- Solana’s market share in stablecoins soared from 1.2% to nearly 32%.

- Solana’s network is now challenging Ethereum’s dominance.

- Solana is faster, but Ethereum still has the first-mover advantage.

Ethereum, the biggest smart contract network, has long dominated the stablecoin market. However, high transaction costs and slow speeds have been constant issues for users. Now, Solana is finally taking advantage of this.

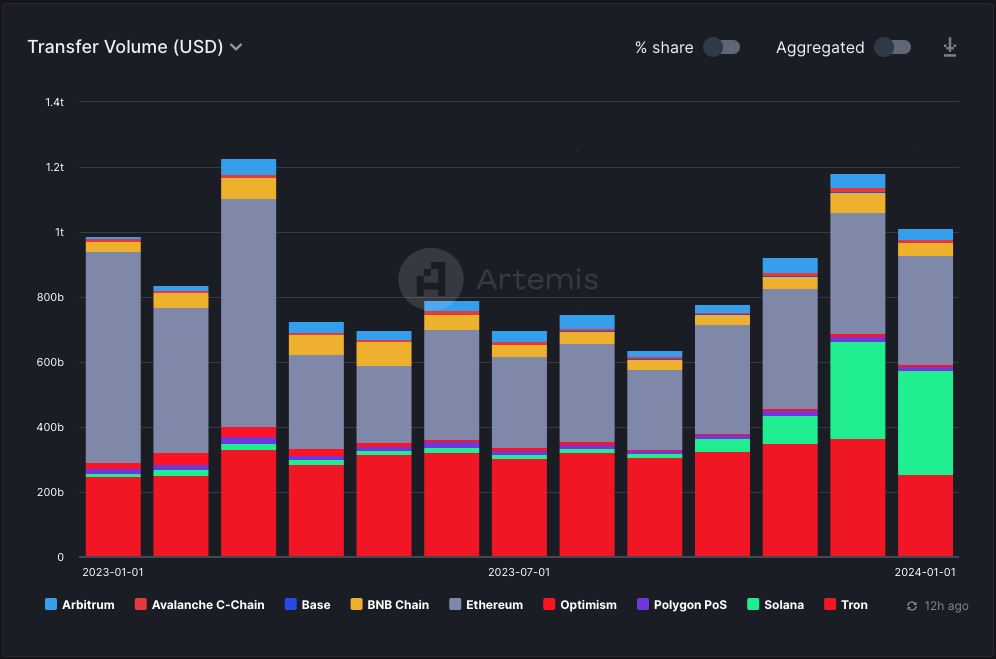

Between October 2023 and January 2024, Solana experienced an unprecedented surge in market share, leaping from a modest 1.2% to nearly 32%. This dramatic increase signals a potential realignment in the stablecoin market, challenging Ethereum’s dominance.

Solana’s Stablecoin Volume Rivals Ethereum

Recent data shows that Solana’s total stablecoin volume reached $322 billion in January after a dramatic surge since October. In that period, Solana’s volume went from a modest $12 billion in the market to within striking distance of Ethereum.

Sponsored

The USD Coin’s (USDC) and Paxos’ stablecoin USDP’s launch on the Solana blockchain played crucial roles in this growth. These tokens attracted more users and transactions to Solana.

Ethereum, which long dominated stablecoin transfers, registered a $335 volume in January, just $13 billion more than Solana. Now, Solana is close to flipping Ethereum in transfers after taking the second spot, overtaking the Tron Network.

Can Solana Overtake Ethereum?

One of Solana’s most compelling advantages is its high transaction speeds. Boasting a system capable of processing thousands of transactions per second, Solana offers an efficient and scalable solution for stablecoin transfers. This means that users must pay lesser fees when sending money by Solana.

Sponsored

Still, it won’t be easy for Solana to flip Ethereum. As the first mover in the blockchain industry, Ethereum has established a robust ecosystem, a loyal user base, and decentralized applications. This first-mover advantage provides Ethereum with a significant competitive edge.

Moreover, despite challenges, Ethereum continues to innovate. The platform is actively addressing its limitations with upgrades to improve scalability and efficiency, such as Ethereum 2.0.

While it is impossible to predict future market movements in certain, current trends show that Solana has an advantage over Ethereum. However, overtaking Ethereum involves challenges such as building trust with users and ensuring the security and scalability of the network. Solana’s success will depend on that.

On the Flipside

- Solana’s rise in the stablecoin market came after SOL saw a dramatic rise in 2023. On Monday, January 22, Solana was up 254.79% from last year, having recovered from the FTX crash.

- Solana Mobile’s smartphone launch has also boosted the credibility of the Solana ecosystem.

Why This Matters

Solana’s adoption and its blockchain’s performance are not just about SOL. They also drive the adoption and mainstream acceptance of blockchain technology.

Read more about Solana’s surge in the stablecoin market:

Solana Inks Record-High $300B Stablecoin Volume in January

Read more about the new crypto phone by Solana Mobile:

Solana’s New Phone Bags 30k Preorders Ahead of 2025 Release