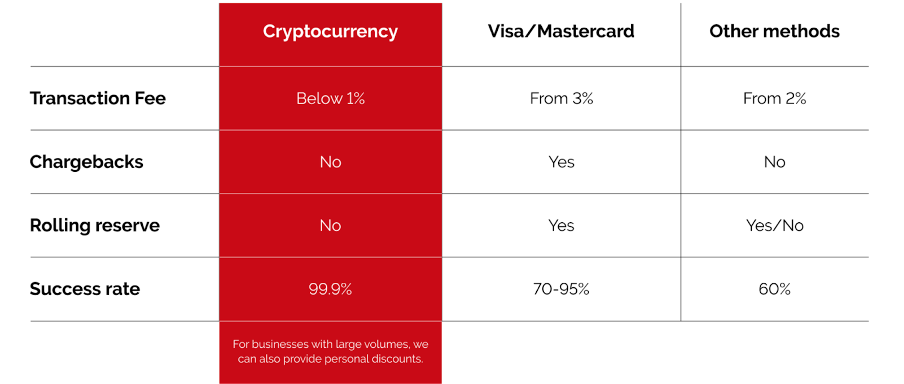

Then, consider the transaction fees charged by the processor. Traditional online payment methods usually incur fees from banks or credit card companies, which can be as high as 3.5%. Cryptocurrency payments, on the other hand, can offer lower transaction fees, saving money for both businesses and customers. For instance, Cryptoprocessing.com offers fees as low as 1%.

Furthermore, merchants can say goodbye to chargebacks and rolling reserves. Blockchain technology, the backbone of cryptocurrencies, provides advanced security features. Transactions are encrypted and immutable, significantly reducing the risk of fraud. Fewer chargebacks mean the need for rolling reserves is lessened, thereby enhancing a company’s liquidity for capital activation and investments.

The preference of some customers to pay in cryptocurrencies can unlock new markets, demographics, and customer types for merchants. Additionally, accepting cryptocurrencies can position a business as forward-thinking, innovative, and tech-savvy, appealing to demographics that value these qualities. Indeed, as the popularity of cryptocurrencies increases, more customers are seeking businesses that accept these digital currencies. Offering crypto payment options meets this demand, expanding the customer base and enhancing satisfaction.

So, there are numerous reasons for merchants to consider accepting crypto payments in 2024. Having discussed e-commerce several times today, let’s delve into how crypto payments function within a typical industry example in the following section.

How do Crypto Payments Work?

Let’s illustrate each step of the crypto payment gateway using a fictional e-commerce merchant, “GadgetPort,” which sells tech gadgets online:

1. Transaction Initiation

Example: A customer chooses a high-tech smartwatch from GadgetPort’s extensive online catalog. At the checkout, they opt to pay with Ethereum, leveraging GadgetPort’s capability to accept various cryptocurrencies through its integration with CryptoProcessing or any other payment gateway.

2. Cryptocurrency Payment Gateway Integration

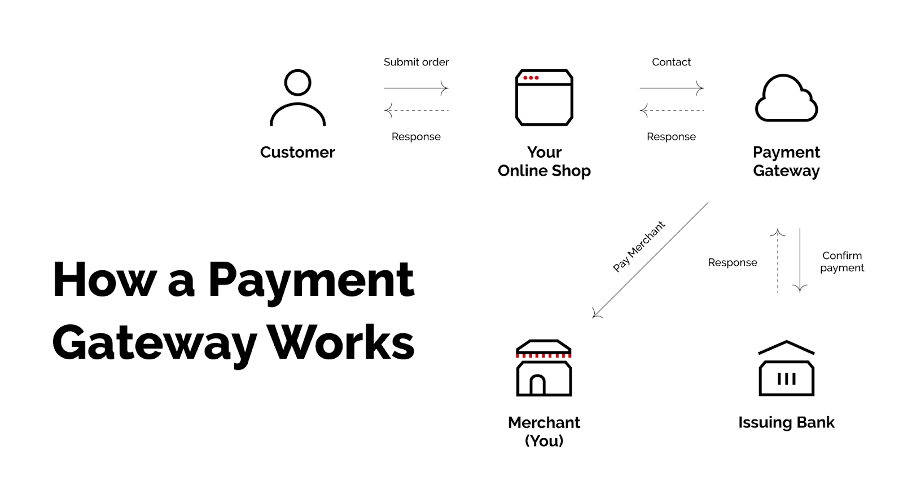

Crypto Payment Gateway: GadgetPort utilizes a crypto payment gateway to facilitate cryptocurrency transactions. The payment gateway acts as a bridge, converting the smartwatch’s price from USD to the equivalent in Ethereum based on the prevailing exchange rate.

Invoice Generation: Upon selecting Ethereum as the payment method, the payment gateway generates an invoice for the customer. This invoice includes a QR code and a unique wallet address, specifying the exact amount of Ethereum required to finalize the purchase, according to the current market rate.

3. Transaction on the Blockchain

Buyer Sends the Payment: The customer uses their digital wallet to scan the QR code or inputs the wallet address manually, transferring the indicated amount of Ethereum to the wallet address managed by a cryptocurrency payment processor for GadgetPort.

Blockchain Confirmation: The Ethereum transaction is submitted to the network for verification. Network validators (or miners) authenticate the transaction’s validity, and upon successful confirmation, it is irrevocably recorded on the Ethereum blockchain. The time needed for this step may vary based on the network’s current congestion.

4. Transaction Verification and Settlement

Cryptocurrency Payment Gateway Verification: After the Ethereum network confirms the transaction, the payment gateway verifies its completion and promptly notifies GadgetPort that the payment has been received.

Settlement: GadgetPort has configured its account with crypto processing to automatically convert cryptocurrency payments into USD, safeguarding against the volatility of cryptocurrency prices. Following this policy, the crypto payment provider, such as CryptoProcessing, converts the Ethereum received into USD at the latest exchange rate and deposits the fiat amount into GadgetPort’s bank account. Nonetheless, GadgetPort retains the flexibility to keep a portion of their earnings in cryptocurrency, allowing them to diversify their financial portfolio and potentially benefit from potential future value appreciation of Ethereum.

When we consider factors such as the speed and price at which this process can take place, it’s clear that we have a payment flow much more suited to the 2020s. As such, it’s no wonder that crypto adoption for payments and remittances is skyrocketing.

What’s the Best Cryptocurrency Payment Gateway?

We’ve mentioned CryptoProcessing several times today, and for good reason too. It stands as a secure, proven leader in the market with some of the most competitive fees.

Last year, the gateway was cited as the №1 solution in crypto processing at the EGR B2B Awards 2023. Aside from being one of the best crypto payment gateways on the market, the company holds over a decade of expertise in the cryptocurrency domain, all the while ensuring zero customer funds are at risk, imposing no setup or monthly fees.

With over 800 merchant accounts serviced and processing more than €700M in crypto monthly, CryptoProcessing has demonstrated its vast capacity and reliability in handling a high volume of transactions.

Final thoughts

In wrapping up, the landscape of cryptocurrency payment processing has drastically transformed, offering a seamless, cost-effective, and secure avenue for merchants to widen their market reach and cater to a growing demographic of crypto users.

We hope that today has given you some desired insights into crypto processing solutions and how they work. After all, as we observe a significant surge in crypto adoption for payments and remittances, it’s evident that the future of commerce lies in leveraging digital currencies.

Businesses that adapt to this shift future-proof their operations and position themselves as pioneers in the digital finance landscape.

This article contains sponsored content from an external source. The opinions and information presented may differ from those of DailyCoin. Readers are encouraged to independently verify the details and consult with experts before acting on any information provided. Please note that our Terms and Conditions, Privacy Policy, and Risk Warning have been recently updated.