- SOL’s price is up to its highest since December 2023.

- SOL’s market cap expands to $49.6 billion.

- Strong investor interest is evident in the rapid price and market cap increase.

The cryptocurrency market is a landscape of constant flux, with Solana being no exception. Recent events have put Solana under the spotlight, particularly a network outage that tested the resilience and stability of the platform.

Despite this challenge, Solana’s performance today indicates a noteworthy recovery. On the tail of a bull rally, SOL reached its highest point in 2024.

Solana Hits Yearly High

On Tuesday, February 13, SOL saw an impressive surge. The token’s price reached as high as $115, translating to a 10% increase in a single day and a 21.00% growth over the past week. This remarkable rally has propelled Solana to hit a yearly high, showcasing its significant potential and resilience.

Solana’s recent price trajectory reflects a broader recovery trend and optimism in the cryptocurrency market. The 10% daily growth signifies investor confidence and an increasing interest in Solana’s technological proposition. This is also reflected in SOL’s strong technicals.

Solana’s Technicals Show Bullish Signals

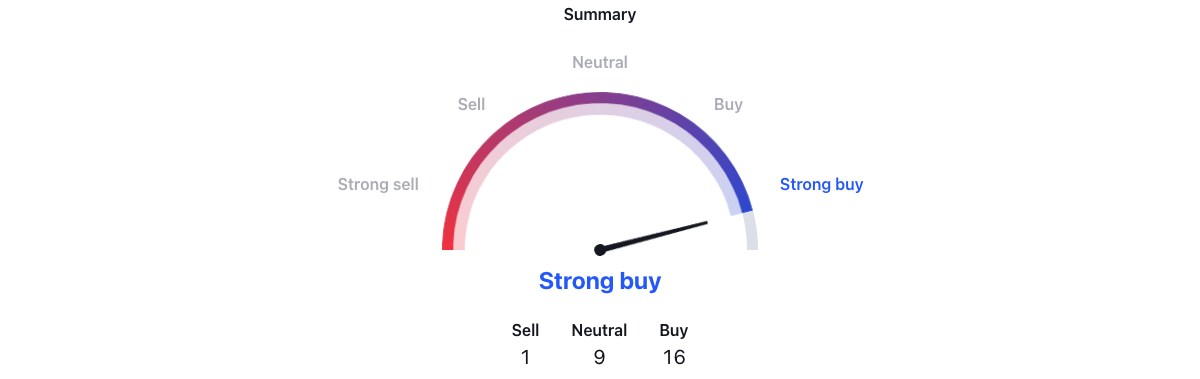

The aggregate of technical indicators points towards a bullish sentiment for Solana. With most moving averages signaling a buy and the oscillator’s general neutrality hinting at stability, SOL appears well-positioned for further gains.

The oscillators, predominantly neutral, suggest a stable trading environment for Solana. The mixture of one sell, two buy signals, and a notable lean towards neutrality (8 neutral signals) indicates balanced market conditions. Specifically, the Momentum indicator and the MACD Level signal a buy, reinforcing the bullish momentum in Solana’s price action.

The moving averages present a clear bullish signal, with 14 out of 15 indicators recommending a buy. This unanimous stance across various time frames, from short to long-term (10 to 200 days), underscores a strong bullish trend for Solana. The consensus among both simple and exponential moving averages enhances the credibility of this positive outlook.

On the Flipside

- Solana’s performance is particularly noteworthy given the network challenges it has faced in the past. This includes the latest network outage, which caused significant concern but was followed by a swift recovery.

- Like most crypto, SOL is still short of its all-time high of $259.96, reached on Nov 6, 2021.

Why This Matters

Solana’s performance in the bull market positions it as a significant player in the cryptocurrency space. The recent surge in SOL’s price reflects a broader trend of recovery and optimism in the market, signaling investor confidence in Solana’s potential.

Sponsored

Read more about Solana’s latest outage:

Solana Outage Post-Mortem Raises More Questions Than Answers

Read more about Worldcoin’s latest grant:

Worldcoin Gives $2M to Grant Winners on Five Continents