- Solana’s network is back online after a 5-hour outage due to a software bug.

- Despite the downtime, Solana’s native token, SOL, shows remarkable price resilience.

- Solana commits to enhancing network stability and preventing future disruptions.

Solana faced the nightmare scenario this week, as the network experienced downtime. For the first time in almost a year, users couldn’t send transactions over the network.

Still, the swift response by the dev team ensured that the week remained positive for SOL. Solana’s native token ended the week higher than at the start despite the downtime.

Solana Bounces Back from Downtime

On Tuesday, February 6, Solana experienced a significant network outage, which ceased transaction processing and blocked production for nearly five hours. The downtime was attributed to a bug in the software managing network upgrades.

Sponsored

Despite this challenge, Solana’s engineering team and community validators quickly identified and rectified the issue, deploying a software update that restored the network to full functionality.

The price of Solana’s native token, SOL, exhibited remarkable stability during and after the outage, with only a minor dip of 4% observed during the downtime but showing signs of a swift recovery after that.

Technicals Turn Around for Solana After Downtime

On Friday, February 9, SOL was trading around $105.00, reflecting a positive trend over the week and indicating strong investor confidence in Solana’s long-term value and the network’s ability to manage technical challenges effectively.

Sponsored

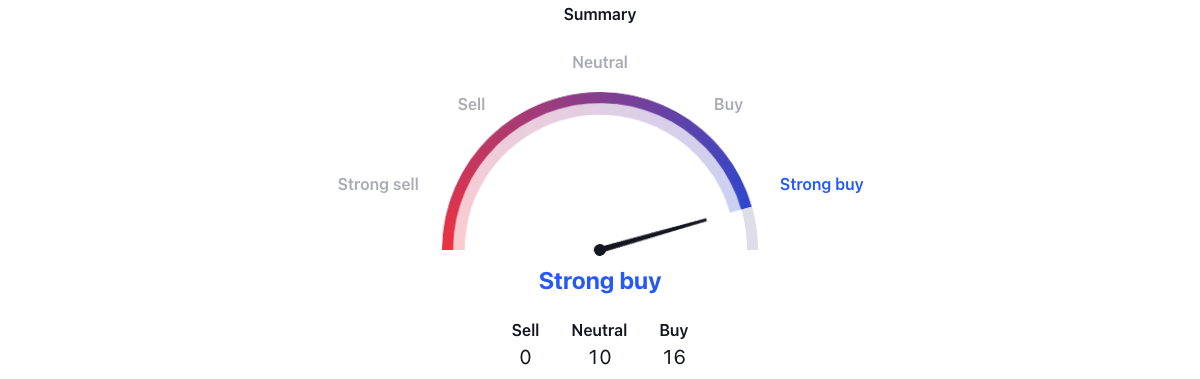

Moreover, technical indicators for Solana present an encouraging picture, reflecting its recovery from its recent network downtime.

The collective behavior of both Exponential Moving Averages (EMA) and Simple Moving Averages (SMA) across various time frames signals a bullish trend. Most MAs suggest a ‘Buy, ‘ which indicates a sustained upward movement, showcasing a positive sentiment surrounding Solana post-recovery.

Despite the overall positive trend indicated by the moving averages, the oscillators remain mostly ‘Neutral.’ Key indicators such as the Relative Strength Index (RSI), standing at 62.05, alongside Stochastic %K, Commodity Channel Index (CCI), and Williams Percent Range, suggest that SOL is balanced, neither overbought nor oversold.

The technical summary for Solana (SOLUSD) tilts towards a ‘Neutral’ to ‘Buy’ sentiment, signaling a cautiously optimistic outlook on the cryptocurrency’s price movement.

On the Flipside

- Despite the swift recovery, the incident serves as a reminder of the inherent challenges in maintaining a high-performance blockchain network.

- Technical indicators reflect current market sentiment, not a prediction of future performance.

Why This Matters

The recent outage on the Solana network is a critical reminder of the technical complexities and challenges of blockchain technology. While the swift resolution and minimal impact on SOL’s value demonstrate resilience, it underscores the importance of ongoing improvements and vigilance.

Read more about Solana’s network outage:

Solana Outage Post-Mortem Raises More Questions Than Answers

Read more about ransomware attacks last year:

Crypto Ransoms Soar to Over $1B in Payments: Chainalysis