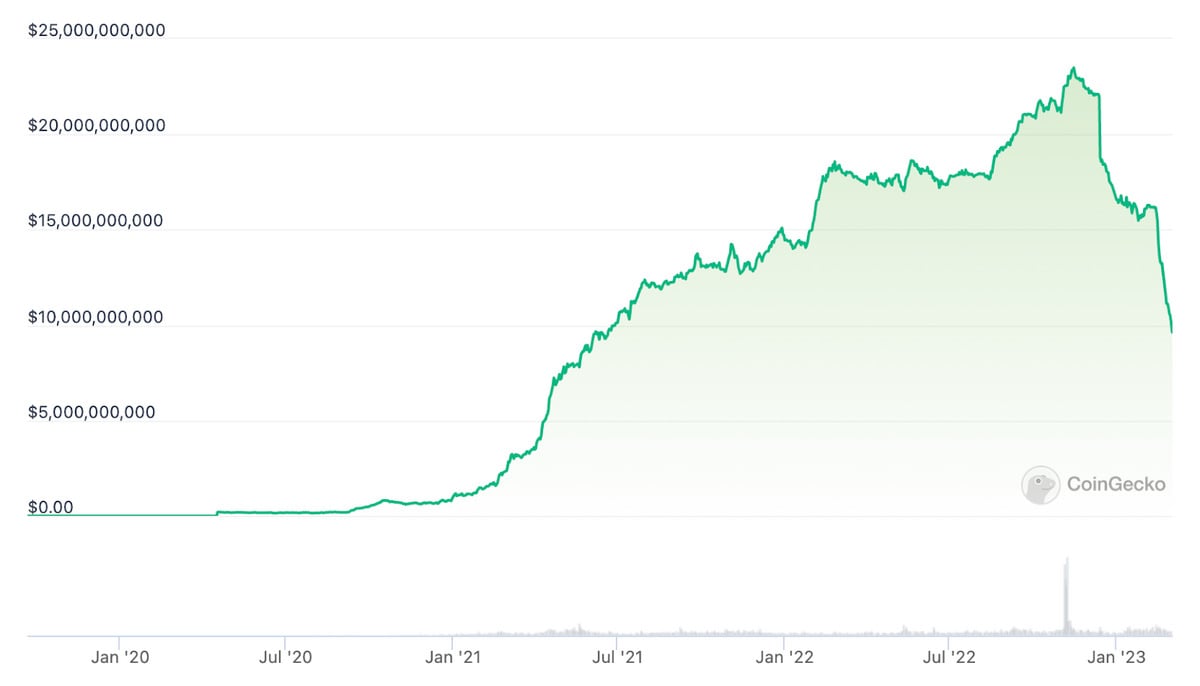

- BUSD has shed more than 50% of its market cap since maxing out at its all-time high of $23.4 billion.

- BUSD’s market cap is in freefall, and there is currently no way for it to turn around.

- Despite regulatory pressure on Stablecoins in the U.S., other Dollar-pegged tokens are gaining market cap share.

Following the SEC’s issuance of a Wells notice to BUSD issuer Paxos, and subsequent demand to cease minting the stablecoin, BUSD’s market cap has been in freefall.

BUSD reached a peak market cap of $23.3 billion on November 16, 2022, following a consistent upward trajectory after its launch in September 2019. However, its market cap has dropped to $9.6 billion at publishing as tokens continue to be burned in light of the SEC’s ruling.

Sponsored

The popular stablecoin started shedding market cap shortly after reaching an all-time high, with a notable drop occurring from December 13, 2022, when approximately $6 billion was wiped off. However, the regulatory pressure starting on February 14 truly catalyzed the collapse.

All-time market cap chart for BUSD. Source: CoinGecko

A Regulatory Battle

The SEC’s Wells notice directly led to the visible collapse in the BUSD chart; compounding this, the New York Department of Financial Services (NYDFS) requirement that Paxos cease minting the token means that the only way is down for the once mighty stablecoin.

Despite its implied ties to the coin, Binance is not too involved. Binance quickly distanced itself from BUSD, stating it is “wholly owned and managed by Paxos.”

Sponsored

A few days after the Paxos drama, the CEO of Binance, Changpeng “CZ” Zhao, highlighted that the entire stablecoin landscape is declining due to regulatory pressure, reiterating his company’s distance from BUSD.

Furthermore, in a February 14 Twitter Space, CZ said that he never thought highly of Binance’s main stablecoin project, even going so far as to say that he believed it “may fail” when first launched.

“To be honest, BUSD was never a big business for us. When we started, I actually thought the BUSD project might fail, so we actually don’t have very good economics on that collaboration,” Zhao said.

Moving On

With the BUSD stablecoin now in market cap freefall, the major exchange appears to be looking to other stablecoin options.

On February 27, Binance minted $150 million worth of True USD (TUSD)—a dollar-pegged stablecoin issued by ArchBlock. It remains to be seen if this pivot will be tolerated by regulators and slide past the general stablecoin crackdown in the U.S.

Binance and CZ have never shied away from highlighting the impact of the ongoing stablecoin crackdown in the U.S. In the February 14 Twitter Space, CZ added:

“I think with the current stances taken by the regulators on the U.S. dollar-based stablecoin, the industry will probably move away to a non-U.S. dollar-based stablecoins.”

On the Flipside

- The top two Stablecoins by market cap, Tether and USDC, have capitalized on the pressure on BUSD. Both coins have added to their market cap since February 14, with Tether jumping from $68.5 billion to $71.2 Billion and USDC rising from $40.9 billion to $43.3 billion.

Why You Should Care

Stablecoins have a vital role in the crypto space, but regulators—notably in the U.S. —feel they undermine the Federal Reserve and Banking Industry. The SEC and other bodies are working to limit Stablecoins’ potential, and some have underlined that CBDCs could even crowd out the entire crypto space.