- Solana faced a significant network outage, temporarily halting transactions.

- Despite the outage, SOL’s price exhibited remarkable resilience.

- However, Solana’s technicals have taken a hit.

The digital currency landscape is no stranger to the challenges of technical disruptions. Among the biggest projects, SOL seems to be the most impacted. The latest Solana outage has tested the coin’s resilience, which has proved strong for now.

Despite anxieties, the price of SOL displayed remarkable stability, dipping briefly below $94 before stabilizing around $95.17. However, SOL’s technicals have taken a hit, raising questions for the near future.

Solana Outage Has Investors Questioning its Market Stability

The recent network outage on February 6th, 2024, brought Solana’s operations to a standstill, yet the market’s response was notably subdued. Initially, SOL’s price dipped below $94, reflecting immediate market reactions to the outage.

Sponsored

This downturn was short-lived, as prices quickly recovered, demonstrating the robustness of investor sentiment towards Solana. The incident, characterized by a halt in transactional activities due to “performance degradation,” highlighted ongoing concerns regarding the network’s stability.

Still, days after the outage, SOL’s technicals have taken a significant hit, showing signs of dwindling confidence.

Solana Outage Hits SOL Technicals Hard

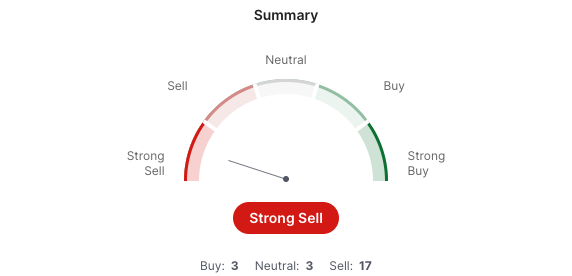

In light of the recent Solana network outage, technical indicators as of Wednesday, February 7, paint a worrying picture. Short-term consensus reveals a “Strong Sell,” reflected across various metrics.

Sponsored

The Relative Strength Index (RSI), sitting at 44.708, suggests that SOL is neither overbought nor oversold territory but closer to the lower end, indicating potential selling pressure.

Stochastic Oscillators and MACD (Moving Average Convergence Divergence) further align with the bearish sentiment, highlighting a lack of momentum and potential downtrend continuation.

Moving Averages overwhelmingly signal a “Strong Sell,” with most short-term and medium-term moving averages leaning towards selling, despite a couple of exceptions hinting at potential buying signals in the longer-term perspective.

These indicators show that Solana could still face downward pressure in the short and medium run due to the recent network outage.

On the Flipside

- Technical indicators reflect market sentiment and should not be viewed as predictions of future price movements.

- Investors should not use these metrics as investment advice.

Why This Matters

Understanding the technical analysis is crucial for investors and traders as it provides insights into market sentiment, which influences price movements.

Read more about the latest Solana Network outage:

Solana Outage Reignites Criticisms Over Network Reliability

Read more about Polkadot’s surprising performance in NFTs:

Polkadot NFT Mint Breaks Records, Surpasses Solana, Polygon