- A 10% decrease sends shockwaves across the crypto market.

- Broader crypto sell-off raises concerns and speculations.

- Indicators hint at potential future price movements.

Crypto markets are on a downturn, and few projects are spared. Solana, known for its robust technology and strong community support, witnessed a 10% drop in its valuation in just 24 hours.

Appearing as a larger trend in the crypto market, the downturn is accompanied by bearish technicals for Solana. This left traders asking if this negative trend would continue.

Solana’s Technical Indicators Show Bearish Signs

On Tuesday, January 23, the crypto market saw a significant downturn, with major currencies taking a hit. Solana, one of the major cryptos, dropped by as much as 10% at one point, reaching $80. Worse, this drop follows a weekly decline, with Solana losing 15% over the last seven days.

Sponsored

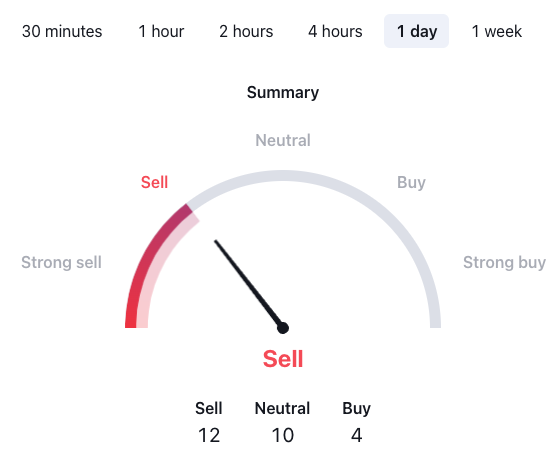

Solana’s market situation presents a mix of neutral and bearish signals. According to TradingView, most technical indicators are bearish. Out of the major technical indicators for the day, 12 flash sell, 10 are neutral, and only four flash buy.

Moving averages, in particular, suggest a bearish sentiment. On the other hand, oscillators provide a more neutral outlook. Moreover, key indicators such as the Relative Strength Index (RSI) and Commodity Channel Index (CCI) indicate neutrality and a potential buy signal, respectively, hinting at possible fluctuations in the near term.

Will Solana Recover?

Bitcoin’s current price, as of January 2024, hovers around $39,000, as the market is experiencing a correction following a notable bull rally fueled by the excitement around ETFs. This recent rally saw Bitcoin’s price surge toward the $49,000 mark before facing rejection, indicating a market overheating.

Sponsored

For Solana, this broader market trend suggests a likelihood of recovery in alignment with the overall market. As seen in past trends, altcoins like Solana often follow the lead of Bitcoin, hinting that a revival in Bitcoin’s price could positively impact Solana’s market performance.

On the Flipside

- While technical indicators provide valuable insights, they can’t predict future movements. Instead, they indicate current market trends.

- External factors such as regulatory, technical, and macroeconomic trends heavily influence the crypto market’s sentiment.

Why This Matters

Solana’s recent 10% drop reflects the broader market’s sentiment. Understanding these market dynamics, from technical indicators to historic patterns, is crucial for navigating the crypto market.

Read more about Solana’s recent performance:

Can Solana Stablecoin Volume Threaten Ethereum’s Dominance?

Read more about the unfolding MtGox case:

Hope Emerges for MtGox Users as Verification Emails Roll Out