- The reason to buy digital assets for crypto payments falls by half.

- Gambling remains the most popular reason to buy cryptocurrency.

- Using crypto for payment was faced with friction and technical difficulties.

The publishing of the Bitcoin white paper in 2008 turned the concept of money upside down by proposing a permissionless “electronic cash system.” Yet 15 years later, data compiled by the UK’s Financial Conduct Authority (FCA) underscores how little Bitcoin and cryptocurrency are being used for their intended purpose as a medium of exchange.

Crypto Payments Are a No-Go

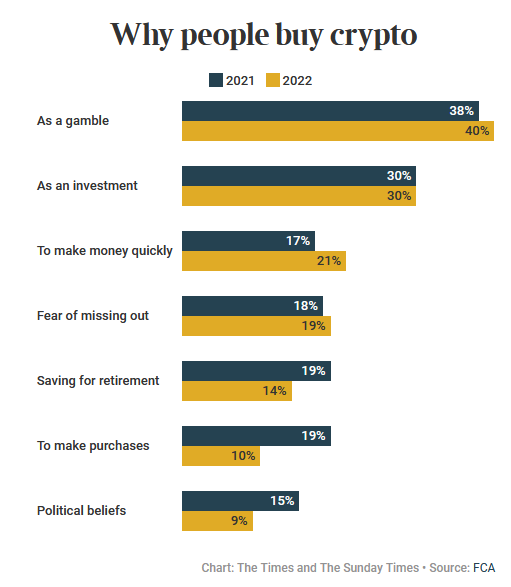

Survey data compiled by the FCA and published by the Times showed a sharp drop in those purchasing cryptocurrencies intending to utilize them for payments, falling from 19% in 2021 to just 10% in 2022. Conversely, speculative reasons to buy cryptocurrency remained consistently strong over the two years.

The Times author’s firsthand experience attempting to pay with Bitcoin at London retailers reflected this overall trend. Despite research identifying select shops touting crypto payment options, the author found several shops had already reversed course due to meager adoption rates.

Sponsored

In cases where crypto was accepted at the retail establishment, it was not uncommon to face technical difficulties such as drained batteries on crypto payment devices, incompatible wallet apps, or losing phone signal at the critical stage of sending payment. These issues often resulted in staff asking the author to pay by debit or credit card to save further hassle.

Faced with this myriad of adoption barriers and inadequate infrastructure, it is unsurprising that digital asset investors are primarily motivated by speculative reasons to buy cryptocurrency.

Crypto Speculation Rules

According to the FCA survey, the biggest reason to buy cryptocurrency per the FCA survey was “as a gamble” in both 2021 and 2022, increasing from 38% to 40%, respectively. This highlights the speculative nature of cryptocurrency investing.

Sponsored

Similarly, a 2018 research paper published by the Journal of International Financial Markets, Institutions, and Money reached similar conclusions after examining the statistical properties of analyzed Bitcoin transactions, finding that most transactions were related to speculative investment purposes.

Though conceived as “electronic cash,” the reality is that speculation has become Bitcoin’s predominant use case due to the efficiency and reliability of existing payment methods.

On the Flipside

- Bitcoin and cryptocurrency are popular payment methods in undeveloped countries with unstable currencies and high numbers of unbanked.

- The FCA survey had several other responses that conveyed speculative reasons to buy cryptocurrencies, those being “as an investment,” “to make money quickly,” and “saving for retirement.”

- Goods and services tend to be priced in local fiat, presenting an additional barrier to making payments in cryptocurrency.

Why This Matters

The adoption of Bitcoin and other cryptocurrencies as an everyday medium of exchange is still limited, especially in developed nations. However, this does not imply that the grand crypto experiment has failed. The use case of cryptocurrencies as a store of value and alternative system is as strong as ever.

Learn more about key Bitcoin trends, including the rise of the ORDI memecoin and Lightning payments, here:

Bitcoin’s ORDI Could Surge 1,200% in 2024: Bitget Report

Read more on the growing popularity of Bitcoin memecoins here:

BRC-20 Token SATS Soars on Major Exchange Listing