- CryptoQuant has reported an increase in stablecoin exchange inflows, measuring the year’s highest level.

- Low BTC inflows have indicated a preference for holding and accumulating.

- Tether and Circle have been actively minting throughout Q1 of 2023, significantly increasing their circulating supplies.

Centralized crypto exchanges have been experiencing increased inflows (deposits) of stablecoins, signaling a potential uptick in buying pressure. Despite this coinciding with a short-term decline in the price of Bitcoin, analytics firms have suggested that the market’s potential purchasing power is strengthening.

Stablecoin On-Chain Data Providers Findings

According to recent reports by CryptoQuant, centralized crypto exchanges have been seeing increased stablecoin inflows. On March 5th, the data aggregator reported the “highest level [of inflows] of this year” as stablecoin balances on crypto exchanges surged. Stablecoins being deposited on exchanges often signifies that investors are preparing buy orders at current or lower levels.

Stablecoin Exchange Netflow Data. Source: CryptoQuant

Sponsored

In contrast, Glassnode noted a new one-month low for USDC at 1,544 for March in terms of the number of unique addresses that received incoming transactions within a given hour.

Despite this, February saw USDT achieve a monthly high mean transaction volume, even with the average number of exchange BTC deposits, typically indicative of market direction, at a monthly low. This has reinforced the notion that people are holding and accumulating instead of selling now.

Stablecoin Giants Gain Ground at the Expense of Binance and BUSD

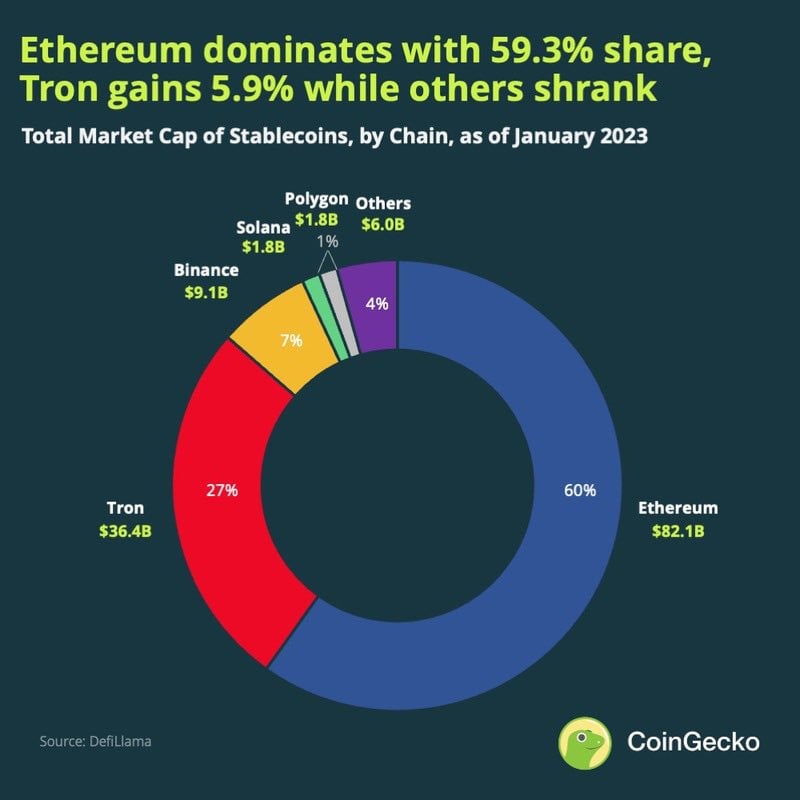

On March 6, CoinGecko reported that Ethereum has continued to dominate the stablecoin market, with 60% of the total share. TRON is the second-largest network for stable asset supply, holding a 27% share following a 5.9% increase. Binance’s BNB Chain is third with a 7% market share.

Sponsored

Stablecoins currently account for approximately 12.7% of the entire crypto market, with a total capitalization of around $136 billion, according to CoinGecko.

Stablecoin Market Share Chart. Source: CoinGecko

Tether remains the stablecoin market leader, with its USDT coin claiming an approximate 52% market share, with $70 billion in circulation. Circle’s USD Coin (USDC) has just under $44 billion in circulating supply, giving it a market share of 32%. The gains made by the stablecoin giants have largely come at the expense of Binance and BUSD following recent regulatory action.

Since the Securities and Exchange Commission took action against Paxos, the issuer of BUSD, its circulating supply has decreased by 46%. As a result, BUSD’s market share now stands at 6.4%, with $8.7 billion in circulation.

On the Flipside

- Stablecoin inflows don’t necessarily translate to immediate price increases in cryptocurrencies, as various factors influence market movements.

- The stablecoin ecosystem constantly evolves, with new stablecoins being introduced and existing stablecoins changing.

Why You Should Care

Stablecoins are a major player in the crypto market, accounting for 12.7% of its total capitalization of around $136 billion. As a result, the movement of stablecoins can significantly impact the overall crypto market.

To learn more about what we mean by “at the expense of Binance and BUSD” read here:

Binance Stablecoin BUSD Falls Below $10 Billion Market Cap for First Time

Also, check this:

Ripple CEO: US Is Falling Behind Over SEC’s XRP Suit