- Solana surged 35%, and analysts can’t explain why.

- Santiment looks at several factors that could have contributed to the dynamic.

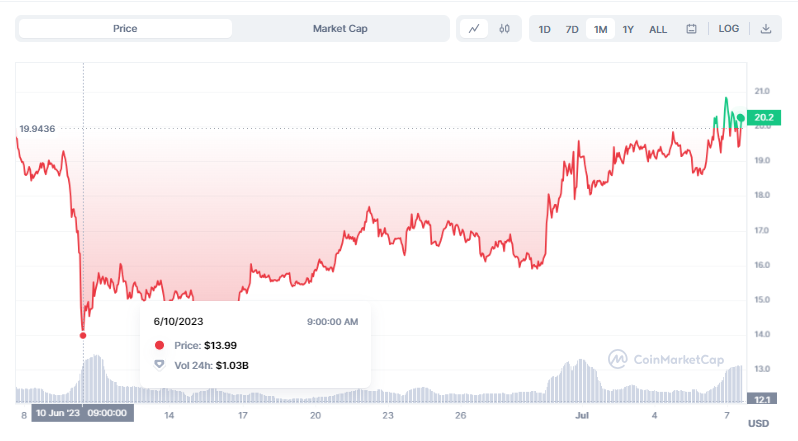

- Recent Solana price movements put the surge into perspective.

In the volatile crypto world, Solana (SOL) has recently made headlines with a significant price surge. Over the past three weeks, SOL jumped 35%, puzzling analysts and investors alike.

Solana’s Surprising Surge

On Thursday, July 6, Santiment, a crypto market intelligence firm, published a report on Solana’s performance. The report highlighted a 35% increase in Solana’s price over the previous three weeks, surprising many. Currently, Solana is trading at $20, having recovered from its recent low of $13.9 on June 10.

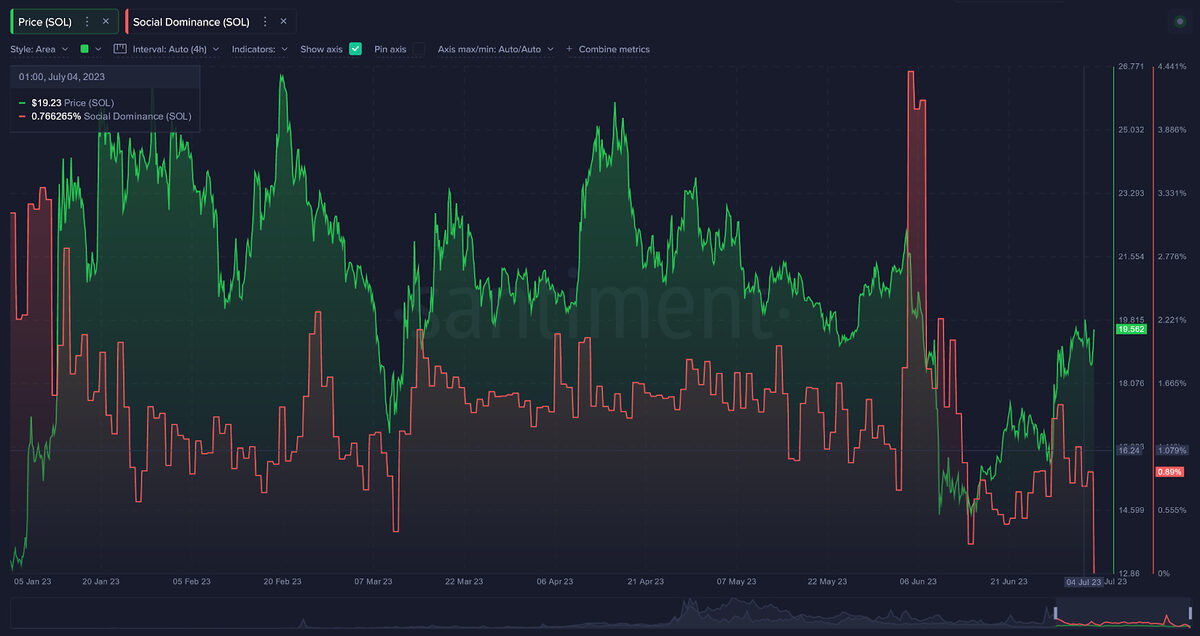

While the report did not pinpoint a specific cause for the recovery, it suggested several contributing factors. These include increased social volume on Reddit and potential speculation in Solana’s Non-Fungible Token (NFT) community.

Sponsored

Still, analysts at Santiment did not find these factors sufficient to explain the price increase. In particular, they noted that the uptick in NFT volumes was nothing unusual for Solana. Moreover, the report noted a decline in Solana’s social dominance since the beginning of the year.

The report also noted that the trading volume for Solana had yet to show any significant increase. This indicates that other factors could drive the price surge, including the latest regulatory and technical developments for the network.

Solana’s Surge in Context: Recent Ups and Downs

Solana’s recent upswing signals its recovery from a major drop in June, following major regulatory issues in the US for Solana.

Sponsored

On June 10, 2023, Solana and other well-known blockchains like Cardano and Polygon experienced a nearly 30% plunge. This drop came after the US Securities and Exchange Commission (SEC) called these tokens securities in its lawsuit against Binance.

Following this news, multiple mainstream trading platforms, including Robinhood, signaled they would delist Solana for its US users. Still, despite this development, Solana managed to bounce back, recovering all its losses by early July.

On the Flipside

- Despite recent positive momentum, Solana is still 90% down from where it was in 2022.

- Despite the price drop, Solana’s ecosystem continues to expand. For example, Solana Labs recently entered the mobile market with its own Web3 Android phone.

Why This Matters

Understanding the factors that drive price changes in crypto like Solana allows traders to make informed decisions and potentially capitalize on market trends.

Read about what Vitalik Buterin said about Solana’s troubles with the SEC:

Solana and Vitalik: Ethereum Founder Backs Rival Project vs. SEC

Read more about AI and its use cases in Web3 gaming: